Answered step by step

Verified Expert Solution

Question

1 Approved Answer

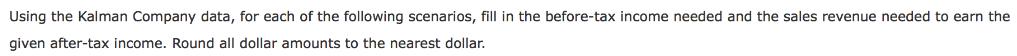

Using the Kalman Company data, for each of the following scenarios, fill in the before-tax income needed and the sales revenue needed to earn

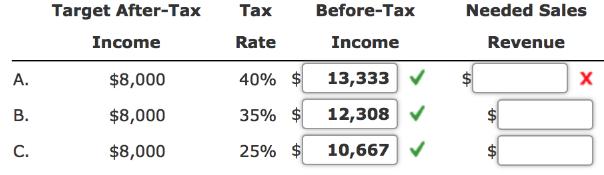

Using the Kalman Company data, for each of the following scenarios, fill in the before-tax income needed and the sales revenue needed to earn the given after-tax income. Round all dollar amounts to the nearest dollar. Target After-Tax Tax Before-Tax Needed Sales Income Rate Income Revenue 13,333 V 40% $ A. $8,000 12,308 V 35% $ B. $8,000 10,667 V 25% $ $8,000 C. %%24 %24 $12 Price Unit variable cost $3 Total fixed cost $31,500 Tax rate 40 % Kalman wants to earn after-tax income of $9,000 next year. What is the before-tax income? Before-tax income = $9,000/(1 - 0.4) = $15,000 Suppose Kalman's tax rate was 35%, the before-tax income needed to earn $9,000 after taxes would be lower v $15,000. The before-tax income in this case would be $ 13,846 v (Round to the nearest dollar). The sales revenue needed to earn this level of before-tax income would be $ (Round to the nearest dollar). We can show that this is true by constructing an income statement. Sales $60,461 Total variable cost (0.25 x $60,461) 15,115 Contribution margin $45,346 Total fixed cost 31,500 $13,846 Operating income 4,846 Less: income taxes (0.35 x $13,846) $9,000 After-tax income

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Target After Tax Income Tax Rate Before tax Income Fixed Cost Needed Contribution Margin Incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started