Question

Vita International (VT) intends to purchase equipment. To get the best price, VT asked for bids from vendors. Analysis shows that, equipments from the vendors

Vita International (VT) intends to purchase equipment. To get the best price, VT asked for bids from vendors. Analysis shows that, equipments from the vendors is similar and has estimated useful life of 20 years.

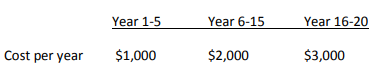

Additionally, every equipment will have year-end maintenance costs as follows:

Below are the packages of three vendors:

Vendor 1: VT pays $55,000 cash at time of delivery and payments of $18,000 at end of each of the next 10 years. DT can elect to purchase a 20-year maintenance service agreement for $10,000 one-time fee. The purchase agreement is optional but if purchased, VT won?t have to maintain the equipment for a fee for the useful life of the equipment. (Use PV of ordinary annuity table

Vendor 2: Sales price is $380,000. Payment of $9,500 is payable semi-annually for 20 years. Upon delivery, VT pays $9,500. Then, it makes remaining 39 payments starting 6 months after delivery. The annual maintenance for the next 20 years is included in the price. (Use PV of annuity due table; remember the payment is twice a year, so interest rate will be half of annual interest rate provided below).

Vendor 3: Sales price is $150,000. VT must pay the whole sales price at delivery. (Use PV of ordinary annuity table but take into consideration the years of the maintenance cost).

Assume VT will pay for the maintenance contract with vendor 1 if selected and that vendor 2 will perform maintenance at no extra charge as indicated. Since Vendor 3 doesn?t offer maintenance, VT will pay for this based on the year-end maintenance cost provided. Which vendor should DT select if its cost of funds is 10%?.

Cost per year Year 1-5 $1,000 Year 6-15 $2,000 Year 16-20 $3,000

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Vendor 1 Vendor 2 V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started