You Need to do Financial analysis of the ?Capstone Courier? Financial Summary Cash Flow Statement Survey CashFlows from operating activities Net Income (Loss) Adjustment for

You Need to do Financial analysis of the ?Capstone Courier?

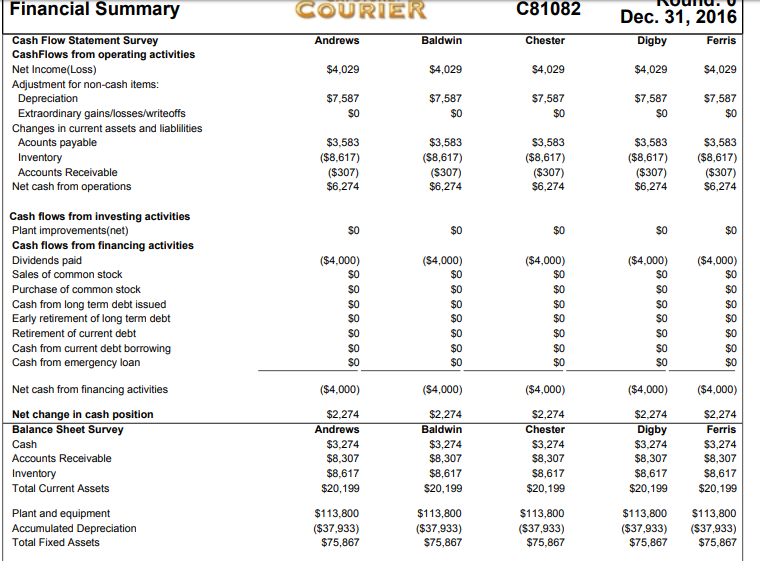

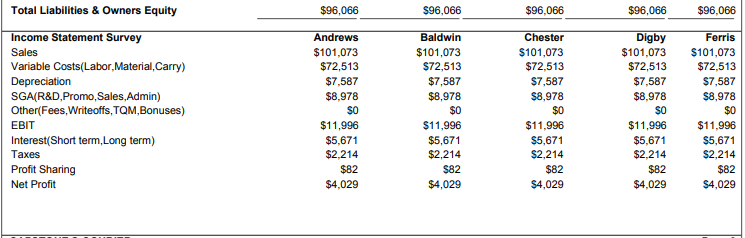

Financial Summary Cash Flow Statement Survey CashFlows from operating activities Net Income (Loss) Adjustment for non-cash items: Depreciation Extraordinary gains/losses/writeoffs Changes in current assets and liablilities Acounts payable Inventory Accounts Receivable Net cash from operations Cash flows from investing activities Plant improvements(net) Cash flows from financing activities Dividends paid Sales of common stock Purchase of common stock Cash from long term debt issued Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan Net cash from financing activities Net change in cash position Balance Sheet Survey Cash Accounts Receivable Inventory Total Current Assets Plant and equipment Accumulated Depreciation Total Fixed Assets COURIER Andrews $4,029 $7,587 $0 $3,583 ($8,617) ($307) $6,274 $0 8 ($4,000) $0 $0 $0 $0 $0 $0 $0 ($4,000) $2,274 Andrews $3,274 $8,307 $8,617 $20,199 $113,800 ($37,933) $75,867 Baldwin $4,029 $7,587 $0 $3,583 ($8,617) ($307) $6,274 $0 ($4,000) $0 3 2 2 2 2 2 $0 $0 $0 $0 $0 $0 ($4,000) $2,274 Baldwin $3,274 $8,307 $8,617 $20,199 $113,800 ($37,933) $75,867 C81082 Chester $4,029 $7,587 $0 $3,583 ($8,617) ($307) $6,274 $0 ($4,000) $0 $0 $0 $0 $0 $0 $0 ($4,000) $2,274 Chester $3,274 $8,307 $8,617 $20,199 $113,800 ($37,933) $75,867 Dec. 31, 2016 Digby Ferris $4,029 $4,029 $7,587 $0 $3,583 ($8,617) ($307) $6,274 $0 ($4,000) $0 $0 $0 $0 $0 $0 $0 ($4,000) $2,274 Digby $3,274 $8,307 $7,587 $0 $3,583 ($8,617) ($307) $6,274 $0 ($4,000) $0 $0 $0 $0 $0 $0 $0 ($4,000) $2,274 Ferris $3,274 $8,307 $8,617 $8,617 $20,199 $20,199 $113,800 $113,800 ($37,933) ($37,933) $75,867 $75,867 Total Liabilities & Owners Equity Income Statement Survey Sales Variable Costs(Labor,Material, Carry) Depreciation SGA(R&D,Promo, Sales, Admin) Other(Fees, Writeoffs, TQM,Bonuses) EBIT Interest(Short term, Long term) Taxes Profit Sharing Net Profit $96,066 Andrews $101,073 $72,513 $7,587 $8,978 $0 $11,996 $5,671 $2,214 $82 $4,029 $96,066 Baldwin $101,073 $72,513 $7,587 $8,978 $0 $11,996 $5,671 $2,214 $82 $4,029 $96,066 Chester $101,073 $72,513 $7,587 $8,978 $0 $11,996 $5,671 $2,214 $82 $4,029 $96,066 Digby $101,073 $72,513 $7,587 $8,978 $0 $11,996 $5,671 $2,214 $82 $4,029 $96,066 Ferris $101,073 $72,513 $7,587 $8,978 $0 $11,996 $5,671 $2,214 $82 $4,029

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Return on assets net profit total assets 4029 96066 004194 or 42 Return on assets ROA is a profitability ratio that demonstrates a companys profitability in relation to its total asset value It demons...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started