Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem #12: Planning and Control Don't-Cha-Wanna-a-Coffee, a large-scale coffee company that has a chain of 125 retail coffee stores throughout New England, was embroiled

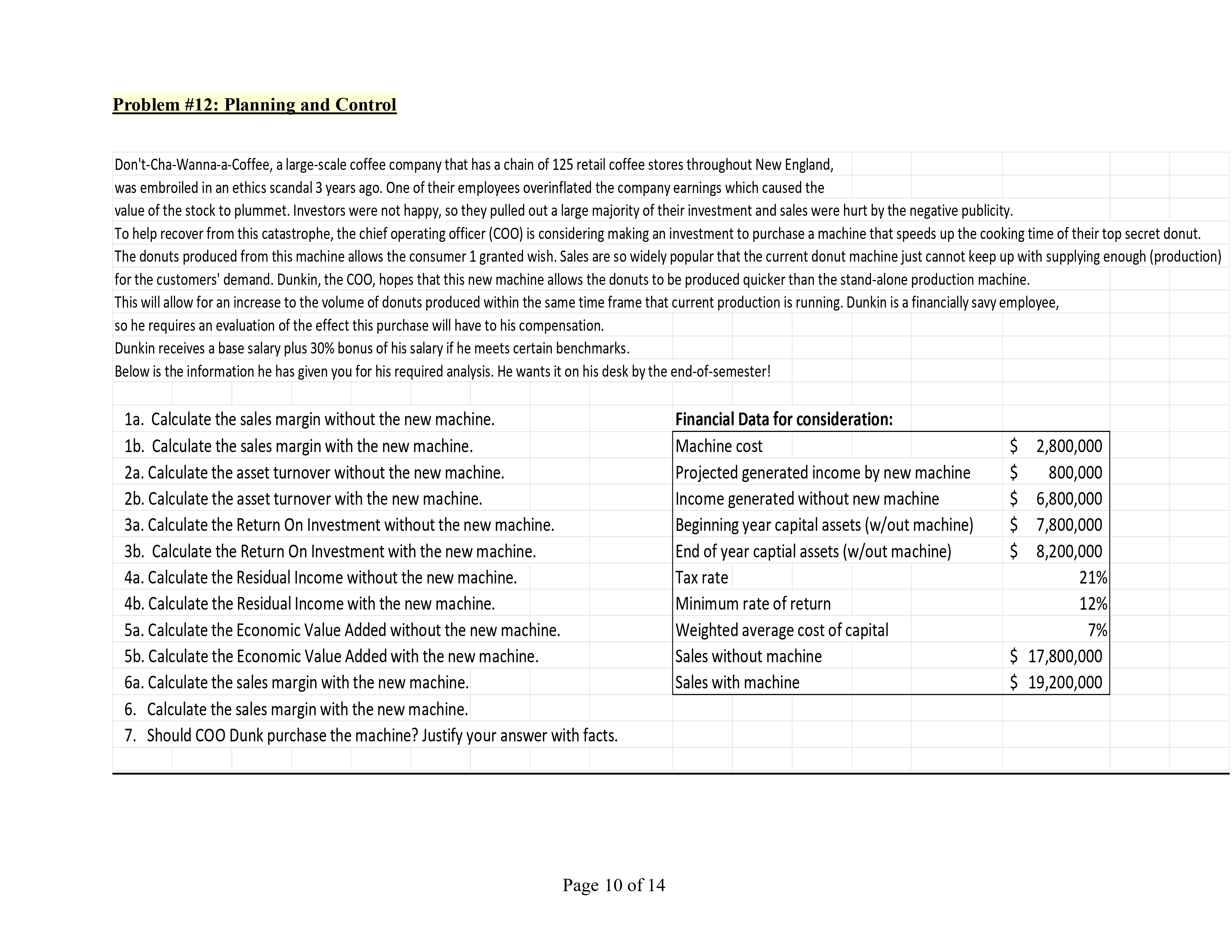

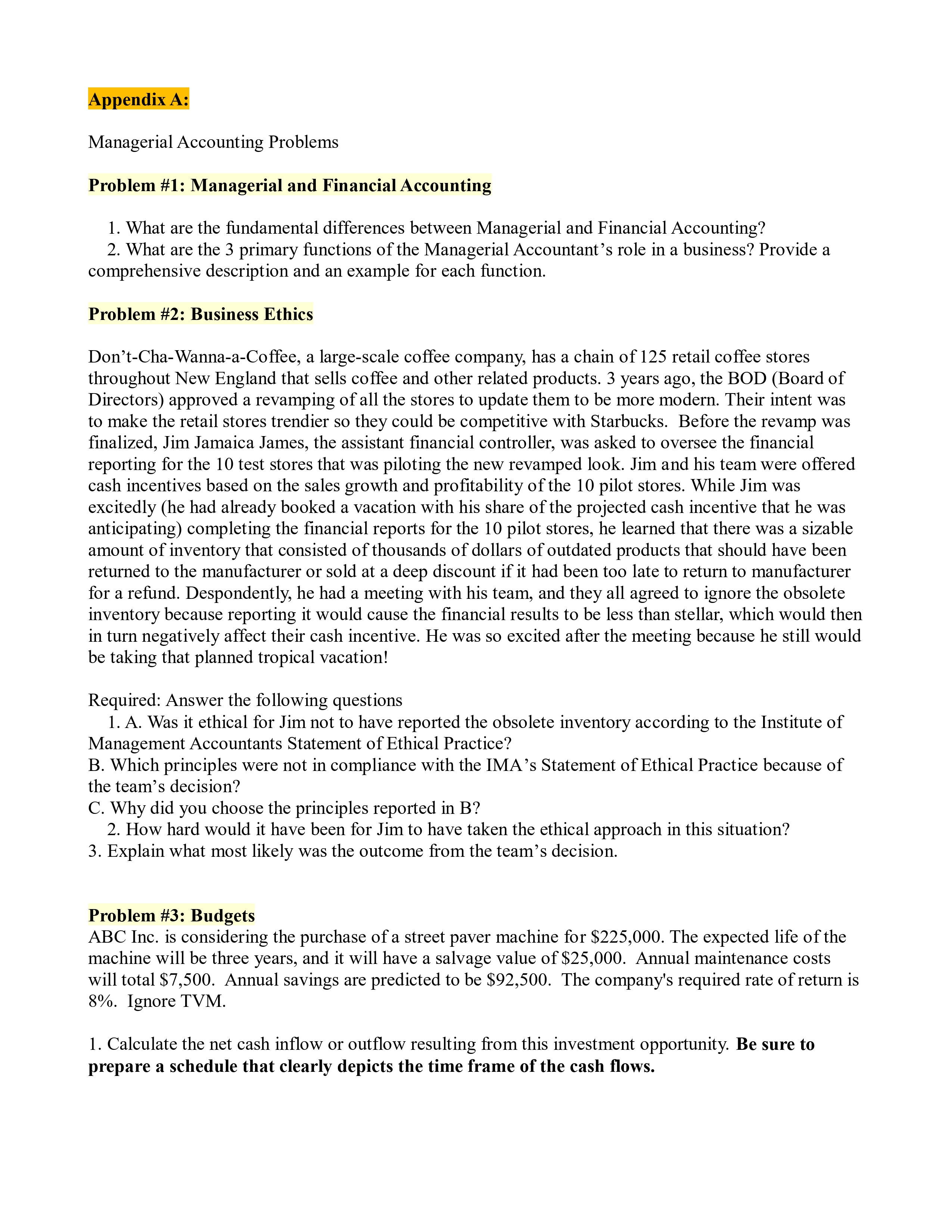

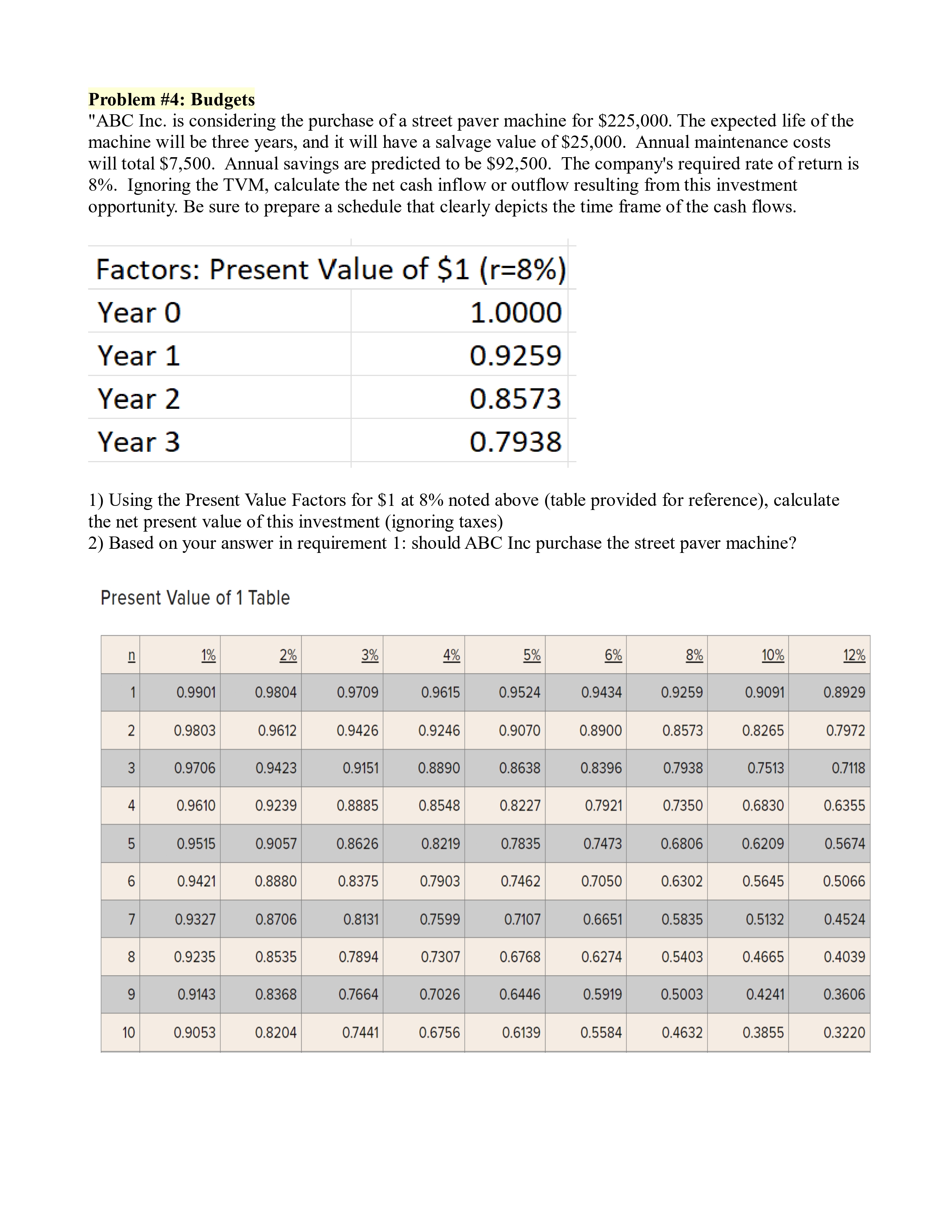

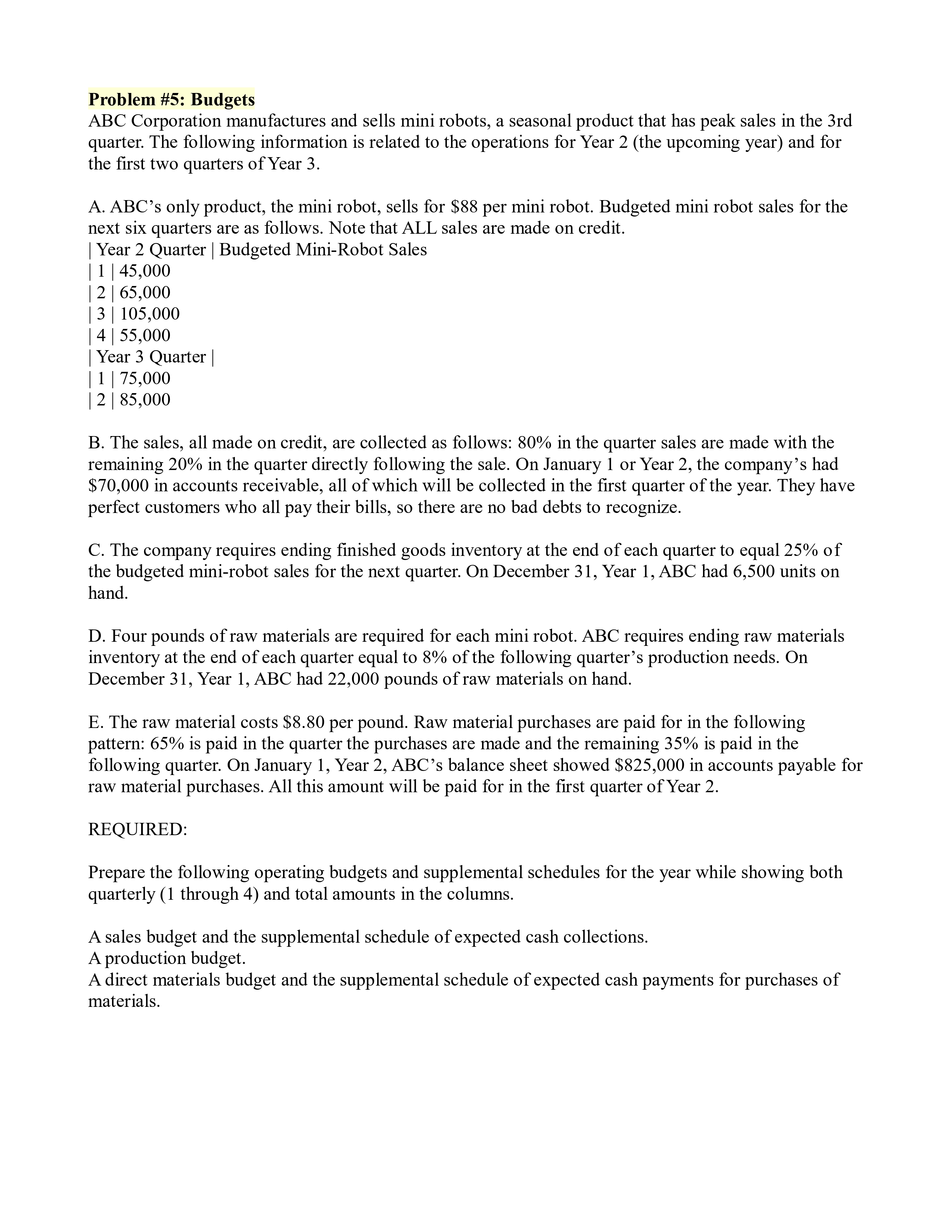

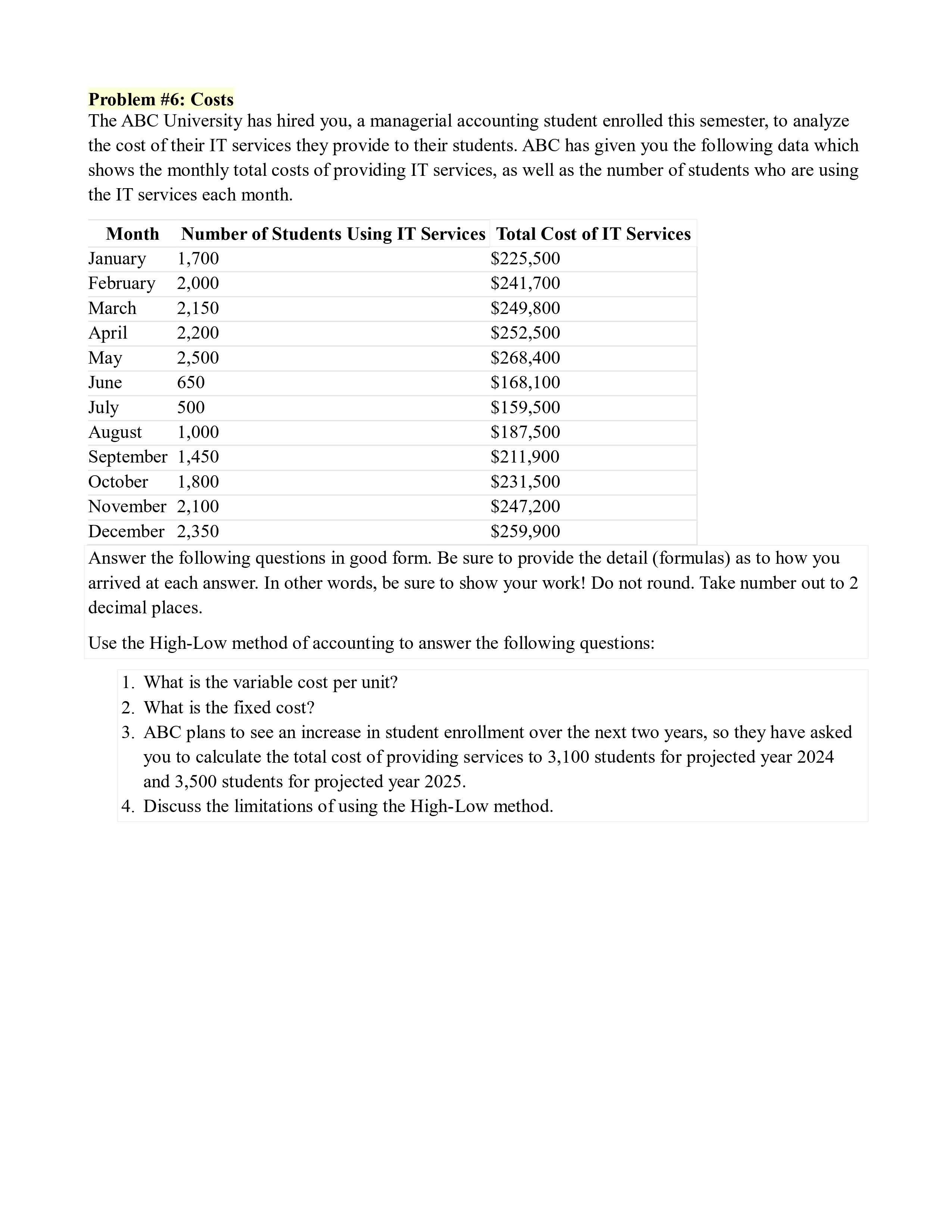

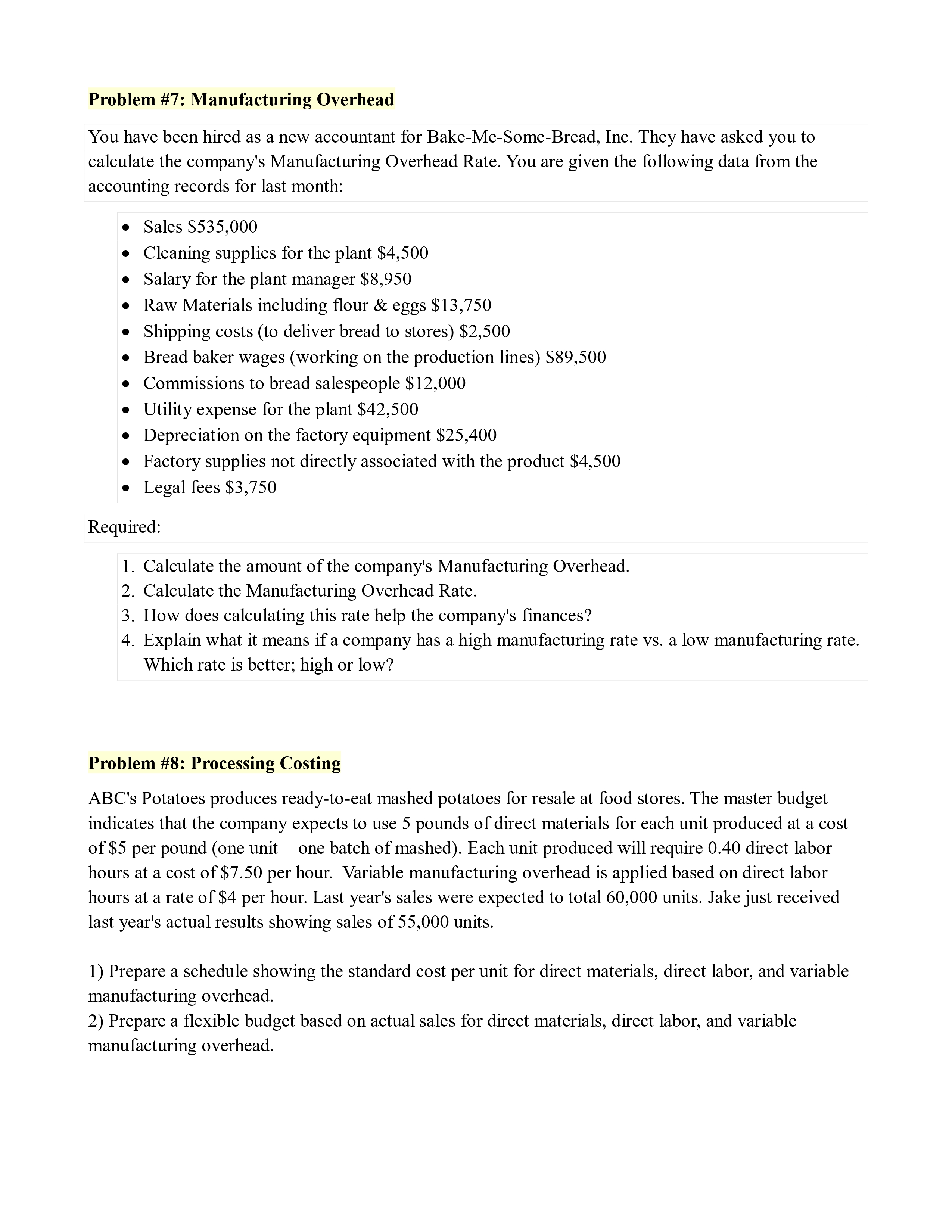

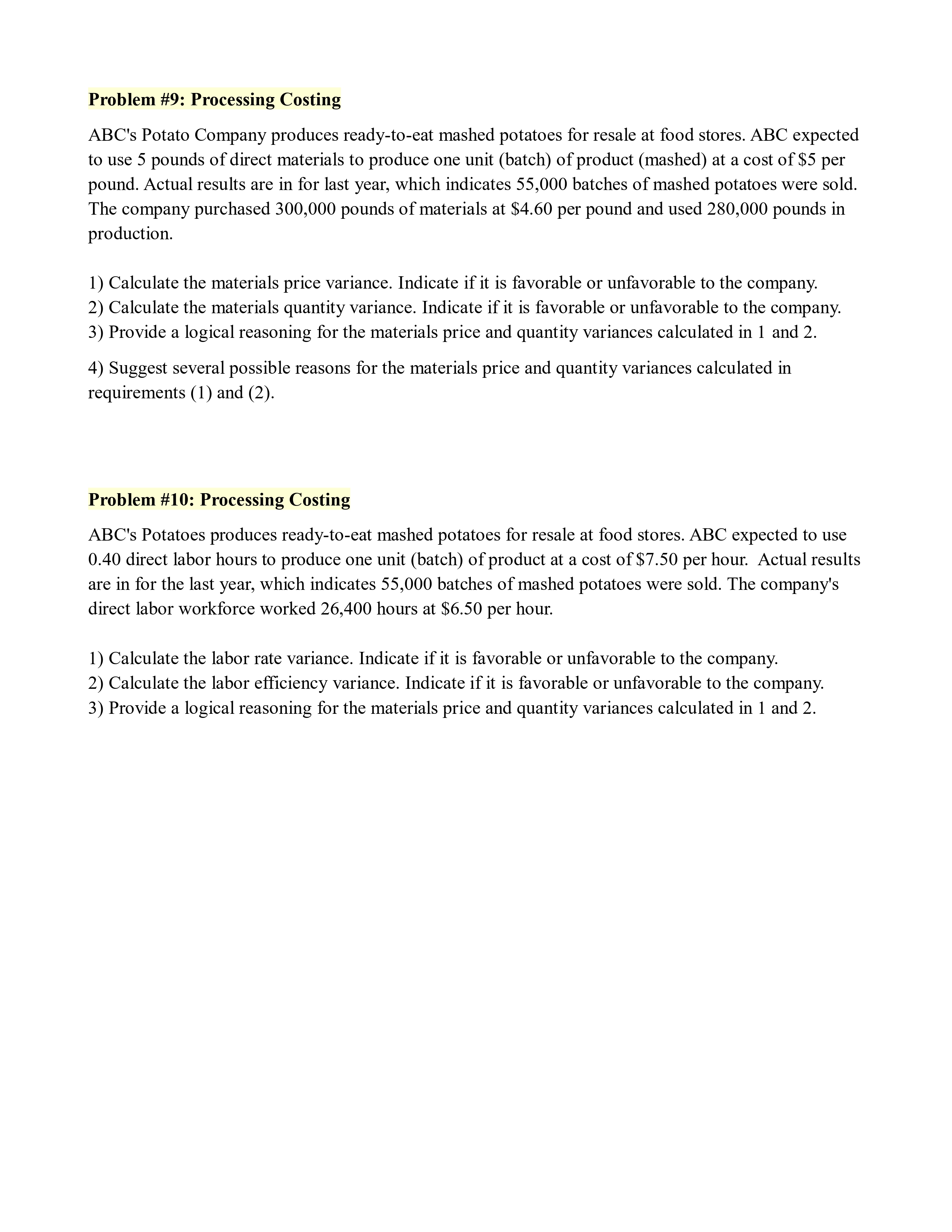

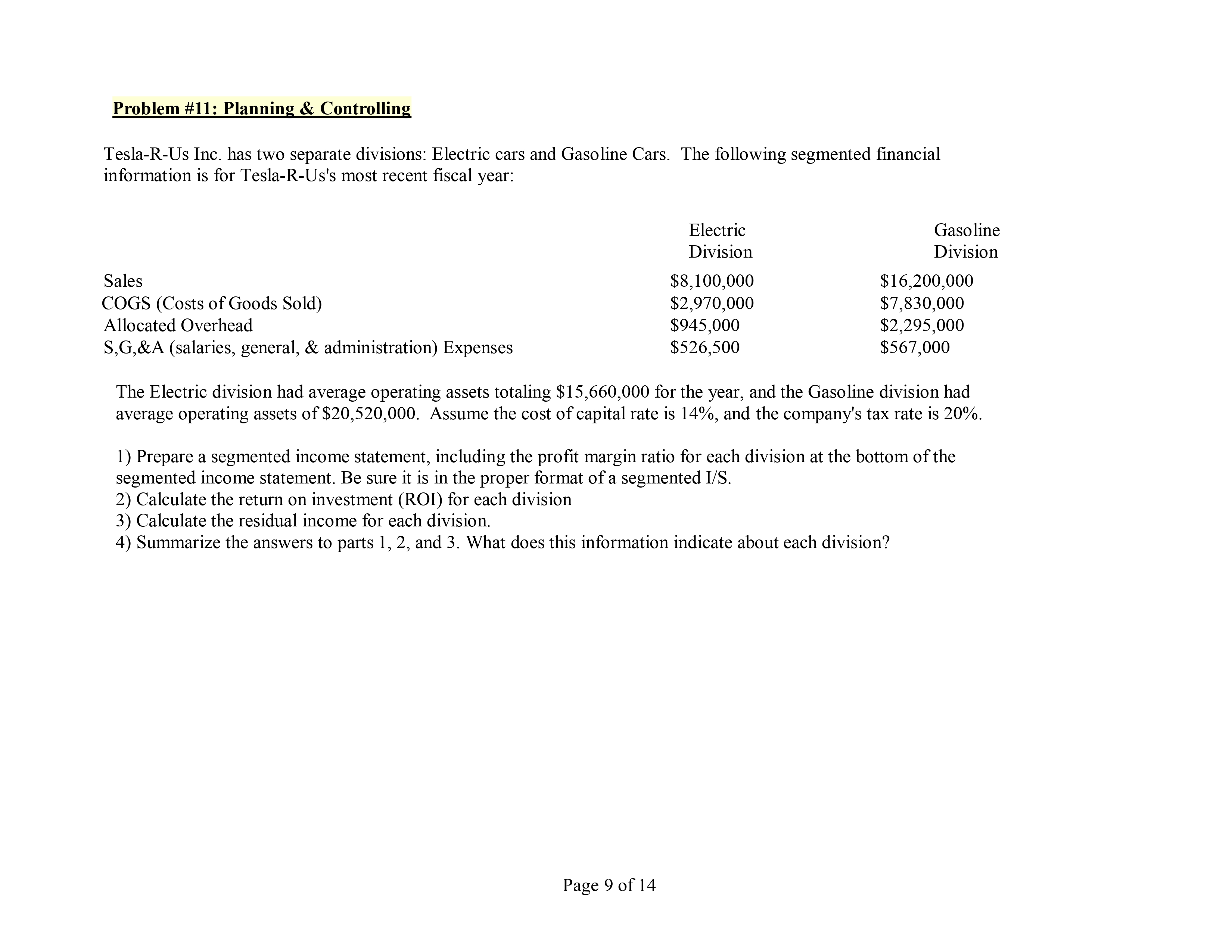

Problem #12: Planning and Control Don't-Cha-Wanna-a-Coffee, a large-scale coffee company that has a chain of 125 retail coffee stores throughout New England, was embroiled in an ethics scandal 3 years ago. One of their employees overinflated the company earnings which caused the value of the stock to plummet. Investors were not happy, so they pulled out a large majority of their investment and sales were hurt by the negative publicity. To help recover from this catastrophe, the chief operating officer (COO) is considering making an investment to purchase a machine that speeds up the cooking time of their top secret donut. The donuts produced from this machine allows the consumer 1 granted wish. Sales are so widely popular that the current donut machine just cannot keep up with supplying enough (production) for the customers' demand. Dunkin, the COO, hopes that this new machine allows the donuts to be produced quicker than the stand-alone production machine. This will allow for an increase to the volume of donuts produced within the same time frame that current production is running. Dunkin is a financially savy employee, so he requires an evaluation of the effect this purchase will have to his compensation. Dunkin receives a base salary plus 30% bonus of his salary if he meets certain benchmarks. Below is the information he has given you for his required analysis. He wants it on his desk by the end-of-semester! 1a. Calculate the sales margin without the new machine. 1b. Calculate the sales margin with the new machine. 2a. Calculate the asset turnover without the new machine. 2b. Calculate the asset turnover with the new machine. 3a. Calculate the Return On Investment without the new machine. 3b. Calculate the Return On Investment with the new machine. 4a. Calculate the Residual Income without the new machine. 4b. Calculate the Residual Income with the new machine. 5a. Calculate the Economic Value Added without the new machine. 5b. Calculate the Economic Value Added with the new machine. 6a. Calculate the sales margin with the new machine. 6. Calculate the sales margin with the new machine. 7. Should COO Dunk purchase the machine? Justify your answer with facts. Financial Data for consideration: Machine cost Projected generated income by new machine. Income generated without new machine Beginning year capital assets (w/out machine) End of year captial assets (w/out machine) Tax rate Minimum rate of return Weighted average cost of capital Sales without machine Sales with machine $ 2,800,000 $ 800,000 $ 6,800,000 $ 7,800,000 $ 8,200,000 21% 12% 7% $ 17,800,000 $ 19,200,000 Page 10 of 14 Problem #13: Balanced Scorecard The Balanced Scorecard begins with the company's strategic . List the four main areas of a balanced scorecard. Provide a comprehensive description of them. b. Define KPIs and how management uses them as a measurement tool. c. Select a business that you are familiar with and provide an example of a KPI for each balanced scorecard area for your selected company. Page 11 of 14 Step 2: Perform Calculations & Explain Methods For each problem (found in Appendix A): 1. Use your plan of action to solve each problem, clearly outlining the procedures used, providing a concise explanation of each step, labeling relevant formulas, and showing worked out calculations and complete solutions. You may use an Excel spreadsheet or a calculator to help you perform the necessary calculations, but all corresponding work must be shown completely. 2. Answer all questions posed in the problem; if applicable, analyze and evaluate your results and provide a contextual explanation of the solutions you obtained. 