0 out of 3 points On 30 June 2019, Asahi Ltd has entered into an agreement to lease a beer-making machine to Hite Ltd.

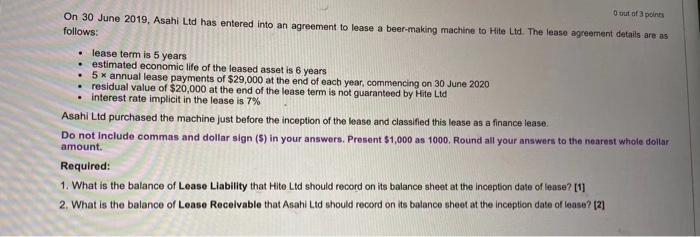

0 out of 3 points On 30 June 2019, Asahi Ltd has entered into an agreement to lease a beer-making machine to Hite Ltd. The lease agreement details are as follows: . lease term is 5 years estimated economic life of the leased asset is 6 years 5x annual lease payments of $29,000 at the end of each year, commencing on 30 June 2020 residual value of $20,000 at the end of the lease term is not guaranteed by Hite Ltd interest rate implicit in the lease is 7% Asahi Ltd purchased the machine just before the inception of the lease and classified this lease as a finance lease. Do not include commas and dollar sign ($) in your answers. Present $1,000 as 1000. Round all your answers to the nearest whole dollar amount. Required: 1. What is the balance of Lease Liability that Hite Ltd should record on its balance sheet at the inception date of lease? [1] 2. What is the balance of Lease Receivable that Asahi Ltd should record on its balance sheet at the inception date of lease? [2]

Step by Step Solution

3.54 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Lease liability Minimum Lease Payment 118906 Lease receivable Minimum Lease payment ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards