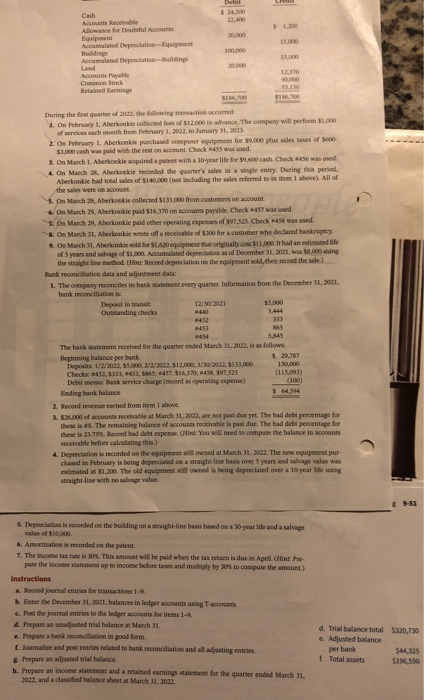

$ .0 ADA Equipe During the first quarter of the wint e r 1. On ray. Alenke collected fees of inadhance. The company will of wrices each hr ubry 1.2003, January 31, 2001 2. O bruary 1, Ahok purchased computer equipment for ce plus sales of $1,000 cash w pad with the rest on account Check 455 was used. 3. On March 1. Ahoki a ired aptent with a 10-year life for cash. Check owad 4. On March 2, Abertake recorded the quarter sales in a single entry Turing this period Alerkankehad e s of $140,00 (not including the sales referred to site e All of the sales were on account On March . Aber elected from customers on account. On March . Aber 16,0 payable. Check 457 was used On March . Ale pad her penting expenses of 97.25. Check 45 used On March A w ard for a customer who declaredbukty Os Masch A n the from the December 2001 Bank recent data and w ent dat L The company reconcilesi hankement every quarter bank reconciliationis 1230 2001 Outstanding checks 35.000 The bank walement received for the quarter ended March 31, 2023, is as follows Beginning balance per bank $ 2,77 Deposit 1/30/2023, 3 0 /3/2002512. 0 3/30/2022.5133,000 150,000 Checko 2 11, , 457,316370-458, 597,525 (115.091) Det me Baskervice charge records operating expense) Ending bank balance $ 654 2. Record e red from item bove. I March 2003. u yet. The baddest percentage for these. The w h ole of h is past due. The hadde percentage for Depo is recorded on the equipmentioned at March 31, 2002. The sw chased in February is being deprecated on a s ight line basis over 5 years and estimated 10. The equipment will owned as being deprecated over a straight line with ne g e value e et was year Me 5. Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage 6. Amortization is recorded on the patient. 7. The income tax rates . This amount will be paid when the tax return is due in April the pare the income a nd up to income before tres and multiply by os to compute the amount) Instructions Prepare a March 10730 Lourd post more than motion and get Popurustetrance h. Prepare an income s t andar d caring statement for the quarter ended March 2022, and a classified balance sheet at March 2012 Trabalance M ed balance per bank 1 Totales $44. 518 590 $ .0 ADA Equipe During the first quarter of the wint e r 1. On ray. Alenke collected fees of inadhance. The company will of wrices each hr ubry 1.2003, January 31, 2001 2. O bruary 1, Ahok purchased computer equipment for ce plus sales of $1,000 cash w pad with the rest on account Check 455 was used. 3. On March 1. Ahoki a ired aptent with a 10-year life for cash. Check owad 4. On March 2, Abertake recorded the quarter sales in a single entry Turing this period Alerkankehad e s of $140,00 (not including the sales referred to site e All of the sales were on account On March . Aber elected from customers on account. On March . Aber 16,0 payable. Check 457 was used On March . Ale pad her penting expenses of 97.25. Check 45 used On March A w ard for a customer who declaredbukty Os Masch A n the from the December 2001 Bank recent data and w ent dat L The company reconcilesi hankement every quarter bank reconciliationis 1230 2001 Outstanding checks 35.000 The bank walement received for the quarter ended March 31, 2023, is as follows Beginning balance per bank $ 2,77 Deposit 1/30/2023, 3 0 /3/2002512. 0 3/30/2022.5133,000 150,000 Checko 2 11, , 457,316370-458, 597,525 (115.091) Det me Baskervice charge records operating expense) Ending bank balance $ 654 2. Record e red from item bove. I March 2003. u yet. The baddest percentage for these. The w h ole of h is past due. The hadde percentage for Depo is recorded on the equipmentioned at March 31, 2002. The sw chased in February is being deprecated on a s ight line basis over 5 years and estimated 10. The equipment will owned as being deprecated over a straight line with ne g e value e et was year Me 5. Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage 6. Amortization is recorded on the patient. 7. The income tax rates . This amount will be paid when the tax return is due in April the pare the income a nd up to income before tres and multiply by os to compute the amount) Instructions Prepare a March 10730 Lourd post more than motion and get Popurustetrance h. Prepare an income s t andar d caring statement for the quarter ended March 2022, and a classified balance sheet at March 2012 Trabalance M ed balance per bank 1 Totales $44. 518 590