3. Review your calculations and solutions and make sure that an external viewer would be able to follow your methodology and make sense of your calculations and corresponding explanations. Make certain that you have completed all the steps of each problem. Step 3: Complete Checklist for Submission Before you submit, check to see if you believe you have met the criteria noted below. Did you.... Answer all parts of each question completely and accurately? Provide clear and accurate steps, calculations, and solutions? . Include an insightful analysis and evaluation of results where relevant? Provide a comprehensive and accurate description of each of the four areas of a balanced scorecard, an accurate and clear definition of a key performance indicator (KPI), and meaningful real-world examples of KPIs for each balanced score card area? Appendix A: Managerial Accounting Problems Problem #1: Managerial and Financial Accounting 1. What are the fundamental differences between Managerial and Financial Accounting? 2. What are the 3 primary functions of the Managerial Accountant's role in a business? Provide a comprehensive description and an example for each function. Problem #2: Business Ethics Don't-Cha-Wanna-a-Coffee, a large-scale coffee company, has a chain of 125 retail coffee stores throughout New England that sells coffee and other related products. 3 years ago, the BOD (Board of Directors) approved a revamping of all the stores to update them to be more modern. Their intent was to make the retail stores trendier so they could be competitive with Starbucks. Before the revamp was finalized, Jim Jamaica James, the assistant financial controller, was asked to oversee the financial reporting for the 10 test stores that was piloting the new revamped look. Jim and his team were offered cash incentives based on the sales growth and profitability of the 10 pilot stores. While Jim was excitedly (he had already booked a vacation with his share of the projected cash incentive that he was anticipating) completing the financial reports for the 10 pilot stores, he learned that there was a sizable amount of inventory that consisted of thousands of dollars of outdated products that should have been returned to the manufacturer or sold at a deep discount if it had been too late to return to manufacturer for a refund. Despondently, he had a meeting with his team, and they all agreed to ignore the obsolete inventory because reporting it would cause the financial results to be less than stellar, which