Question

Margie Frump is employed as a teacher. She occasionally purchases items that she uses in the course of her employment that are subject to depreciation.

Margie Frump is employed as a teacher. She occasionally purchases items that she uses in the course of her employment that are subject to depreciation.

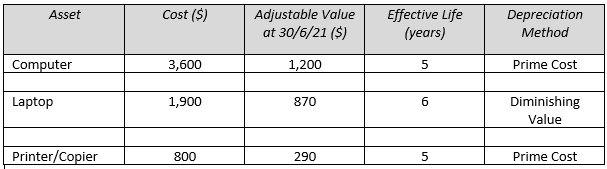

Assets held by Margie at 30 June 2021:

Margie uses each of these assets entirely for work.

- Margie has not previously used a low value pool for her assets.

- Margie wishes to maximise her deduction for decline in value.

Calculate the deduction for decline in value available for 2021/22.

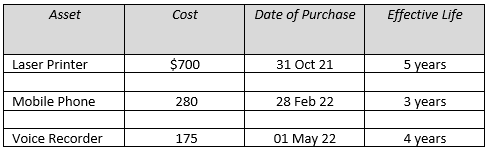

Asset Cost Date of Purchase Effective Life Laser Printer $700 31 Oct 21 5 years Mobile Phone 280 28 Feb 22 3 years Voice Recorder 175 01 May 22 4 years

Step by Step Solution

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the decline in value depreciation of the assets that Margie Frump uses for work well need to rely on the depreciation method that is most beneficial for her situation and in line with tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2023 Comprehensive Volume

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

46th Edition

0357719689, 9780357719688

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App