Answered step by step

Verified Expert Solution

Question

1 Approved Answer

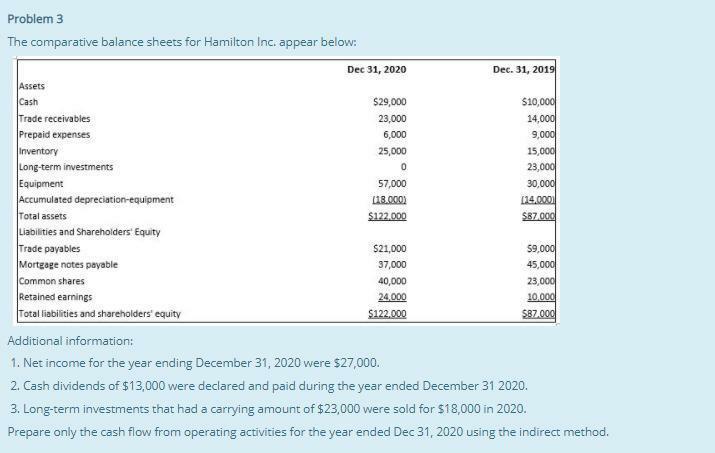

0 Problem 3 The comparative balance sheets for Hamilton Inc. appear below: Dec 31, 2020 Dec. 31, 2019 Assets Cash $29,000 $10,000 Trade receivables 23,000

0 Problem 3 The comparative balance sheets for Hamilton Inc. appear below: Dec 31, 2020 Dec. 31, 2019 Assets Cash $29,000 $10,000 Trade receivables 23,000 14,000 Prepaid expenses 6,000 9,000 Inventory 25,000 15,000 Long-term investments 23,000 Equipment 57,000 30,000 Accumulated depreciation-equipment 118.000) 114.0001 Total assets $122.000 $87.000 Liabilities and Shareholders Equity Trade payables $21,000 59,000 Mortgage notes payable 37,000 45,000 Common shares 40,000 23,000 Retained earnings 24,000 10,000 Total liabilities and shareholders' equity $122.000 $87.000 Additional information: 1. Net income for the year ending December 31, 2020 were $27,000. 2. Cash dividends of $13,000 were declared and paid during the year ended December 31 2020. 3. Long-term investments that had a carrying amount of $23,000 were sold for $18,000 in 2020. Prepare only the cash flow from operating activities for the year ended Dec 31, 2020 using the indirect method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started