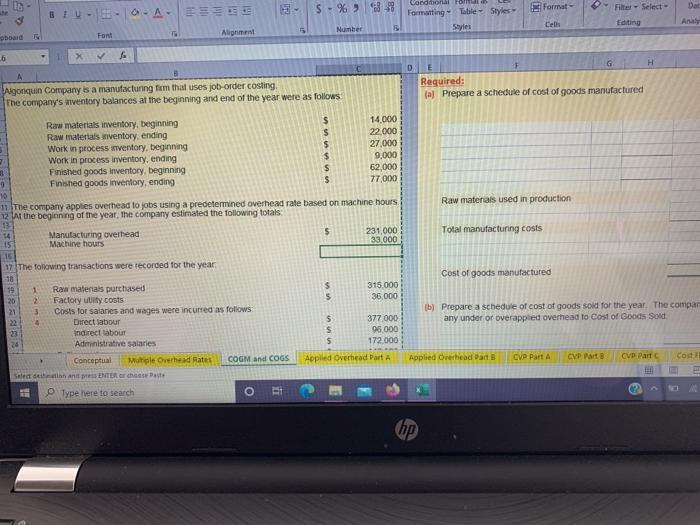

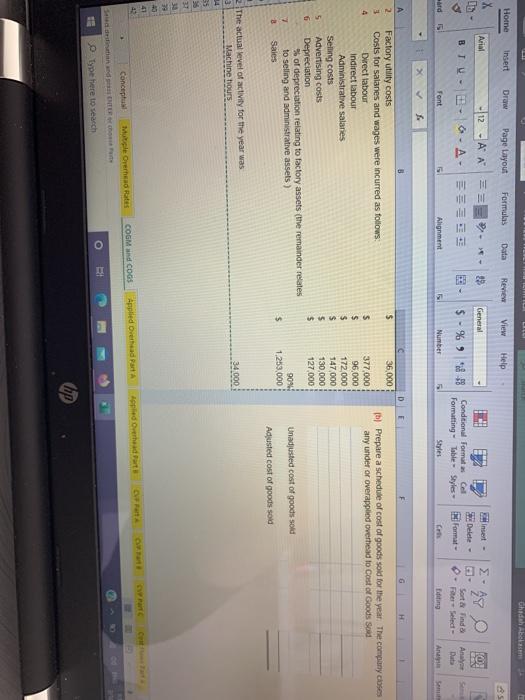

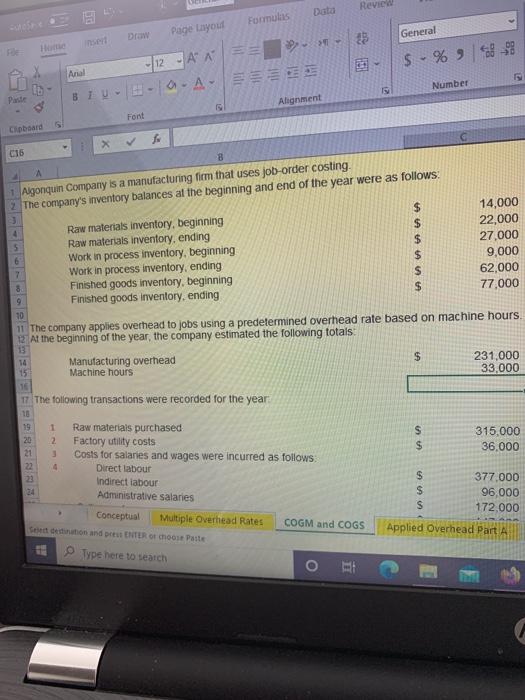

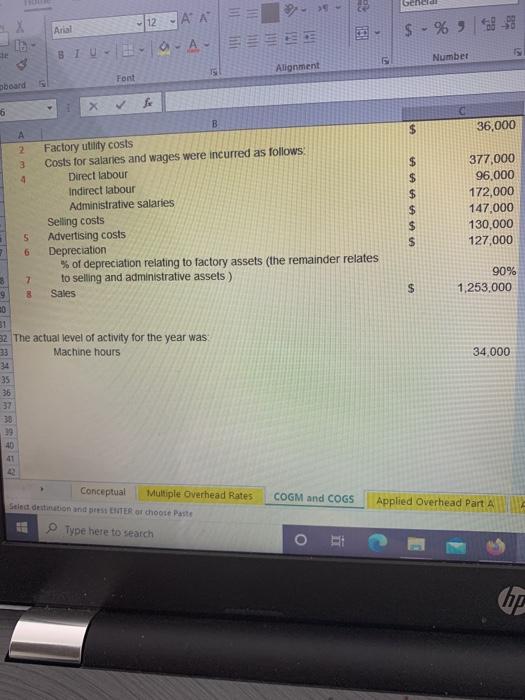

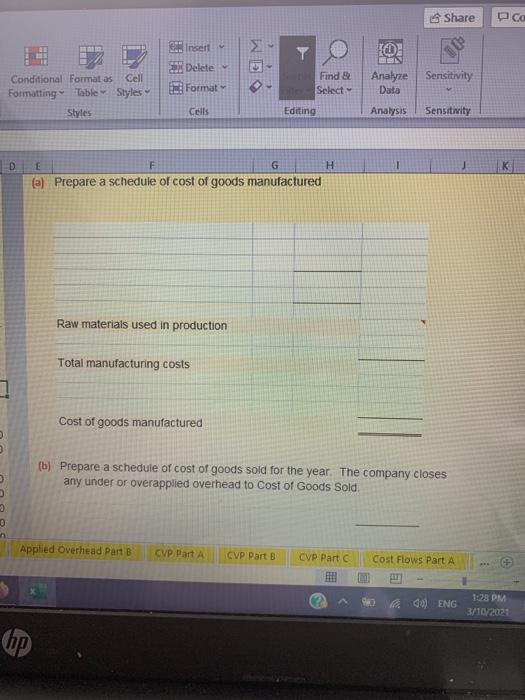

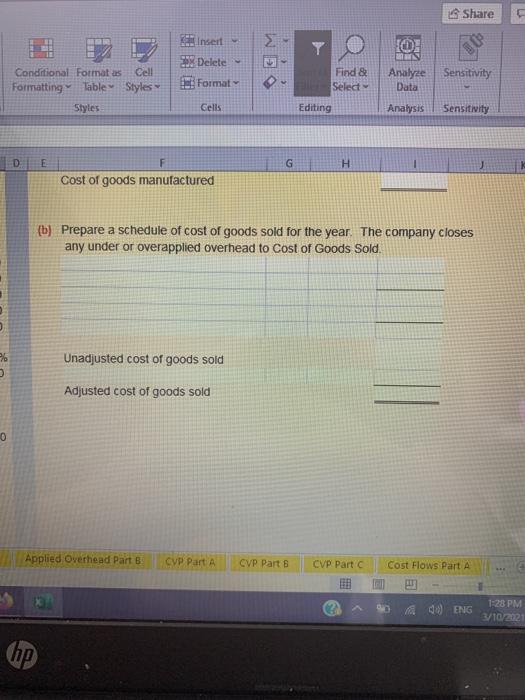

0 $ . % Format - Dat Cardona Ford Formatting Table Styles Styles - Filter - Select- Editing Cell Analy Number Font Alignment > 6 D E G H Required: (aj Prepare a schedule of cost of goods manufactured Algonquin Company is a manufacturing firm that uses job-order costing The company's wiventory balances at the beginning and end of the year were as follows Raw materials used in production Total manufacturing costs Raw materials inventory, beginning 14.000 Raw materials wventory, ending 22.000 Work in process aventory, beginning 27.000 Work in process inventory, ending 9.000 3 Finished goods inventory, beginning 62,000 9 Finished goods inventory, ending 77,000 10 11. The company applies overhead to jobs using a predetermined overhead rate based on machine hours 12 All the beginning of the year, the company estimated the following totals 13 14 Manufacturing overhead $ 231,000 15 Machirve hours 33.000 16 17. The following transactions were recorded for the year 18 19 1 Raw materials purchased 315.000 20 Factory uity costs 5 36,000 21 Costs for salanes and wages were incurred as follows Direct labour $ 377 000 Indirect labour 5 95.000 24 Administrative salaries 5 172.000 Conceptual Motiple Overhead Rates COGM and COGS Applied Overhead Part A Select the hand UNTER hose Paste Type here to search o Cost of goods manufactured b) Prepare a schedule of cost of goods sold for the year. The compan any under or overapped overhead to cost of Goods Sold Applied Overhead an CVP Part A CVP Part 8 CVD Part Co hp Ghidh an Home Insert Draw Page Layout Formulas Data Review View Help x General Arial 32. *- BTU-DO-A- Font Alignment $ - % 9 818 Insert - Delete - Conditional Formats Cell Formatting - Table Styles Format Styles Sort & Find For Sale Analyse Data ard Number Ang X D H 36.000 2 3 4 Prepare a schedule of cost of goods sold for the year. The company cioses any under or overapplied overhead to cast of Goods Soad $ Factory utility costs Costs for salanes and wages were incurred as follows: Direct labour Indirect labour Administrative salaries Selling costs Advertising costs Depreciation % of depreciation relating to factory assets (the remainder relates to selling and administrative assets) Sales 377,000 96,000 172,000 147,000 130,000 127,000 5 6 DON Unadjusted cost of goods sold 2 $ 1,253,000 Adjusted cost of goods sold The actual level of activity for the year was a Machine Hours 34.000 mim Applied Owerhead Part Applied Overhead Part A Conceptu COGM COGS Mutile Orhad Rates O 11 Type here to search Data Review Formulas Draw Page Layou General - $ -% - Ariel 112 - A A B i U-18-a A- Number Paste Alignment Font Ciboard C16 8 4 A 1. Algonquin Company is a manufacturing firm that uses job-order costing 2. The company's inventory balances at the beginning and end of the year were as follows: 3 14,000 Raw materials inventory, beginning 22,000 5 Raw materials inventory, ending 27,000 6 Work in process inventory, beginning 9,000 7 Work in process inventory, ending $ 62,000 3 Finished goods inventory, beginning 9 Finished goods inventory, ending 77,000 30 11 The company applies overhead to jobs using a predetermined overhead rate based on machine hours At the beginning of the year, the company estimated the following totals 13 14 Manufacturing overhead $ 15 Machine hours 231,000 33,000 315.000 36.000 A 17 The following transactions were recorded for the year 10 19 1 Raw materials purchased 2 Factory utility costs 3 Costs for salaries and wages were incurred as follows: 22 4 Direct labour Indirect labour 24 Administrative