Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(0) A. Record the basic consolidation entry. B. Record the excess value (differential) reclassification entry. Prophet Corporation acquired 75 percent of Seer Corporation's voting common

(0)

A. Record the basic consolidation entry.

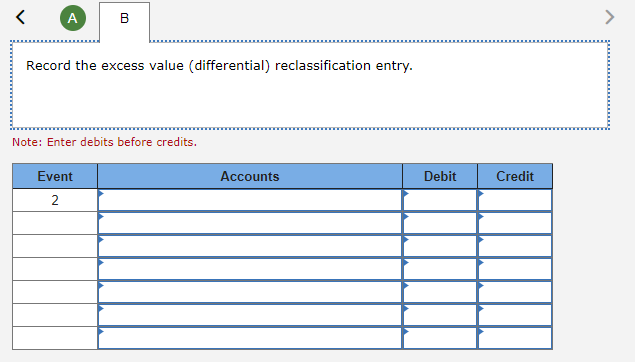

B. Record the excess value (differential) reclassification entry.

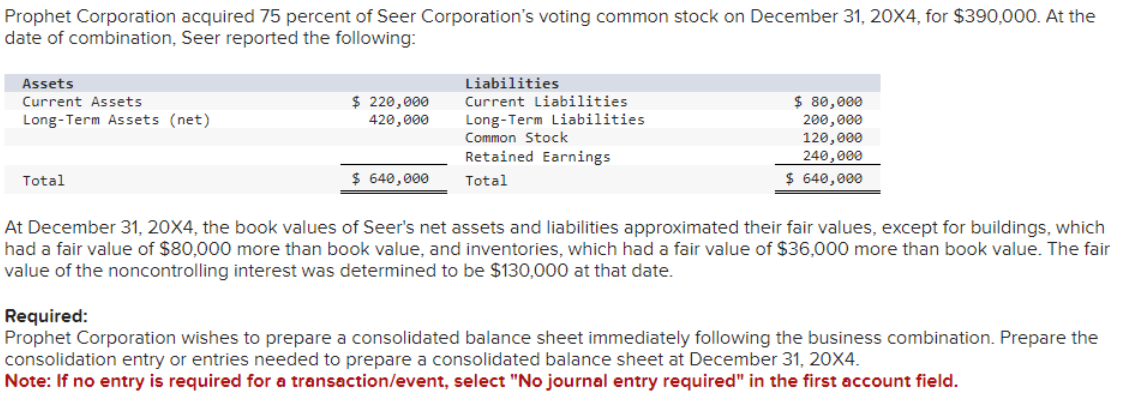

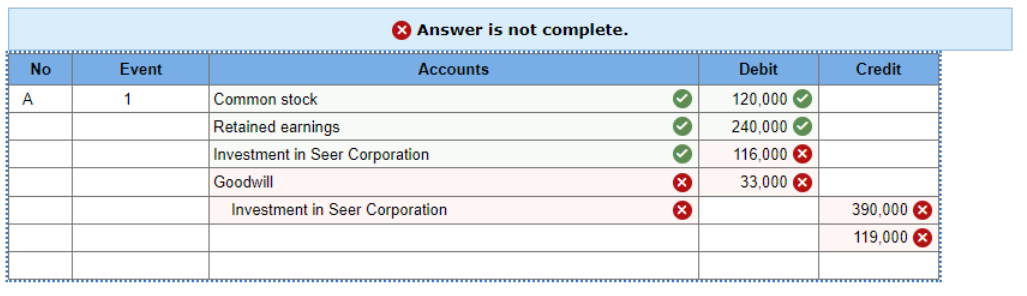

Prophet Corporation acquired 75 percent of Seer Corporation's voting common stock on December 31,204, for $390,000. At the date of combination, Seer reported the following: At December 31, 20X4, the book values of Seer's net assets and liabilities approximated their fair values, except for buildings, which had a fair value of $80,000 more than book value, and inventories, which had a fair value of $36,000 more than book value. The fair value of the noncontrolling interest was determined to be $130,000 at that date. Required: Prophet Corporation wishes to prepare a consolidated balance sheet immediately following the business combination. Prepare the consolidation entry or entries needed to prepare a consolidated balance sheet at December 31, 204. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Record the excess value (differential) reclassification entry. Note: Enter debits before credits. \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Answer is not complete. } \\ \hline No & Event & Acco & & Debit & Credit \\ \hline \multirow[t]{6}{*}{ A } & 1 & Common stock & & 120,000 & \\ \hline & & Retained earnings & 2 & 240,000 & \\ \hline & & Investment in Seer Corporation & & 116,000 & \\ \hline & & Goodwill & x & 33,000 & \\ \hline & & Investment in Seer Corporation & & & 390,000 \\ \hline & & & & & 119,000 \\ \hline \end{tabular}

Prophet Corporation acquired 75 percent of Seer Corporation's voting common stock on December 31,204, for $390,000. At the date of combination, Seer reported the following: At December 31, 20X4, the book values of Seer's net assets and liabilities approximated their fair values, except for buildings, which had a fair value of $80,000 more than book value, and inventories, which had a fair value of $36,000 more than book value. The fair value of the noncontrolling interest was determined to be $130,000 at that date. Required: Prophet Corporation wishes to prepare a consolidated balance sheet immediately following the business combination. Prepare the consolidation entry or entries needed to prepare a consolidated balance sheet at December 31, 204. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Record the excess value (differential) reclassification entry. Note: Enter debits before credits. \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Answer is not complete. } \\ \hline No & Event & Acco & & Debit & Credit \\ \hline \multirow[t]{6}{*}{ A } & 1 & Common stock & & 120,000 & \\ \hline & & Retained earnings & 2 & 240,000 & \\ \hline & & Investment in Seer Corporation & & 116,000 & \\ \hline & & Goodwill & x & 33,000 & \\ \hline & & Investment in Seer Corporation & & & 390,000 \\ \hline & & & & & 119,000 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started