would then in turn negatively affect their cash incentive. He was so excited after the meeting because he still would be taking that planned tropical vacation! Required: Answer the following questions 1. A. Was it ethical for Jim not to have reported the obsolete inventory according to the Institute of Management Accountants Statement of Ethical Practice? B. Which principles were not in compliance with the IMA's Statement of Ethical Practice because of the team's decision? C. Why did you choose the principles reported in B? 2. How hard would it have been for Jim to have taken the ethical approach in this situation? 3. Explain what most likely was the outcome from the team's decision. Problem #3: Budgets ABC Inc. is considering the purchase of a street paver machine for $225,000. The expected life of the machine will be three years, and it will have a salvage value of $25,000. Annual maintenance costs will total $7,500. Annual savings are predicted to be $92,500. The company's required rate of return is 8%. Ignore TVM. 1. Calculate the net cash inflow or outflow resulting from this investment opportunity. Be sure to prepare a schedule that clearly depicts the time frame of the cash flows. Problem #4: Budgets "ABC Inc. is considering the purchase of a street paver machine for $225,000. The expected life of the machine will be three years, and it will have a salvage value of $25,000. Annual maintenance costs will total $7,500. Annual savings are predicted to be $92,500. The company's required rate of return is 8%. Ignoring the TVM, calculate the net cash inflow or outflow resulting from this investment opportunity. Be sure to prepare a schedule that clearly depicts the time frame of the cash flows. Factors: Present Value of $1 (r=8%) Year O Year 1 Year 2 Year 3 1.0000 0.9259 0.8573 0.7938 1) Using the Present Value Factors for $1 at 8% noted above (table provided for reference), calculate the net present value of this investment (ignoring taxes) 2) Based on your answer in requirement 1: should ABC Inc purchase the street paver machine? Present Value of 1 Table 1% 2% 3% 4% 5% 6% 8% 10% 12% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9259 0.9091 0.8929 2 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8573 