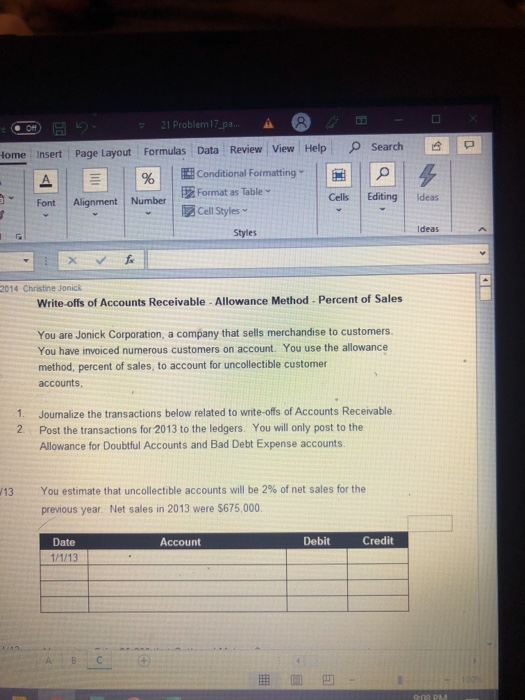

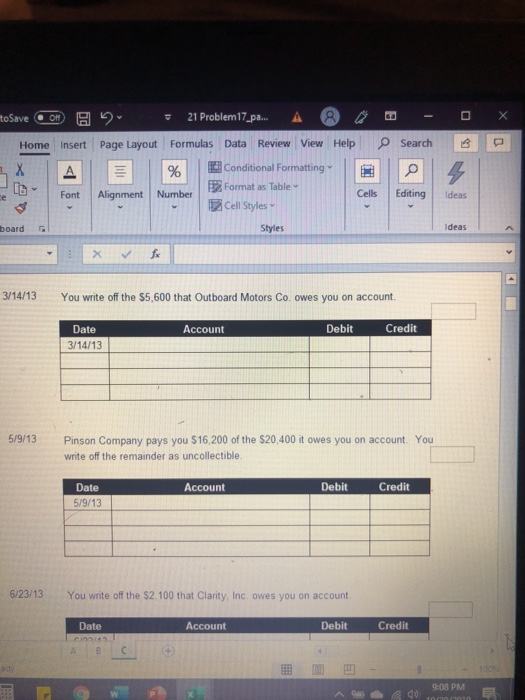

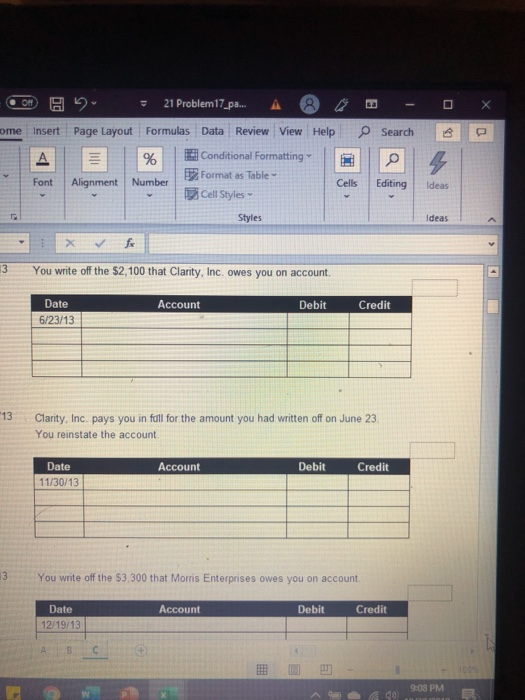

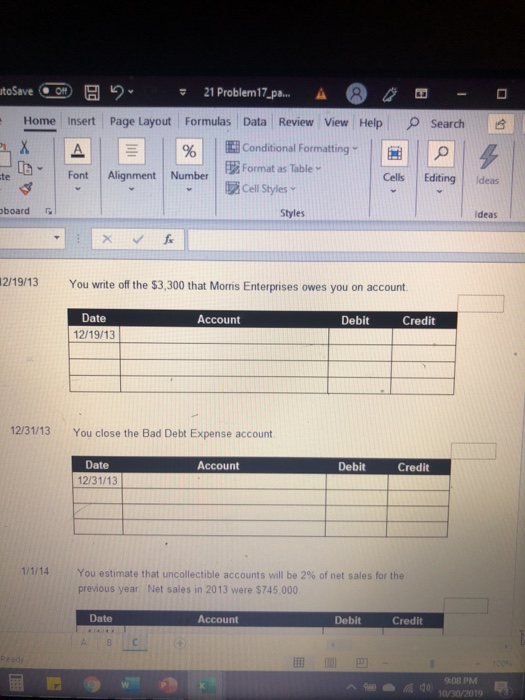

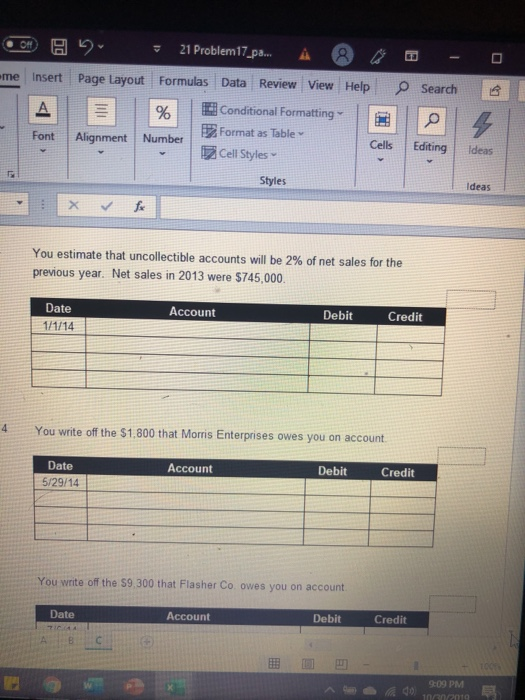

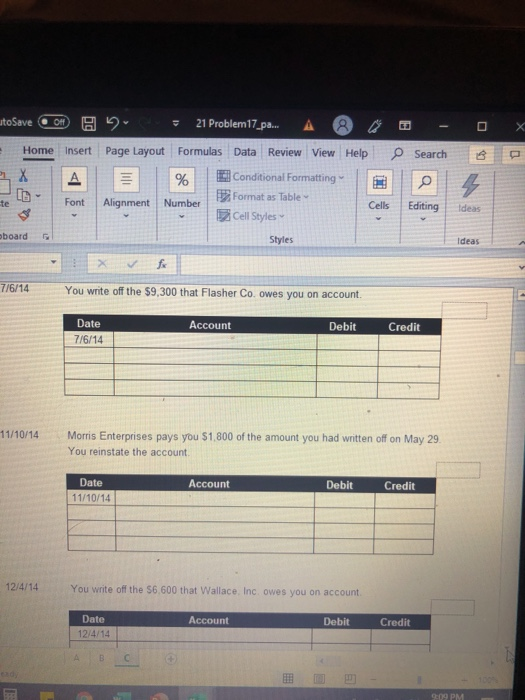

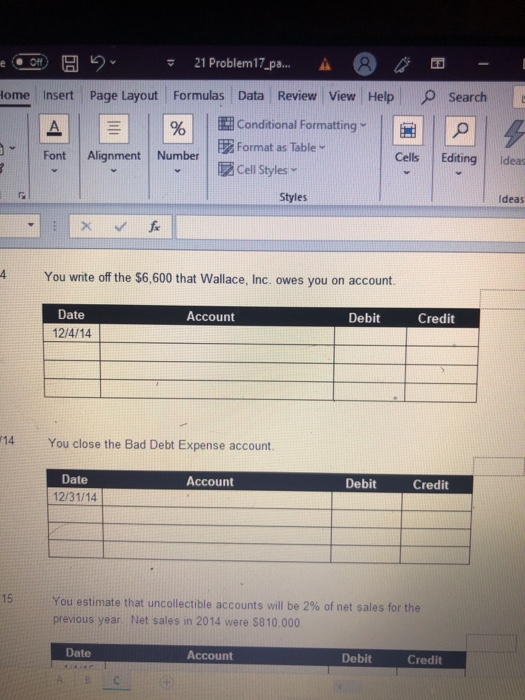

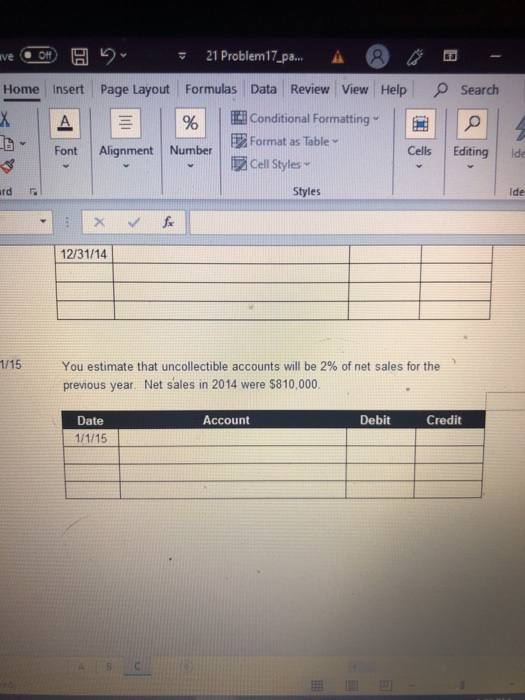

0 0 9 - Search Home Insert 9 21 Problem 17.2. A 8 Page Layout Formulas Data Review View Help % Conditional Formatting 2 Format as Table Alignment Number Cells | Cell Styles Font Editing Ideas Styles Ideas - X fx 2014 Christine Jonick Write-offs of Accounts Receivable - Allowance Method - Percent of Sales You are Jonick Corporation, a company that sells merchandise to customers. You have invoiced numerous customers on account. You use the allowance method, percent of sales, to account for uncollectible customer accounts, 1. 2 Journalize the transactions below related to write-offs of Accounts Receivable. Post the transactions for 2013 to the ledgers. You will only post to the Allowance for Doubtful Accounts and Bad Debt Expense accounts 13 You estimate that uncollectible accounts will be 2% of net sales for the previous year. Net sales in 2013 were $675,000 Account Debit Credit Date 1/1/13 0 - x - Search toSave OD 21 Problem17_pa... A a Home Insert Page Layout Formulas Data Review View Help % Conditional Formatting Font Alignment Format as Table Number Cell Styles Styles ID Editing Ideas board Ideas 3/14/13 You write off the $5,600 that Outboard Motors Co. owes you on account Account Debit Credit Date 3/14/13 5/9/13 Pinson Company pays you $16,200 of the $20.400 it owes you on account. You write