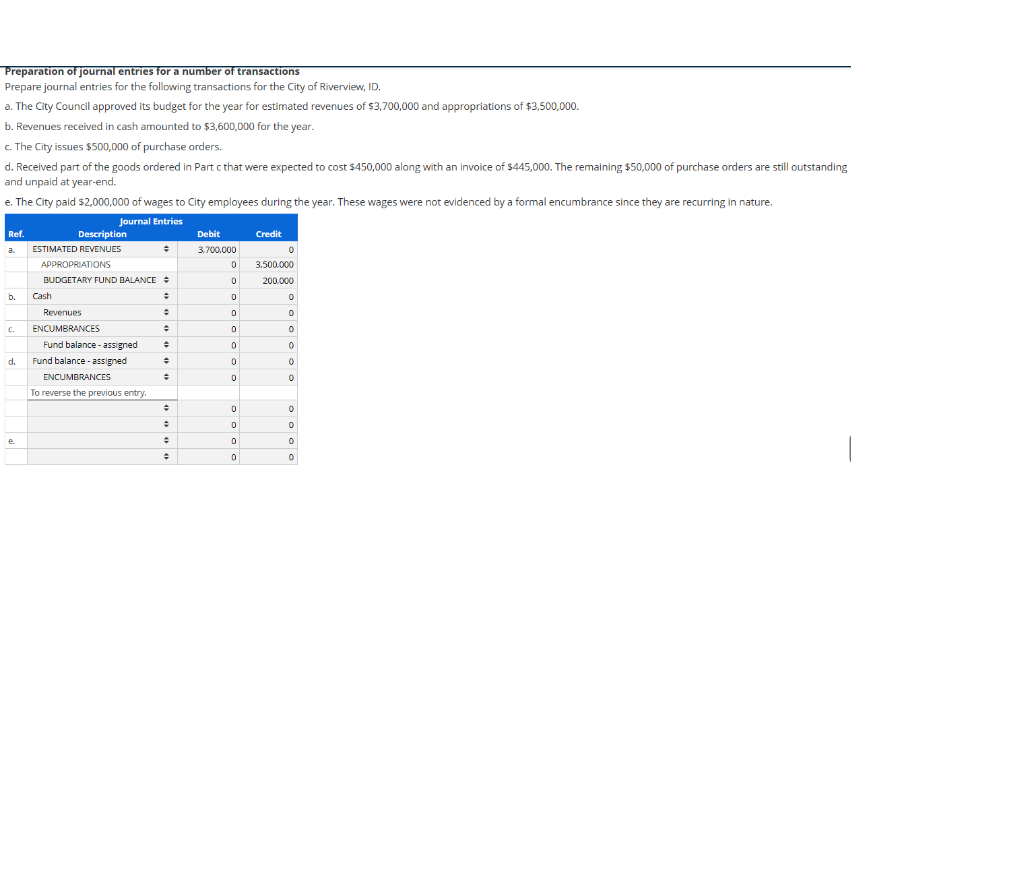

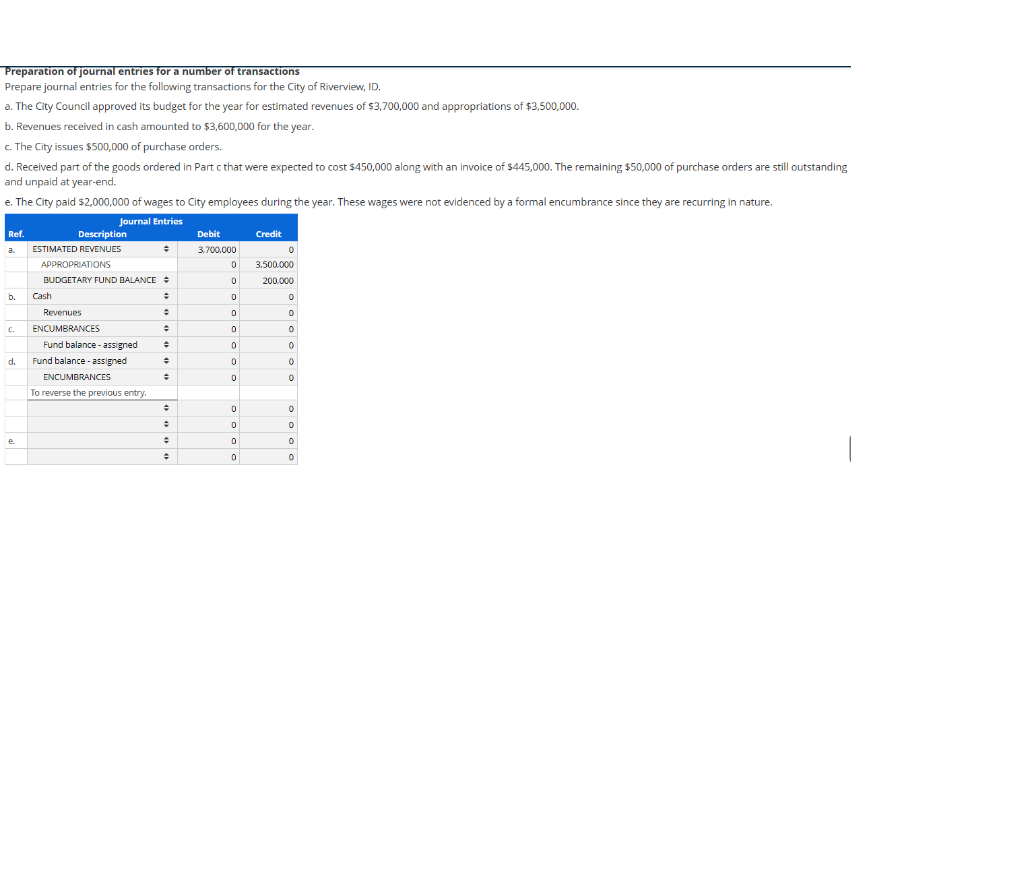

0 Preparation of journal entries for a number of transactions Prepare journal entries for the following transactions for the City of Riverview, ID. a. The City Council approved its budget for the year for estimated revenues of $3,700,000 and appropriations of $3,500,000. b. Revenues received in cash amounted to $3,600,000 for the year. c. The City issues $500,000 of purchase orders. d. Received part of the goods ordered in Part that were expected to cost $450,000 along with an invoice of $445,000. The remaining $50,000 of purchase orders are still outstanding and unpaid at year-end. e. The City paid $2,000,000 of wages to City employees during the year. These wages were not evidenced by a formal encumbrance since they are recurring in nature. Journal Entries Ref. Description Debit Credit ESTIMATED REVENUES 3.700.000 APPROPRIATIONS 3.500.000 BUDGETARY FUND BALANCE - 200.000 Cash Revenues ENCUMBRANCES Fund balance - assigned Fund balance - assigned ENCUMBRANCES To reverse the previous entry . 0 0 . 0 0 0 0 u b. 0 C. U 0 o d. 0 0 0 0 e - 0 0 Preparation of journal entries for a number of transactions Prepare journal entries for the following transactions for the City of Riverview, ID. a. The City Council approved its budget for the year for estimated revenues of $3,700,000 and appropriations of $3,500,000. b. Revenues received in cash amounted to $3,600,000 for the year. c. The City issues $500,000 of purchase orders. d. Received part of the goods ordered in Part that were expected to cost $450,000 along with an invoice of $445,000. The remaining $50,000 of purchase orders are still outstanding and unpaid at year-end. e. The City paid $2,000,000 of wages to City employees during the year. These wages were not evidenced by a formal encumbrance since they are recurring in nature. Journal Entries Ref. Description Debit Credit ESTIMATED REVENUES 3.700.000 APPROPRIATIONS 3.500.000 BUDGETARY FUND BALANCE - 200.000 Cash Revenues ENCUMBRANCES Fund balance - assigned Fund balance - assigned ENCUMBRANCES To reverse the previous entry . 0 0 . 0 0 0 0 u b. 0 C. U 0 o d. 0 0 0 0 e - 0