Question

You have just bought a used track-type tractor to add to your production fleet The initial capitalized value of the tractor is S110.000. The estimated

You have just bought a used track-type tractor to add to your production fleet The initial capitalized value of the tractor is S110.000. The estimated service life remaining on the tractor is 10.000 hours and the anticipated operating conditions across the remainder of its life are normal. The salvage value of the tractor is $12.000. The tractor was purchased on July 1. 1997.

a. What amount of depreciation will you claim for each calendar year between 2007 and 2010?

b. What percent of the total depreciable amount is taken in the first year?

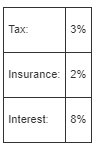

c. The IIT components of ownership cost based on average annual value are:

What cost per hour of operation would you charge to cover IIT?

d. If the total average operating cost for the tractor is $23.50 per hour and the amount of overhead cost prorated to this tractor for the year is $4,000, what would be your total hourly cost for the operation of the tractor (during the first year of its service life)?

Tax: 3% Insurance: 2% Interest: 8%

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Declining balance accelerated method is used to depreciate the tractor which allows larger amounts o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started