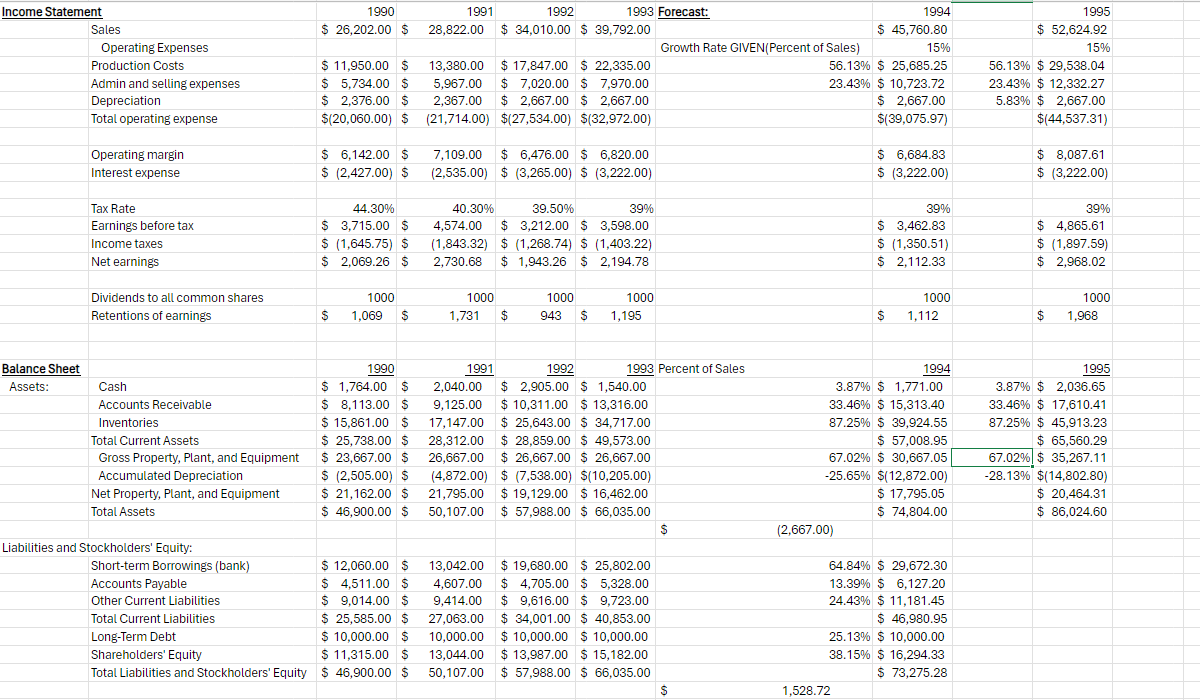

Income Statement 1990 1991 1992 1993 Forecast: 1994 1995 Sales $ 26,202.00 $ 28,822.00 $ 34,010.00 $ 39,792.00 $ 45,760.80 $ 52,624.92 Operating Expenses Growth Rate GIVEN(Percent of Sales) 15% 15% Production Costs $ 11,950.00 $ 13,380.00 $ 17,847.00 $ 22,335.00 56.13% $ 25,685.25 56.13% $ 29,538.04 Admin and selling expenses $ 5,734.00 5,967.00 $ 7,020.00 $ 7,970.00 23.43% $ 10,723.72 23.43% $ 12,332.27 Depreciation $ 2,376.00 $ 2,367.00 $ 2,667.00 $ 2,667.00 $ 2,667.00 5.83% $ 2,667.00 Total operating expense $(20,060.00) $ (21,714.00) $(27,534.00) $(32,972.00) $(39,075.97) $(44,537.31) Operating margin $ 6,142.00 $ 7,109.00 $ 6,476.00 $ 6,820.00 $ 6,684.83 $ 8,087.61 Interest expense $ (2,427.00) $ (2,535.00) $ (3,265.00) $ (3,222.00) $ (3,222.00) $ (3,222.00) Tax Rate 44.30% 40.30% 39.50% 39% 39% 39% Earnings before tax $ 3,715.00 $ 4,574.00 $ 3,212.00 $ 3,598.00 $ 3,462.83 $ 4,865.61 Income taxes $ (1,645.75) $ (1,843.32) $ (1,268.74) $ (1,403.22) $ (1,350.51) $ (1,897.59) Net earnings $ 2,069.26 $ 2,730.68 $ 1,943.26 $ 2,194.78 $ 2,112.33 $ 2,968.02 Dividends to all common shares 1000 1000 1000 1000 1000 1000 Retentions of earnings $ 1,069 $ 1,731 $ 943 $ 1,195 $ 1,112 $ 1,968 Balance Sheet 1990 1991 1992 1993 Percent of Sales 1994 1995 Assets: Cash $ 1,764.00 $ 2,040.00 $ 2,905.00 $ 1,540.00 3.87% $ 1,771.00 3.87% $ 2,036.65 Accounts Receivable $ 8,113.00 9,125.00 $ 10,311.00 $ 13,316.00 33.46% $ 15,313.40 33.46% $ 17,610.41 Inventories $ 15,861.00 $ 17,147.00 $ 25,643.00 $ 34,717.00 87.25% $ 39,924.55 87.25% $ 45,913.23 Total Current Assets $ 25,738.00 $ 28,312.00 $ 28,859.00 $ 49,573.00 $ 57,008.95 $ 65,560.29 Gross Property, Plant, and Equipment $ 23,667.00 $ 26,667.00 $ 26,667.00 $ 26,667.00 67.02% $ 30,667.05 67.02%| $ 35,267.11 Accumulated Depreciation $ (2,505.00) $ (4,872.00) $ (7,538.00) $(10,205.00) -25.65% $(12,872.00) -28.13% $(14,802.80) Net Property, Plant, and Equipment $ 21, 162.00 $ 21,795.00 $ 19,129.00 $ 16,462.00 $ 17,795.05 $ 20,464.31 Total Assets $ 46,900.00 $ 50,107.00 $ 57,988.00 $ 66,035.00 $ 74,804.00 $ 86,024.60 (2,667.00) Liabilities and Stockholders' Equity: Short-term Borrowings (bank) $ 12,060.00 $ 13,042.00 $ 19,680.00 $ 25,802.00 64.84% $ 29,672.30 Accounts Payable $ 4,511.00 $ 4,607.00 $ 4,705.00 $ 5,328.00 13.39% $ 6,127.20 Other Current Liabilities $ 9,014.00 9,414.00 $ 9,616.00 $ 9,723.00 24.43% $ 11,181.45 Total Current Liabilities $ 25,585.00 $ 27,063.00 $ 34,001.00 $ 40,853.00 $ 46,980.95 Long-Term Debt $ 10,000.00 $ 10,000.00 $ 10,000.00 $ 10,000.00 25.13% $ 10,000.00 Shareholders' Equity $ 11,315.00 $ 13,044.00 $ 13,987.00 $ 15,182.00 38.15% $ 16,294.33 Total Liabilities and Stockholders' Equity $ 46,900.00 $ 50,107.00 $ 57,988.00 $ 66,035.00 $ 73,275.28 $ 1,528.72