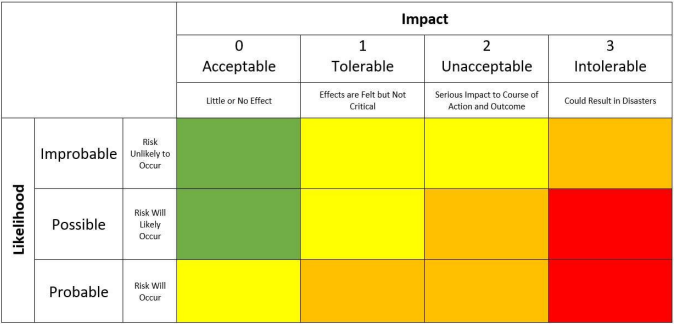

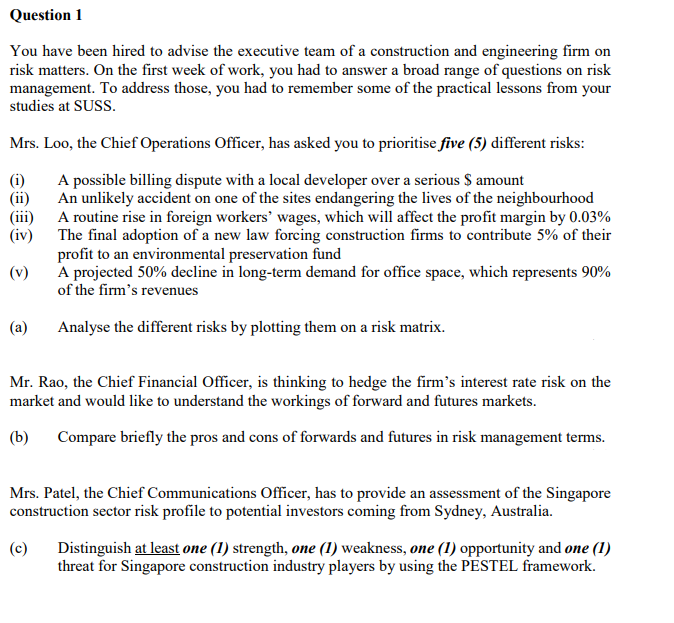

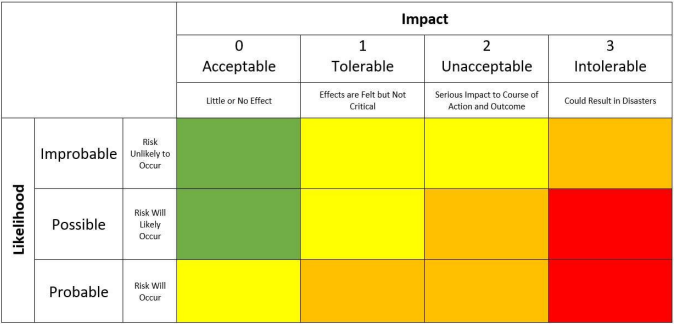

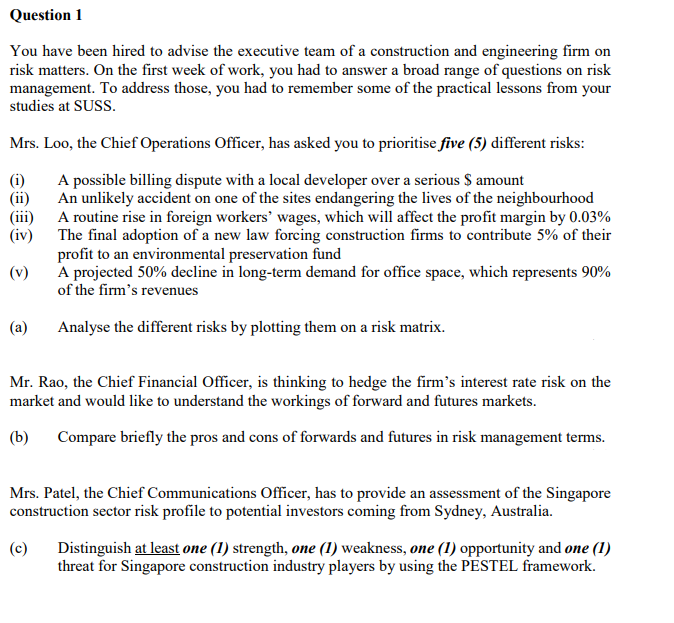

0 Acceptable Impact 1 2 Tolerable Unacceptable Effects are Felt but not Serious Impact to Course of Critical Action and Outcome 3 Intolerable Little or No Effect Could Result in Disasters Risk Improbable unlikely to Occur Likelihood Possible Risk Will Likely Occur Probable Risk Will Occur Question 1 You have been hired to advise the executive team of a construction and engineering firm on risk matters. On the first week of work, you had to answer a broad range of questions on risk management. To address those, you had to remember some of the practical lessons from your studies at SUSS. Mrs. Loo, the Chief Operations Officer, has asked you to prioritise five (5) different risks: (1) A possible billing dispute with a local developer over a serious $ amount (ii) An unlikely accident on one of the sites endangering the lives of the neighbourhood (iii) A routine rise in foreign workers' wages, which will affect the profit margin by 0.03% (iv) The final adoption of a new law forcing construction firms to contribute 5% of their profit to an environmental preservation fund (v) A projected 50% decline in long-term demand for office space, which represents 90% of the firm's revenues (a) Analyse the different risks by plotting them on a risk matrix. Mr. Rao, the Chief Financial Officer, is thinking to hedge the firm's interest rate risk on the market and would like to understand the workings of forward and futures markets. (b) Compare briefly the pros and cons of forwards and futures in risk management terms. Mrs. Patel, the Chief Communications Officer, has to provide an assessment of the Singapore construction sector risk profile to potential investors coming from Sydney, Australia. (c) Distinguish at least one (1) strength, one (1) weakness, one (1) opportunity and one (1) threat for Singapore construction industry players by using the PESTEL framework. 0 Acceptable Impact 1 2 Tolerable Unacceptable Effects are Felt but not Serious Impact to Course of Critical Action and Outcome 3 Intolerable Little or No Effect Could Result in Disasters Risk Improbable unlikely to Occur Likelihood Possible Risk Will Likely Occur Probable Risk Will Occur Question 1 You have been hired to advise the executive team of a construction and engineering firm on risk matters. On the first week of work, you had to answer a broad range of questions on risk management. To address those, you had to remember some of the practical lessons from your studies at SUSS. Mrs. Loo, the Chief Operations Officer, has asked you to prioritise five (5) different risks: (1) A possible billing dispute with a local developer over a serious $ amount (ii) An unlikely accident on one of the sites endangering the lives of the neighbourhood (iii) A routine rise in foreign workers' wages, which will affect the profit margin by 0.03% (iv) The final adoption of a new law forcing construction firms to contribute 5% of their profit to an environmental preservation fund (v) A projected 50% decline in long-term demand for office space, which represents 90% of the firm's revenues (a) Analyse the different risks by plotting them on a risk matrix. Mr. Rao, the Chief Financial Officer, is thinking to hedge the firm's interest rate risk on the market and would like to understand the workings of forward and futures markets. (b) Compare briefly the pros and cons of forwards and futures in risk management terms. Mrs. Patel, the Chief Communications Officer, has to provide an assessment of the Singapore construction sector risk profile to potential investors coming from Sydney, Australia. (c) Distinguish at least one (1) strength, one (1) weakness, one (1) opportunity and one (1) threat for Singapore construction industry players by using the PESTEL framework