Answered step by step

Verified Expert Solution

Question

1 Approved Answer

0 / 6.25 pts Question 15 Generous Dynamics is planning on buying 12000 ounces of gold in six months. The correlation of the six-month change

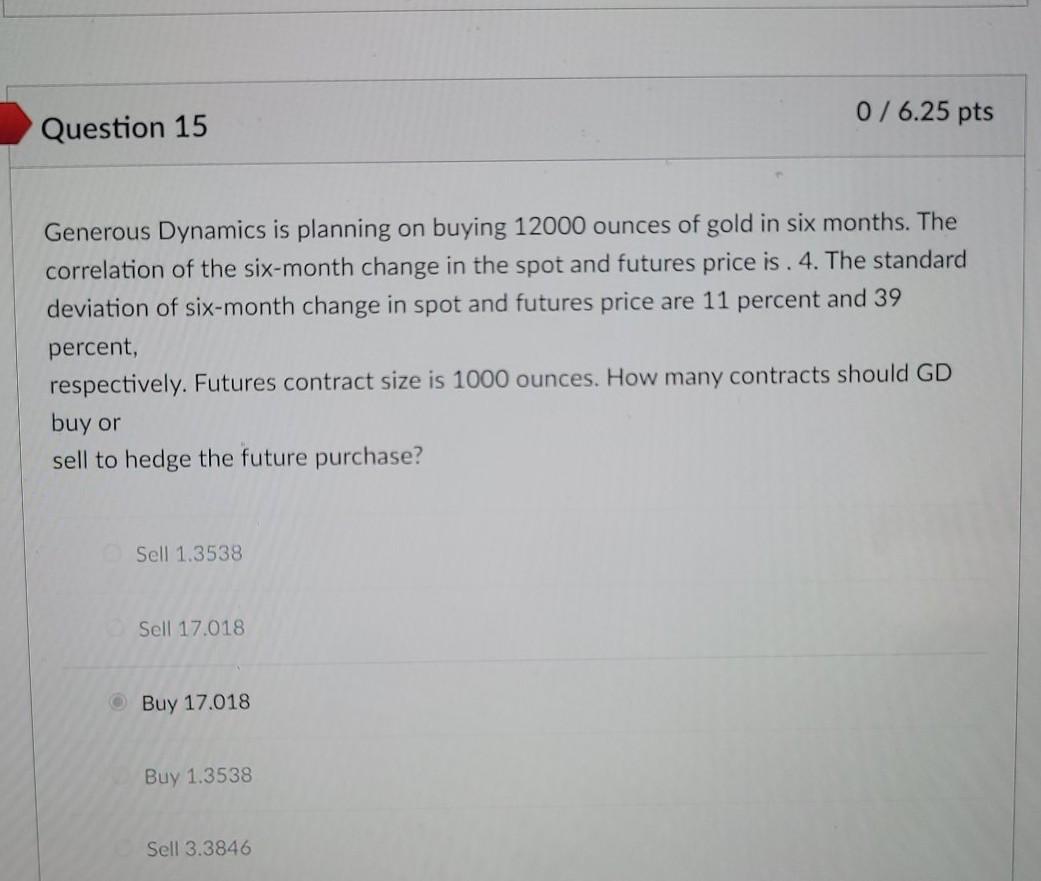

0 / 6.25 pts Question 15 Generous Dynamics is planning on buying 12000 ounces of gold in six months. The correlation of the six-month change in the spot and futures price is . 4. The standard deviation of six-month change in spot and futures price are 11 percent and 39 percent, respectively. Futures contract size is 1000 ounces. How many contracts should GD buy or sell to hedge the future purchase? Sell 1.3538 Sell 17.018 Buy 17.018 Buy 1.3538 Sell 3.3846

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started