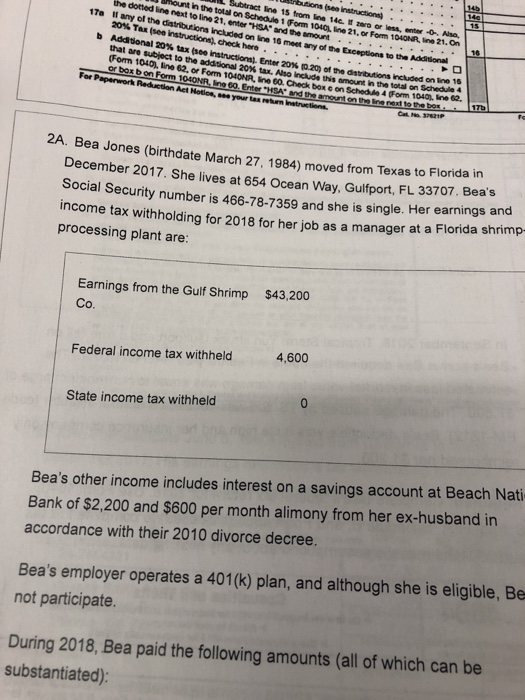

. . . . . . . . . . rutions restructions ....... U Subtract line 15 from line 14. 1 or less, enter D. Also mount in the total on Schedule 1 Form 1040, no 21. or Form 104NR. the dotted line next to line 21, enter "ISAand the amount 21. on 17a 1 any of the distributions included on the 16 metryd te Exceptions to the Addition ...... 20% TAE (see Instructions. Check here . . . . . . . . . . . . . . . . . b Additional 20% tax see instruction Enter 20% 0 20 of the distributions included online that are subject to the additional 20% . Ako include the mount in the total on Schedu om 1040), line 62. or Form 1040NA, Ine 10. Check box con School Form 1040. In or box bon Form 1040NR.no 60. Enter "SA" and the amount on the line next to the box For Paperwork Reduction Act Notice, see your tas return tructions Car IP ZA. Bea Jones (birthdate March 27. 1984) moved from Texas to Florida in December 2017. She lives at 654 Ocean Way. Gulfport, FL 33707. Bea's al Security number is 466-78-7359 and she is single. Her earnings and come tax withholding for 2018 for her job as a manager at a Florida shrimp processing plant are: Earnings from the Gulf Shrimp Co. $43,200 Federal income tax withheld 4,600 State income tax withheld Bea's other income includes interest on a savings account at Beach Nati Bank of $2,200 and $600 per month alimony from her ex-husband in accordance with their 2010 divorce decree. Bea's employer operates a 401(k) plan, and although she is eligible, Be not participate. During 2018, Bea paid the following amounts (all of which can be substantiated): . . . . . . . . . . rutions restructions ....... U Subtract line 15 from line 14. 1 or less, enter D. Also mount in the total on Schedule 1 Form 1040, no 21. or Form 104NR. the dotted line next to line 21, enter "ISAand the amount 21. on 17a 1 any of the distributions included on the 16 metryd te Exceptions to the Addition ...... 20% TAE (see Instructions. Check here . . . . . . . . . . . . . . . . . b Additional 20% tax see instruction Enter 20% 0 20 of the distributions included online that are subject to the additional 20% . Ako include the mount in the total on Schedu om 1040), line 62. or Form 1040NA, Ine 10. Check box con School Form 1040. In or box bon Form 1040NR.no 60. Enter "SA" and the amount on the line next to the box For Paperwork Reduction Act Notice, see your tas return tructions Car IP ZA. Bea Jones (birthdate March 27. 1984) moved from Texas to Florida in December 2017. She lives at 654 Ocean Way. Gulfport, FL 33707. Bea's al Security number is 466-78-7359 and she is single. Her earnings and come tax withholding for 2018 for her job as a manager at a Florida shrimp processing plant are: Earnings from the Gulf Shrimp Co. $43,200 Federal income tax withheld 4,600 State income tax withheld Bea's other income includes interest on a savings account at Beach Nati Bank of $2,200 and $600 per month alimony from her ex-husband in accordance with their 2010 divorce decree. Bea's employer operates a 401(k) plan, and although she is eligible, Be not participate. During 2018, Bea paid the following amounts (all of which can be substantiated)