salaries Conceptual Multiple Overhead Rates COGM and COGS Se denon and pe NTR choose Patte Type here to search $ $ S 377.000 96.000 172.000 Applied Overhead Part A Genel > - Ho 2 12 A A Aral $ - % 3 83 La BIU-E9-A- Number Alignment Font pboard 6 $ 36,000 A 2 3 4 B Factory utility costs Costs for salaries and wages were incurred as follows Direct labour Indirect labour Administrative salaries Selling costs Advertising costs Depreciation % of depreciation relating to factory assets (the remainder relates to selling and administrative assets) Sales $ $ $ $ $ 377,000 96,000 172,000 147,000 130,000 127,000 5 6 90% 1,253,000 7 8 3 9 60 $ 2 The actual level of activity for the year was 33 Machine hours 34 35 34.000 36 40 COGM and COGS Conceptual Multiple Overhead Rates Stied detton and HTER or choote Paste Type here to search Applied Overhead Part A IF hp Share Insert Delete WE Y Format Find & Select Analyze Sensitivity Data Conditional Format as Cell Formatting Table Styles Styles Cells Editing Analysis Sensitivity D K E F G H (a) Prepare a schedule of cost of goods manufactured Raw materials used in production Total manufacturing costs 1 Cost of goods manufactured (b) Prepare a schedule of cost of goods sold for the year. The company closes any under or overapplied overhead to Cost of Goods Sold. 3 Applied Overhead Part 8 CVP Part A CVP Part B CVP Part Cost Flows Part A (0) ENG 1:28 PM 3/10/2021 hp) Share Insert Delete Format Conditional Format as Cell Formatting Table Styles Styles Find & Select IN Analyze Sensitivity Data Cells Editing Analysis Sensitivity D E F G H Cost of goods manufactured [b] Prepare a schedule of cost of goods sold for the year. The company closes any under or overapplied overhead to Cost of Goods Sold. Unadjusted cost of goods sold Adjusted cost of goods sold 0 Applied Overhead Part 3 CVP Part A CVP Part 6 CVP Part Cost Flows Part A ENG 1:28 PM 3/10/2012 hp