Question

Company D is currently considering financing. If the financing is all equity, the cost of equity is 10%. If a mix of debt and

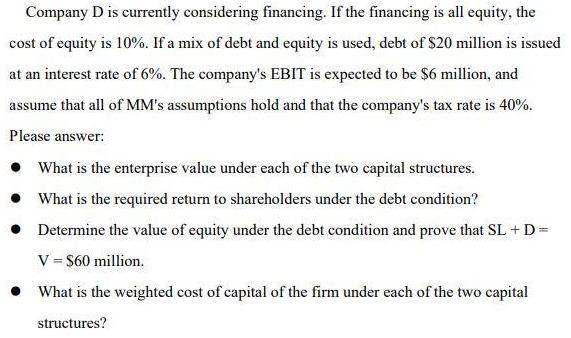

Company D is currently considering financing. If the financing is all equity, the cost of equity is 10%. If a mix of debt and equity is used, debt of $20 million is issued at an interest rate of 6%. The company's EBIT is expected to be $6 million, and assume that all of MM's assumptions hold and that the company's tax rate is 40%. Please answer: What is the enterprise value under each of the two capital structures. What is the required return to shareholders under the debt condition? Determine the value of equity under the debt condition and prove that SL +D= V = $60 million. What is the weighted cost of capital of the firm under each of the two capital structures?

Step by Step Solution

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing A Practical Approach

Authors: Robyn Moroney, Fiona Campbell, Jane Hamilton, Valerie Warren

3rd Canadian edition

1-119-40285-5, 111940276X, 978-1119566007

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App