Answered step by step

Verified Expert Solution

Question

1 Approved Answer

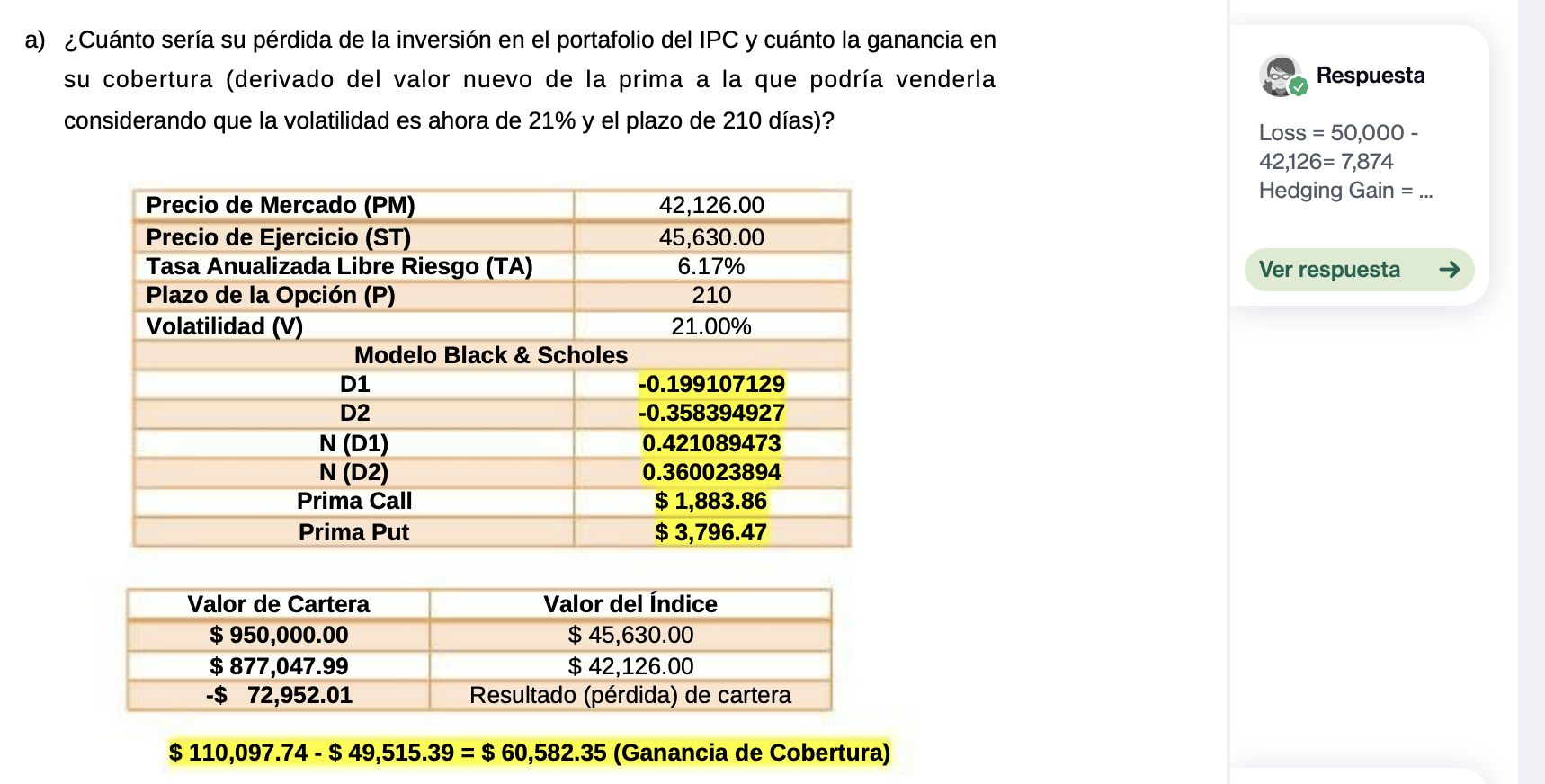

a) &Cunto seria su prdida de la inversin en el portafolio del IPC y cunto la ganancia en su cobertura (derivado del valor nuevo

a) &Cunto seria su prdida de la inversin en el portafolio del IPC y cunto la ganancia en su cobertura (derivado del valor nuevo de la prima a la que podria venderla considerando que la volatilidad es ahora de 21% y el plazo de 210 dias)? Precio de Mercado (PM) Precio de Ejercicio (ST) Tasa Anualizada Libre Riesgo (TA) Plazo de Ia Opci6n (P) Volatilidad Modelo Black & Scholes 42,126.00 45,630.00 6.17% 210 21.00% Respuesta Loss = 50,000 - 7,874 Hedging Gain = Ver respuesta -0.199107129 -0.358394927 N (Dl) 0.421089473 N (D2) 0.360023894 Prima Call $ 1,883.86 Prima Put $ 3,796.47 Valor de Cartera Valor del ndice $ 950,000.00 $ 45,630.00 $ 877,047.99 $ 42,126.00 -$ 72,952.01 Resultado rdida de cartera $ 110,097.74 - $ 49,515.39 = $ 60,582.35 (Ganancia de Cobertura)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started