Question

When a large Omaha Department store moved to a new location, Sherry Winkler was hired as the new shoe department manager. Harold Knox had been

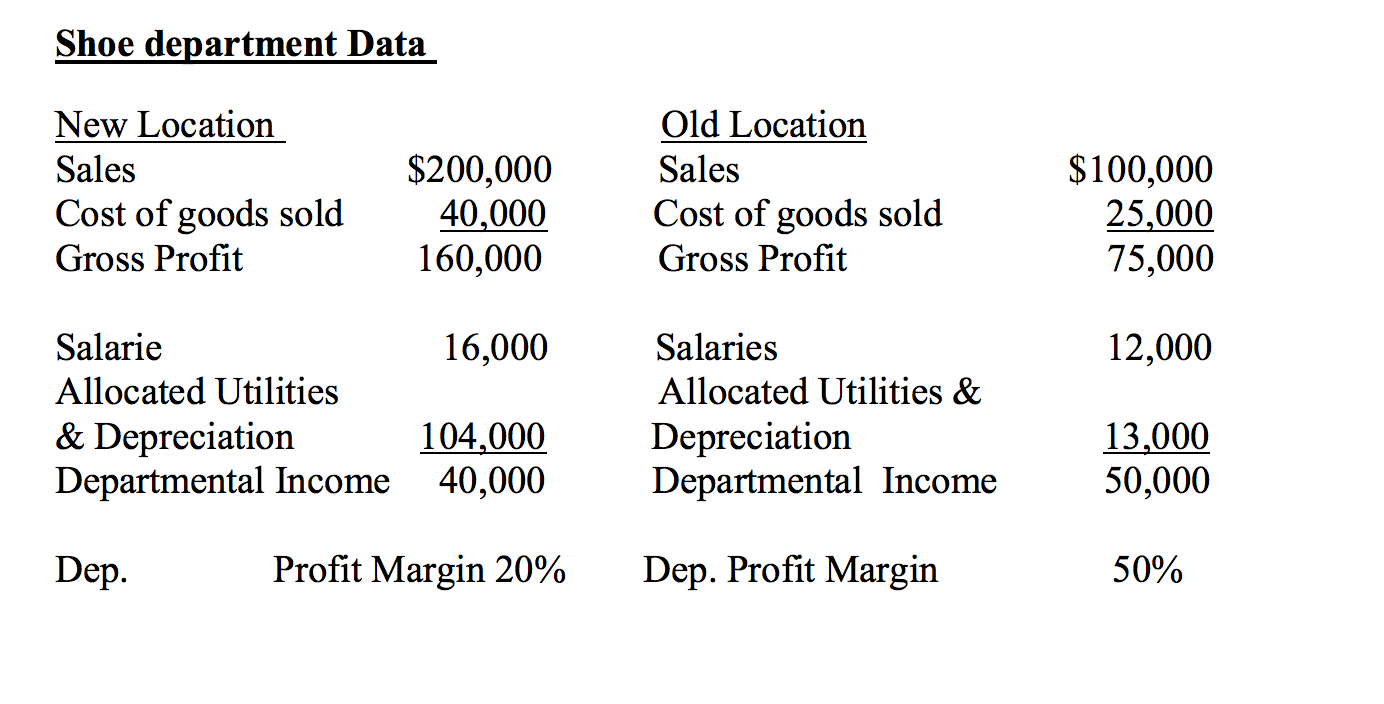

When a large Omaha Department store moved to a new location, Sherry Winkler was hired as the new shoe department manager. Harold Knox had been the manager at the old location. Her boss is concerned about the poor performance since she became shoe department manager. The new store location is much larger than the old store location - not all of the space is currently needed. The extra space is divided up among the various departments including the shoe department. Utilities and depreciation amounts are allocated based on the number of square feet in each department. Shoe department Data Shoe department Data.pdf Katherine Tate is the Manager of the entire store.

In an Interview with Sherry she states: "You are not doing nearly as good as your predecessor, Harold Knox. He had a 50% margin - you only have a 20% margin. He had $50,000 of income - you only have $40,000. You are not going to have much of a future here if you do not start to perform better." Sherry Winkler is not the type of manager to back down from a fight. She said to the Store Manager: "Your figures are skewed by unreasonable data. By any reasonable measure, I am far surpassing the performance of my predecessor, Harold Knox. You should be paying me a bonus - you should not be threatening me." In your post, answer the question: Who is Right??

Shoe department Data New Location Sales Cost of goods sold Gross Profit Salarie Allocated Utilities $200,000 40,000 160,000 Dep. 16,000 & Depreciation 104,000 Departmental Income 40,000 Profit Margin 20% Old Location Sales Cost of goods sold Gross Profit Salaries Allocated Utilities & Depreciation Departmental Income Dep. Profit Margin $100,000 25,000 75,000 12,000 13,000 50,000 50%

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Sherry Winkler is right The new location is much bigger than the old location and the utilitiy expen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6099c2c245e36_30006.pdf

180 KBs PDF File

6099c2c245e36_30006.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started