0.8265 0.7972 3 0.9706 0.9423 0.9151 0.8890 0.8638 0.8396 0.7938 0.7513 0.7118 4 0.9610 0.9239 0.8885 0.8548 0.8227 0.7921 0.7350 0.6830 0.6355 5 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.6806 0.6209 0.5674 6 00 0.9421 0.8880 0.8375 0.7903 0.7462 0.7050 0.6302 0.5645 0.5066 7 0.9327 0.8706 0.8131 0.7599 0.7107 0.6651 0.5835 0.5132 0.4524 8 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5403 0.4665 0.4039 9 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5003 0.4241 0.3606 10 0.9053 0.8204 0.7441 0.6756 0.6139 0.5584 0.4632 0.3855 0.3220 Problem #5: Budgets ABC Corporation manufactures and sells mini robots, a seasonal product that has peak sales in the 3rd quarter. The following information is related to the operations for Year 2 (the upcoming year) and for the first two quarters of Year 3. A. ABC's only product, the mini robot, sells for $88 per mini robot. Budgeted mini robot sales for the next six quarters are as follows. Note that ALL sales are made on credit. Year 2 Quarter | Budgeted Mini-Robot Sales 1 | 45,000 | 2 | 65,000 3 | 105,000 4|55,000 Year 3 Quarter | |1|75,000 |2|85,000 B. The sales, all made on credit, are collected as follows: 80% in the quarter sales are made with the remaining 20% in the quarter directly following the sale. On January 1 or Year 2, the company's had $70,000 in accounts receivable, all of which will be collected in the first quarter of the year. They have perfect customers who all pay their bills, so there are no bad debts to recognize. C. The company requires ending finished goods inventory at the end of each quarter to equal 25% of the budgeted mini-robot sales for the next quarter. On December 31, Year 1, ABC had 6,500 units on hand. D. Four pounds of raw materials are required for each mini robot. ABC requires ending raw materials inventory at the end of each quarter equal to 8% of the following quarter's production needs. On December 31, Year 1, ABC had 22,000 pounds of raw materials on hand. E. The raw material costs $8.80 per pound. Raw material purchases are paid for in the following pattern: 65% is paid in the quarter the purchases are made and the remaining 35% is paid in the following quarter. On January 1, Year 2, ABC's