Question

Turnbull Ltd has entered into an agreement to lease a machine to Abbott Ltd. Details are: Length of lease 5 years Commencement date 1 July

Turnbull Ltd has entered into an agreement to lease a machine to Abbott Ltd. Details are: Length of lease 5 years Commencement date 1 July 2013 Annual lease payment, payable 30 June each year commencing 30 June 2014 $8 000 Fair value of the Machinery at 1 July 2013 $34 797 Estimated economic life of the Machinery 8 years Estimated residual value of the Machinery at the end of its economic life $2 000 Residual value at the end of the lease term, which is fully guaranteed by Abbott Ltd $5 662 Interest rate implicit in the lease 9% The lease is not cancellable. Abbott Ltd does not intend to buy the Machinery at the end of the lease term but will return it to Turnbull. Turnbull Ltd purchased the Machinery for $32 000 several months before the inception of the lease, and from Turnbull's viewpoint this is a manufacturing type lease.

Required

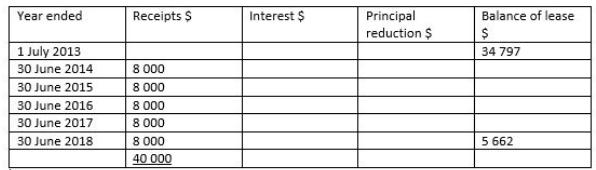

(a) Use the lease schedule below to calculate the interest expense for the following years: 2014, 2015, 2016, 2017 and 2018?

(b) Prepare the journal entry to record the purchase of the machinery in the books of Turnbull Ltd.

(c) Prepare the journal entry to record the lease transactions for the year ended 30 June 2014 in the books of Turnbull Ltd.

(d) Prepare the journal entry to record the lease transactions for the year ended 30 June 2015 in the books of Abbott Ltd.

(e) Prepare the journal entry to record depreciation expense on the leased asset for the year ended 30 June 2015 in the books of Abbott Ltd.

Year ended 1 July 2013 30 June 2014 30 June 2015 30 June 2016 30 June 2017 30 June 2018 Receipts $ 8 000 8 000 8 000 8 000 8 000 40 000 Interest $ Principal reduction $ Balance of lease $ 34 797 5 662

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the interest expense for the following years we need to determine the interest portion of the lease payment and the principal reduction ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started