Answered step by step

Verified Expert Solution

Question

1 Approved Answer

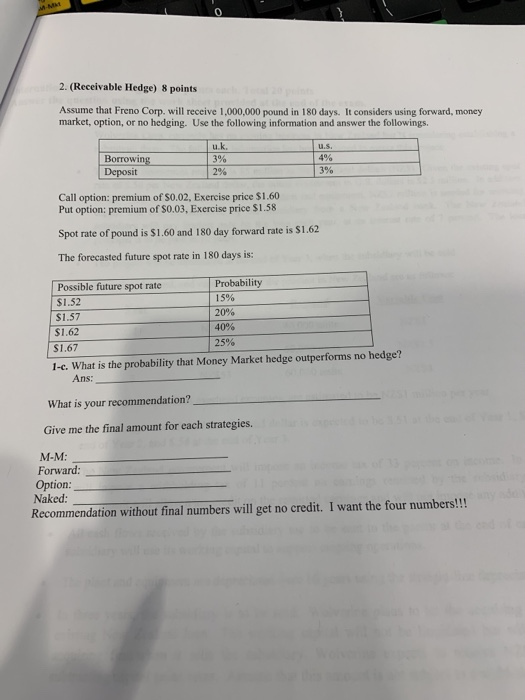

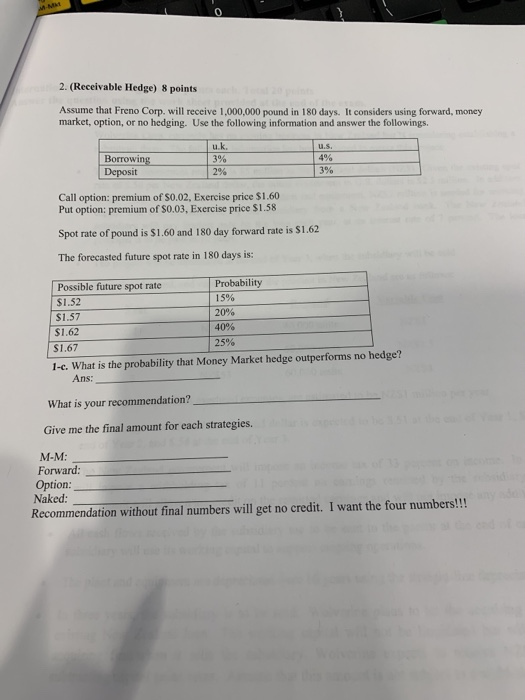

0 2. (Receivable Hedge) 8 points Assume that Freno Corp. will receive 1,000,000 pound in 180 days. It considers using forward, money market, option, or

0 2. (Receivable Hedge) 8 points Assume that Freno Corp. will receive 1,000,000 pound in 180 days. It considers using forward, money market, option, or no hedging. Use the following information and answer the followings. Borrowing Deposit u.k. 3% 2% u.s 490 3% Call option: premium of $0.02, Exercise price $1.60 Put option: premium of $0.03, Exercise price $1.58 Spot rate of pound is $1.60 and 180 day forward rate is $1.62 The forecasted future spot rate in 180 days is: Probability Possible future spot rate $1.52 $1.57 $1.62 S1.67 1 5% 20% 40% 25% 1-c. What is the probability that Money Market hedge outperforms no hedge? Ans: What is your recommendation? Give me the final amount for each strategies. M-M Forward: Option: Naked: Recommendation without final numbers will get no credit. I want the four numbers

0 2. (Receivable Hedge) 8 points Assume that Freno Corp. will receive 1,000,000 pound in 180 days. It considers using forward, money market, option, or no hedging. Use the following information and answer the followings. Borrowing Deposit u.k. 3% 2% u.s 490 3% Call option: premium of $0.02, Exercise price $1.60 Put option: premium of $0.03, Exercise price $1.58 Spot rate of pound is $1.60 and 180 day forward rate is $1.62 The forecasted future spot rate in 180 days is: Probability Possible future spot rate $1.52 $1.57 $1.62 S1.67 1 5% 20% 40% 25% 1-c. What is the probability that Money Market hedge outperforms no hedge? Ans: What is your recommendation? Give me the final amount for each strategies. M-M Forward: Option: Naked: Recommendation without final numbers will get no credit. I want the four numbers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started