balance sheet showed $825,000 in accounts payable for raw material purchases. All this amount will be paid for in the first quarter of Year 2. REQUIRED: Prepare the following operating budgets and supplemental schedules for the year while showing both quarterly (1 through 4) and total amounts in the columns. A sales budget and the supplemental schedule of expected cash collections. A production budget. A direct materials budget and the supplemental schedule of expected cash payments for purchases of materials. Problem #6: Costs The ABC University has hired you, a managerial accounting student enrolled this semester, to analyze the cost of their IT services they provide to their students. ABC has given you the following data which shows the monthly total costs of providing IT services, as well as the number of students who are using the IT services each month. Month Number of Students Using IT Services Total Cost of IT Services January 1,700 February 2,000 March 2.150 April 2,200 May 2,500 June 650 July 500 August 1,000 September 1,450 October 1,800 November 2,100 December 2,350 $225,500 $241,700 $249,800 $252,500 $268,400 $168,100 $159,500 $187,500 $211,900 $231,500 $247,200 $259,900 Answer the following questions in good form. Be sure to provide the detail (formulas) as to how you arrived at each answer. In other words, be sure to show your work! Do not round. Take number out to 2 decimal places. Use the High-Low method of accounting to answer the following questions: 1. What is the variable cost per unit? 2. What is the fixed cost? 3. ABC plans to see an increase in student enrollment over the next two years, so they have asked you to calculate the total cost of providing services to 3,100 students for projected year 2024 and 3,500 students for projected year 2025. 4. Discuss the limitations of using the High-Low method. Problem #7: Manufacturing Overhead You have been hired as a new accountant for Bake-Me-Some-Bread, Inc. They have asked you to calculate the company's Manufacturing Overhead Rate. You are given the following data from the accounting records for last month: Sales $535,000 Cleaning supplies for the plant $4,500 Salary for the plant manager $8,950 Raw Materials including flour & eggs $13,750 