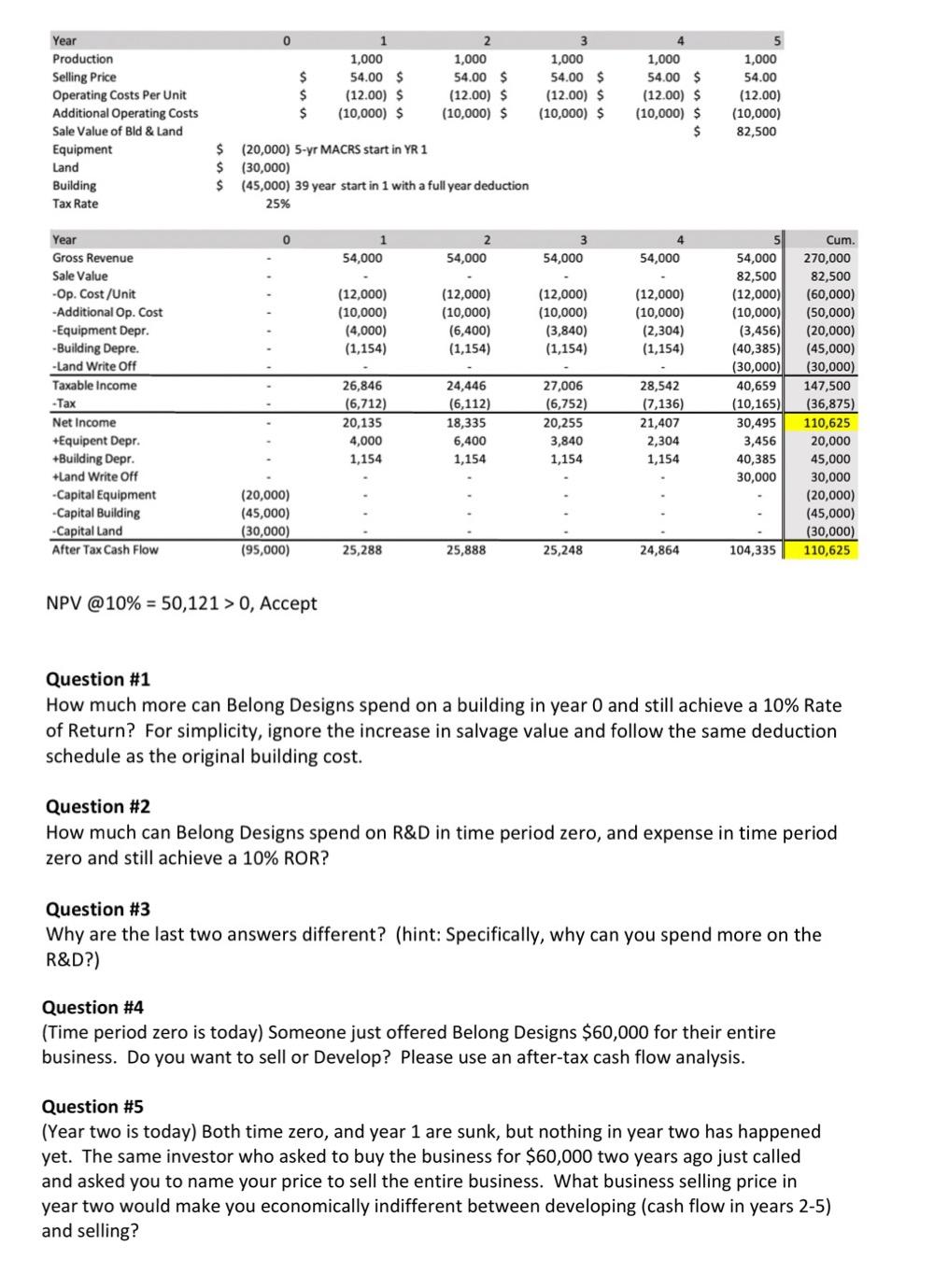

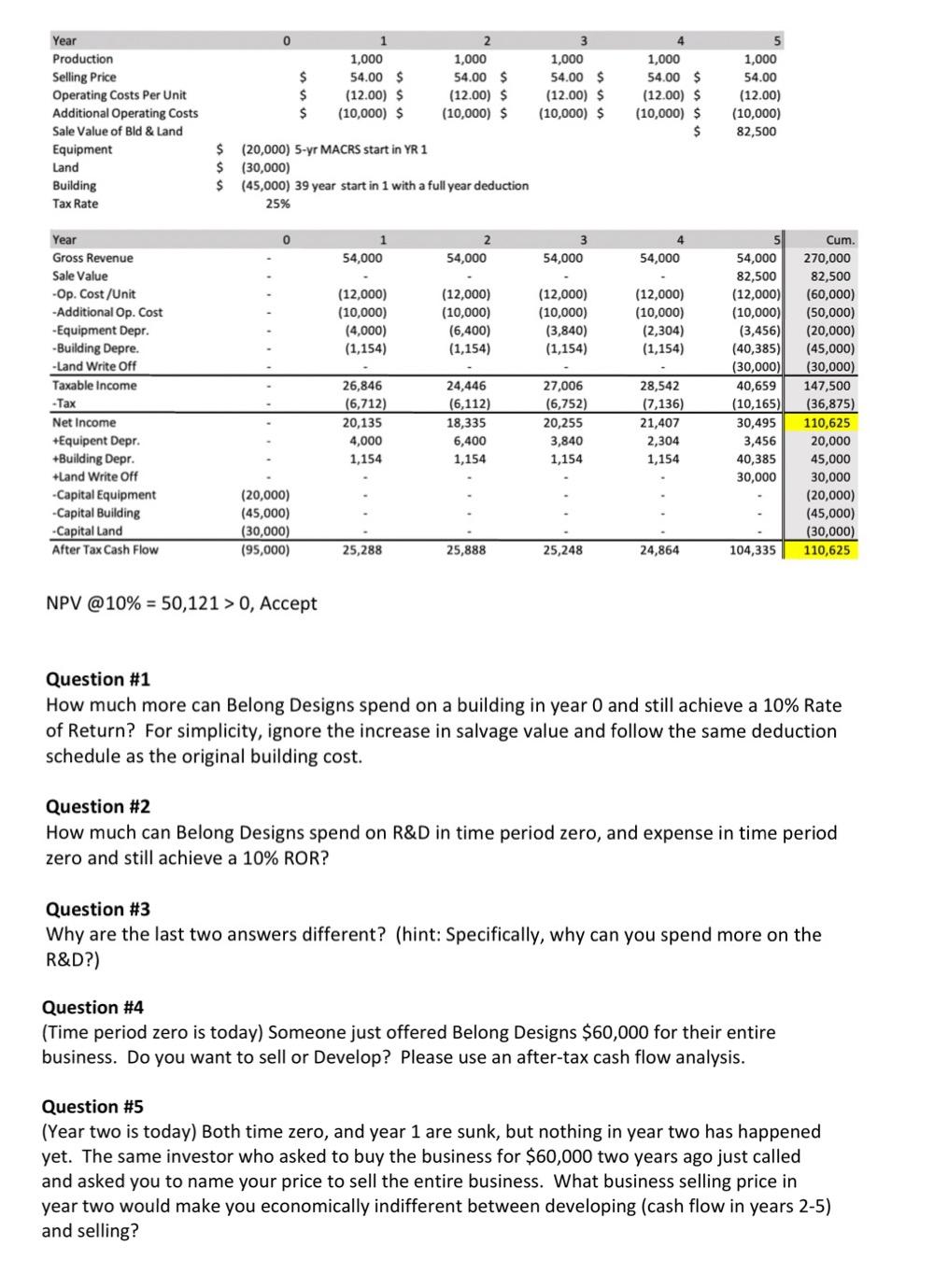

0 $ $ $ 1 1,000 54.00 $ (12.00) $ (10,000) $ Year Production Selling Price Operating Costs Per Unit Additional Operating Costs Sale Value of Bld & Land Equipment Land Building Tax Rate 2 1,000 54.00 $ (12.00) S (10,000) $ 3 1,000 54.00 $ (12.00) $ (10,000) $ 4 1,000 54.00 $ (12.00) $ (10,000) $ $ 5 1,000 54.00 (12.00) (10,000) 82,500 $ $ $ (20,000) 5-yr MACRS start in YR 1 (30,000) (45,000) 39 year start in 1 with a full year deduction 25% 0 2 54,000 3 54,000 4. 54,000 54,000 (12,000) (10,000) (4,000) (1,154) (12,000) (10,000) (6,400) (1,154) (12,000) (10,000) (3,840) (1,154) (12,000) (10,000) (2,304) (1,154) Year Gross Revenue Sale Value -Op. Cost/Unit -Additional Op. Cost -Equipment Depr. -Building Depre. -Land Write Off Taxable income -Tax Net Income +Equipent Depr. +Building Depr. +Land Write Off -Capital Equipment - Capital Building - Capital Land After Tax Cash Flow 54,000 82,500 (12,000) (10,000) (3,456) (40,385) (30,000) 40,659 (10,165) 30,495 3,456 40,385 30,000 26,846 (6,712) 20,135 4,000 1,154 24,446 (6,112) 18,335 6,400 1,154 27,006 (6,752) 20,255 3,840 1,154 28,542 (7,136) 21,407 2,304 1,154 Cum. 270,000 82,500 (60,000) (50,000) (20,000) (45,000) (30,000) 147,500 (36,875) 110,625 20,000 45,000 30,000 (20,000) (45,000) (30,000) 110,625 (20,000) (45,000) (30,000) (95,000) 25,288 25,888 25,248 24,864 104,335 NPV @10% = 50,121 > 0, Accept Question #1 How much more can Belong Designs spend on a building in year 0 and still achieve a 10% Rate of Return? For simplicity, ignore the increase in salvage value and follow the same deduction