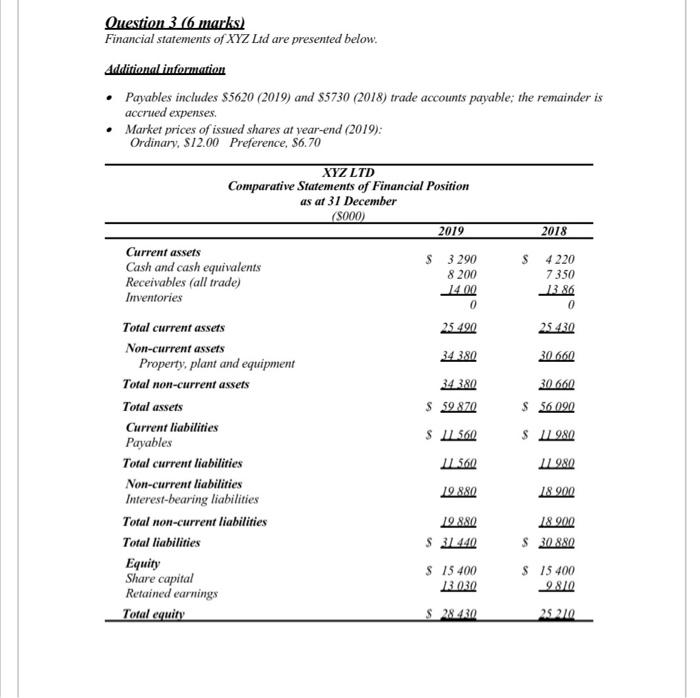

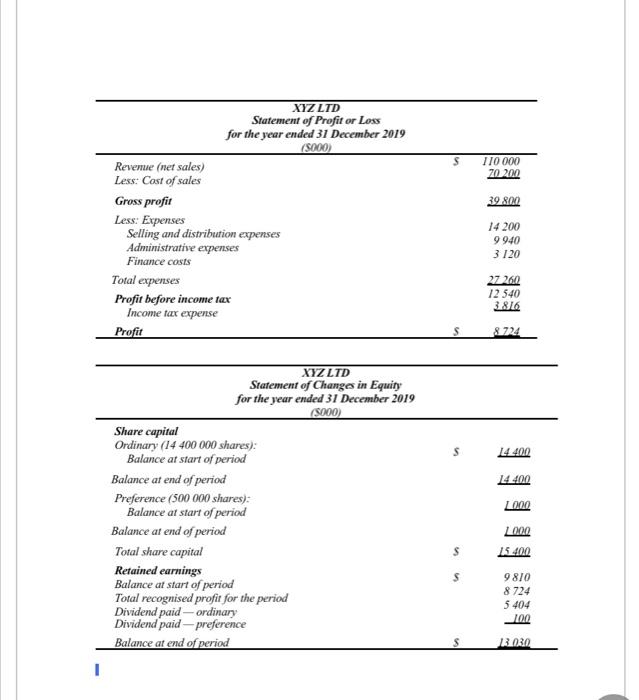

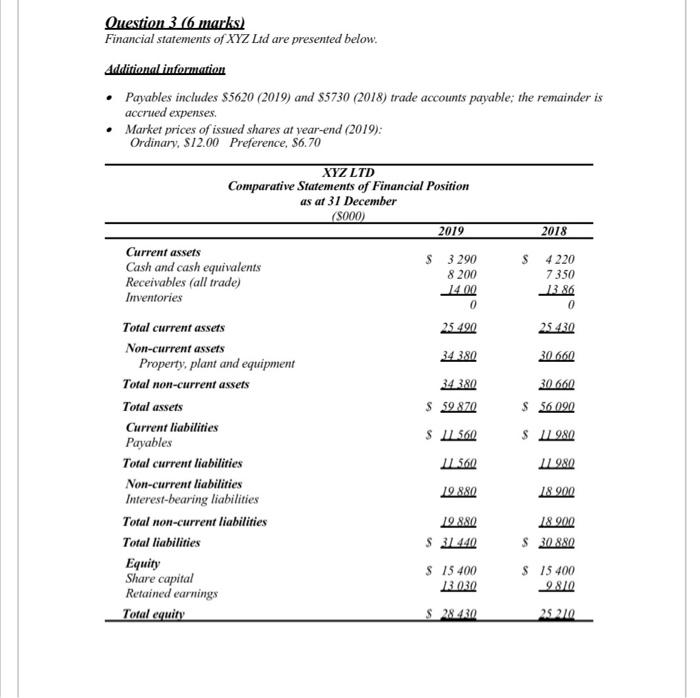

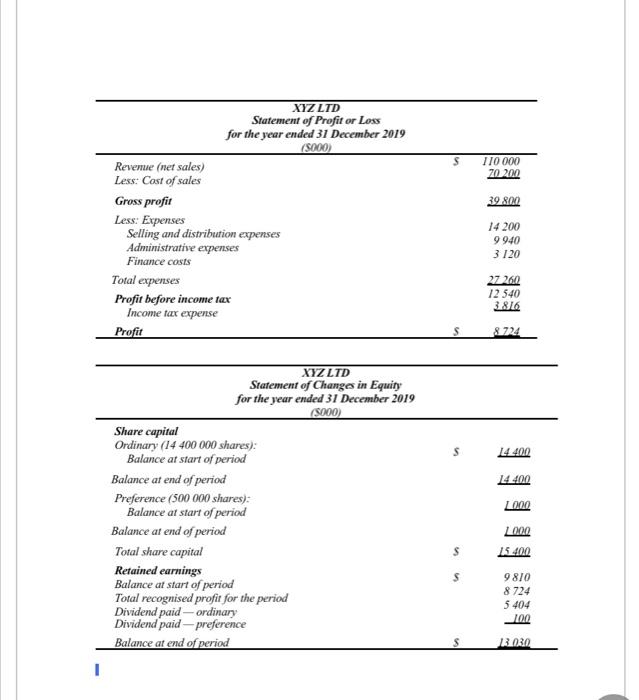

0 Question 3 (6 marks) Financial statements of XYZ Ltd are presented below. Additional information Payables includes $5620 (2019) and $5730 (2018) trade accounts payable; the remainder is accrued expenses. Market prices of issued shares at year-end (2019): Ordinary. $12.00 Preference, $6.70 XYZ LTD Comparative Statements of Financial Position as at 31 December (5000) 2019 2018 Current assets S Cash and cash equivalents 3 290 S4220 8 200 Receivables (all trade) 7350 14.00 13 86 Inventories 0 Total current assets 25 490 25430 Non-current assets 34 380 30660 Property, plant and equipment Total non-current assets 34 380 30 660 Total assets $ 59870 $ 56 090 Current liabilities S 560 Payables $ 11 980 Total current liabilities 360 11 980 Non-current liabilities 19.880 Interest-bearing liabilities 18 900 Total non-current liabilities 19.880 18.900 Total liabilities S 31.440 $ 30880 Equity $ 15400 $ 15 400 Share capital 13.030 9810 Retained earnings Total equity $ 282.RO 2520 S 110 000 7020 39.800 XYZ LTD Statement of Profit or Loss for the year ended 31 December 2019 (5000) Revenue (net sales) Less: Cost of sales Gross profit Less: Expenses Selling and distribution expenses Administrative expenses Finance costs Total expenses Profit before income tax Income tax expense Profit 14 200 9940 3120 27 260 12 540 3876 8724 14 400 14400 XYZ LTD Statement of Changes in Equity for the year ended 31 December 2019 (5000) Share capital Ordinary (14 400 000 shares): Balance at start of period Balance at end of period Preference (500 000 shares): Balance at start of period Balance at end of period Total share capital Retained earnings Balance at start of period Total recognised profit for the period Dividend paid-ordinary Dividend paid - preference Balance at end of period S $ 000 2000 15.400 9810 8 724 5 404 100 13.030 1 0 Question 3 (6 marks) Financial statements of XYZ Ltd are presented below. Additional information Payables includes $5620 (2019) and $5730 (2018) trade accounts payable; the remainder is accrued expenses. Market prices of issued shares at year-end (2019): Ordinary. $12.00 Preference, $6.70 XYZ LTD Comparative Statements of Financial Position as at 31 December (5000) 2019 2018 Current assets S Cash and cash equivalents 3 290 S4220 8 200 Receivables (all trade) 7350 14.00 13 86 Inventories 0 Total current assets 25 490 25430 Non-current assets 34 380 30660 Property, plant and equipment Total non-current assets 34 380 30 660 Total assets $ 59870 $ 56 090 Current liabilities S 560 Payables $ 11 980 Total current liabilities 360 11 980 Non-current liabilities 19.880 Interest-bearing liabilities 18 900 Total non-current liabilities 19.880 18.900 Total liabilities S 31.440 $ 30880 Equity $ 15400 $ 15 400 Share capital 13.030 9810 Retained earnings Total equity $ 282.RO 2520 S 110 000 7020 39.800 XYZ LTD Statement of Profit or Loss for the year ended 31 December 2019 (5000) Revenue (net sales) Less: Cost of sales Gross profit Less: Expenses Selling and distribution expenses Administrative expenses Finance costs Total expenses Profit before income tax Income tax expense Profit 14 200 9940 3120 27 260 12 540 3876 8724 14 400 14400 XYZ LTD Statement of Changes in Equity for the year ended 31 December 2019 (5000) Share capital Ordinary (14 400 000 shares): Balance at start of period Balance at end of period Preference (500 000 shares): Balance at start of period Balance at end of period Total share capital Retained earnings Balance at start of period Total recognised profit for the period Dividend paid-ordinary Dividend paid - preference Balance at end of period S $ 000 2000 15.400 9810 8 724 5 404 100 13.030 1