Shipping costs (to deliver bread to stores) $2,500 Bread baker wages (working on the production lines) $89,500 Commissions to bread salespeople $12,000 Utility expense for the plant $42,500 Depreciation on the factory equipment $25,400 Factory supplies not directly associated with the product $4,500 Legal fees $3,750 Required: 1. Calculate the amount of the company's Manufacturing Overhead. 2. Calculate the Manufacturing Overhead Rate. 3. How does calculating this rate help the company's finances? 4. Explain what it means if a company has a high manufacturing rate vs. a low manufacturing rate. Which rate is better; high or low? Problem #8: Processing Costing ABC's Potatoes produces ready-to-eat mashed potatoes for resale at food stores. The master budget indicates that the company expects to use 5 pounds of direct materials for each unit produced at a cost of $5 per pound (one unit = one batch of mashed). Each unit produced will require 0.40 direct labor hours at a cost of $7.50 per hour. Variable manufacturing overhead is applied based on direct labor hours at a rate of $4 per hour. Last year's sales were expected to total 60,000 units. Jake just received last year's actual results showing sales of 55,000 units. 1) Prepare a schedule showing the standard cost per unit for direct materials, direct labor, and variable manufacturing overhead. 2) Prepare a flexible budget based on actual sales for direct materials, direct labor, and variable manufacturing overhead. Problem #9: Processing Costing ABC's Potato Company produces ready-to-eat mashed potatoes for resale at food stores. ABC expected to use 5 pounds of direct materials to produce one unit (batch) of product (mashed) at a cost of $5 per pound. Actual results are in for last year, which indicates 55,000 batches of mashed potatoes were sold. The company purchased 300,000 pounds of materials at $4.60 per pound and used 280,000 pounds in production. 1) Calculate the materials price variance. Indicate if it is favorable or unfavorable to the company. 2) Calculate the materials quantity variance. Indicate if it is favorable or unfavorable to the company. 3) Provide a logical reasoning for the materials price and quantity variances calculated in 1 and 2. 