You are the junior financial analyst in Impact Resource Sdn Bhd, a company that produce a line of cosmetic products. Your boss requested you to

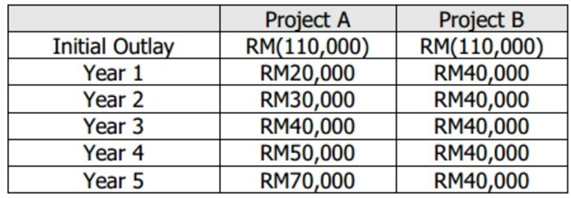

You are the junior financial analyst in Impact Resource Sdn Bhd, a company that produce a line of cosmetic products. Your boss requested you to perform a capital budgeting analysis and evaluate the two proposed projects with the following cash flow forecast:

These two projects involve additions to the company's existing product line and the company requires a rate of return on both projects equal to 12 percent.

a. Compute the NPV for both projects.

b. Calculate the IRR for both projects.

c. Identify which project to be choose if it is a mutually exclusive project.

d. Discuss the importance of the time value of money in finance.

Initial Outlay Year 1 Year 2 Year 3 Year 4 Year 5 Project A RM(110,000) RM20,000 RM30,000 RM40,000 RM50,000 RM70,000 Project B RM(110,000) RM40,000 RM40,000 RM40,000 RM40,000 RM40,000

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a b C year RATE NPV IRR 0 12 2 3 4 5 PROJECT A A 110000 20000 30000 40000 50000 70000 12 3173995 PRO...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started