schedule as the original building cost. Question #2 How much can Belong Designs spend on R&D in time period zero, and expense in time period zero and still achieve a 10% ROR? Question #3 Why are the last two answers different? (hint: Specifically, why can you spend more on the R&D?) Question #4 (Time period zero is today) Someone just offered Belong Designs $60,000 for their entire business. Do you want to sell or Develop? Please use an after-tax cash flow analysis. Question #5 (Year two is today) Both time zero, and year 1 are sunk, but nothing in year two has happened yet. The same investor who asked to buy the business for $60,000 two years ago just called and asked you to name your price to sell the entire business. What business selling price in year two would make you economically indifferent between developing (cash flow in years 2-5) and selling? 0 $ $ $ 1 1,000 54.00 $ (12.00) $ (10,000) $ Year Production Selling Price Operating Costs Per Unit Additional Operating Costs Sale Value of Bld & Land Equipment Land Building Tax Rate 2 1,000 54.00 $ (12.00) S (10,000) $ 3 1,000 54.00 $ (12.00) $ (10,000) $ 4 1,000 54.00 $ (12.00) $ (10,000) $ $ 5 1,000 54.00 (12.00) (10,000) 82,500 $ $ $ (20,000) 5-yr MACRS start in YR 1 (30,000) (45,000) 39 year start in 1 with a full year deduction 25% 0 2 54,000 3 54,000 4. 54,000 54,000 (12,000) (10,000) (4,000) (1,154) (12,000) (10,000) (6,400) (1,154) (12,000) (10,000) (3,840) (1,154) (12,000) (10,000) (2,304) (1,154) Year Gross Revenue Sale Value -Op. Cost/Unit -Additional Op. Cost -Equipment Depr. -Building Depre. -Land Write Off Taxable income -Tax Net Income +Equipent Depr. +Building