4) Suggest several possible reasons for the materials price and quantity variances calculated in requirements (1) and (2). Problem #10: Processing Costing ABC's Potatoes produces ready-to-eat mashed potatoes for resale at food stores. ABC expected to use 0.40 direct labor hours to produce one unit (batch) of product at a cost of $7.50 per hour. Actual results are in for the last year, which indicates 55,000 batches of mashed potatoes were sold. The company's direct labor workforce worked 26,400 hours at $6.50 per hour. 1) Calculate the labor rate variance. Indicate if it is favorable or unfavorable to the company. 2) Calculate the labor efficiency variance. Indicate if it is favorable or unfavorable to the company. 3) Provide a logical reasoning for the materials price and quantity variances calculated in 1 and 2. Problem #11: Planning & Controlling Tesla-R-Us Inc. has two separate divisions: Electric cars and Gasoline Cars. The following segmented financial information is for Tesla-R-Us's most recent fiscal year: Sales COGS (Costs of Goods Sold) Allocated Overhead S,G,&A (salaries, general, & administration) Expenses Electric Gasoline Division Division $8,100,000 $16,200,000 $2,970,000 $7,830,000 $945,000 $2,295,000 $526,500 $567,000 The Electric division had average operating assets totaling $15,660,000 for the year, and the Gasoline division had average operating assets of $20,520,000. Assume the cost of capital rate is 14%, and the company's tax rate is 20%. 1) Prepare a segmented income statement, including the profit margin ratio for each division at the bottom of the segmented income statement. Be sure it is in the proper format of a segmented I/S. 2) Calculate the return on investment (ROI) for each division 3) Calculate the residual income for each division. 4) Summarize the answers to parts 1, 2, and 3. What does this information indicate about each division? Page 9 of 14

Step by Step Solution

★★★★★

3.26 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the impact of purchasing the new machine on the financial performance and compensation of COO Dunkin we need to calculate various financial metrics Lets go through each calculation step by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started