Question: What makes Shenzhen Development Bank (SDB) an attractive target for investment, and what are the potential sources of value? What are the key risks

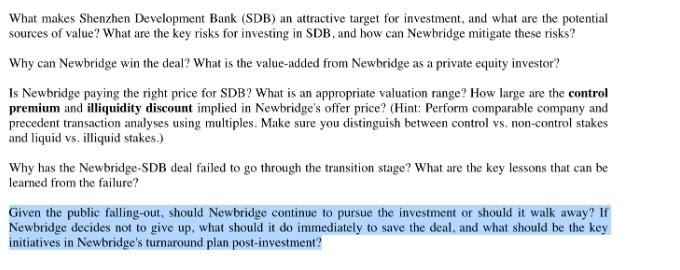

What makes Shenzhen Development Bank (SDB) an attractive target for investment, and what are the potential sources of value? What are the key risks for investing in SDB, and how can Newbridge mitigate these risks? Why can Newbridge win the deal? What is the value-added from Newbridge as a private equity investor? Is Newbridge paying the right price for SDB? What is an appropriate valuation range? How large are the control premium and illiquidity discount implied in Newbridge's offer price? (Hint: Perform comparable company and precedent transaction analyses using multiples. Make sure you distinguish between control vs. non-control stakes and liquid vs. illiquid stakes.) Why has the Newbridge-SDB deal failed to go through the transition stage? What are the key lessons that can be learned from the failure? Given the public falling-out, should Newbridge continue to pursue the investment or should it walk away? If Newbridge decides not to give up, what should it do immediately to save the deal, and what should be the key initiatives in Newbridge's turnaround plan post-investment?

Step by Step Solution

There are 3 Steps involved in it

Sure lets address each part of the question methodically What makes Shenzhen Development Bank SDB an attractive target for investment and what are the potential sources of value What are the key risks ... View full answer

Get step-by-step solutions from verified subject matter experts