Depr. +Land Write Off -Capital Equipment - Capital Building - Capital Land After Tax Cash Flow 54,000 82,500 (12,000) (10,000) (3,456) (40,385) (30,000) 40,659 (10,165) 30,495 3,456 40,385 30,000 26,846 (6,712) 20,135 4,000 1,154 24,446 (6,112) 18,335 6,400 1,154 27,006 (6,752) 20,255 3,840 1,154 28,542 (7,136) 21,407 2,304 1,154 Cum. 270,000 82,500 (60,000) (50,000) (20,000) (45,000) (30,000) 147,500 (36,875) 110,625 20,000 45,000 30,000 (20,000) (45,000) (30,000) 110,625 (20,000) (45,000) (30,000) (95,000) 25,288 25,888 25,248 24,864 104,335 NPV @10% = 50,121 > 0, Accept Question #1 How much more can Belong Designs spend on a building in year 0 and still achieve a 10% Rate of Return? For simplicity, ignore the increase in salvage value and follow the same deduction schedule as the original building cost. Question #2 How much can Belong Designs spend on R&D in time period zero, and expense in time period zero and still achieve a 10% ROR? Question #3 Why are the last two answers different? (hint: Specifically, why can you spend more on the R&D?) Question #4 (Time period zero is today) Someone just offered Belong Designs $60,000 for their entire business. Do you want to sell or Develop? Please use an after-tax cash flow analysis. Question #5 (Year two is today) Both time zero, and year 1 are sunk, but nothing in year two has happened yet. The same investor who asked to buy the business for $60,000 two years ago just called and asked you to name your price to sell the entire business. What business selling price in year two would make you economically indifferent between developing (cash flow in years 2-5) and selling