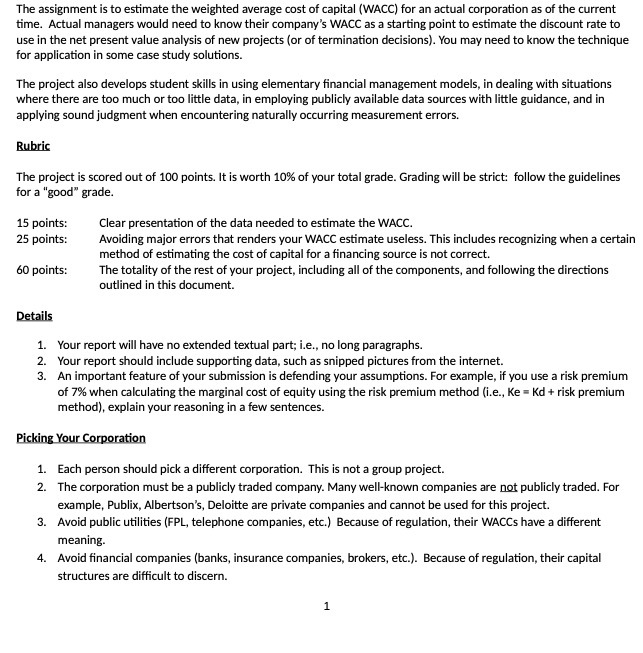

The assignment is to estimate the weighted average cost of capital (WACC) for an actual corporation as of the current time. Actual managers would need to know their company's WACC as a starting point to estimate the discount rate to use in the net present value analysis of new projects (or of termination decisions). You may need to know the technique for application in some case study solutions. The project also develops student skills in using elementary financial management models, in dealing with situations where there are too much or too little data, in employing publicly available data sources with little guidance, and in applying sound judgment when encountering naturally occurring measurement errors. Rubric The project is scored out of 100 points. It is worth 10% of your total grade. Grading will be strict: follow the guidelines for a "good" grade. 15 points: Clear presentation of the data needed to estimate the WACC. 25 points: Avoiding major errors that renders your WACC estimate useless. This includes recognizing when a certain method of estimating the cost of capital for a financing source is not correct. 60 points: The totality of the rest of your project, including all of the components, and following the directions outlined in this document. Details 1. Your report will have no extended textual part; i.e., no long paragraphs. 2. Your report should include supporting data, such as snipped pictures from the internet. 3. An important feature of your submission is defending your assumptions. For example, if you use a risk premium of 7% when calculating the marginal cost of equity using the risk premium method (i.e., Ke = Kd + risk premium method), explain your reasoning in a few sentences. Picking Your Corporation 1. Each person should pick a different corporation. This is not a group project. 2. The corporation must be a publicly traded company. Many well-known companies are not publicly traded. For example, Publix, Albertson's, Deloitte are private companies and cannot be used for this project. 3. Avoid public utilities (FPL, telephone companies, etc.) Because of regulation, their WACCs have a different meaning. Avoid financial companies (banks, insurance companies, brokers, etc.). Because of regulation, their capital structures are difficult to discern. 1