off the remainder as uncollectible. Account Debit Credit Date 5/9/13 6/23/13 You write off the $2.100 that Clarity, Inc. owes you on account Date Account Debit Credit 0:03 PM 0 0 - Search On 21 Problem17_pa. A 8 ome Insert Page Layout Formulas Data Review View Help % Conditional Formatting 2 Format as Table Font Alignment Number Cell Styles Editing Ideas Styles Ideas 13 You write off the $2,100 that Clarity, Inc. owes you on account. Account Debit Credit Date 6/23/13 13 Clarity, Inc. pays you in full for the amount you had written off on June 23 You reinstate the account Date Account Debit Credit 11/30/13 You write off the $3.300 that Morris Enterprises owes you on account Account Debit Credit Date 12/19/13 9:08 PM 0 ito Save om Home Insert - Search A 9 - 21 Problem 17.p A Page Layout Formulas Data Review View Help % Conditional Formatting Format as Table Alignment Number Cells Cell Styles Styles Font Editing Ideas board Ideas 12/19/13 You write off the 53,300 that Morris Enterprises owes you on account. Account Debit Credit Date 12/19/13 12/31/13 You close the Bad Debt Expense account. Account Debit Credit Date 12/31/13 1/1/14 You estimate that uncollectible accounts will be 2% of net sales for the previous year. Net sales in 2013 were $745 000 Date Account Debit Credit O - Search - 9 - 21 Problem17_paw A me Insert Page Layout Formulas Data Review View Help Conditional Formatting Format as Table Font Alignment Number Cell Styles Cells Editing Styles Ideas You estimate that uncollectible accounts will be 2% of net sales for the previous year. Net sales in 2013 were $745,000 Account Debit Credit Date 1/1/14 You write off the $1,800 that Morris Enterprises owes you on account Account Debit Credit Date 5/29/14 You write off the 59,300 that Flasher Co. owes you on account Date Account Debit Credit 9:09 PM O - Search itoSave an A2 21 Problem 17 pa.. A Home Insert Page Layout Formulas Data Review View Help 2X A % % Conditional Formatting Font Alignment Number Format as Table Cells Cell Styles Editing Ideas board Styles Ideas f 7/6/14 You write off the $9,300 that Flasher Co. owes you on account. Account Debit Credit Date 7/6/14 11/10/14 Morris Enterprises pays you $1,800 of the amount you had written off on May 29 You reinstate the account Account Debit Credit Date 11/10/14 12/4/14 You write off the 56.600 that Wallace. Inc. owes you on account Account Debit Credit Date 12/4/14 - Search Help - H H 21 Problem 17.p. A. ome Insert Page Layout Formulas Data Review View A % E conditional Formatting Font Format as Table Alignment Number Cell Styles Cells Editing Idea Styles Ideas - X fx You write off the $6,600 that Wallace, Inc. owes you on account. Account Debit Credit Date 12/4/14 14 You close the Bad Debt Expense account. Account Debit Credit Date 12/31/14 You estimate that uncollectible accounts will be 2% of net sales for the previous year. Net sales in 2014 were $810,000 Date Account Debit Credit uveo Home Insert - Search y = 21 Problem 17.pa. A Page Layout Formulas Data Review View Help Conditional Formatting Format as Table Alignment Number Cells Cell Styles Font Editing and Styles 12/31/14 1/15 You estimate that uncollectible accounts will be 2% of net sales for the previous year. Net sales in 2014 were $810,000. Account Debit Credit Date 1/1/15