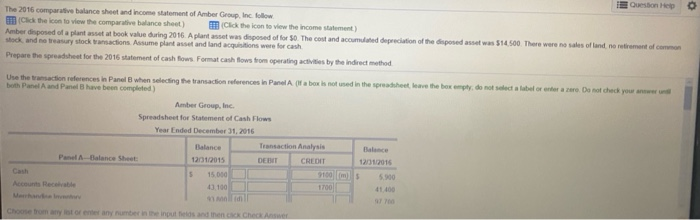

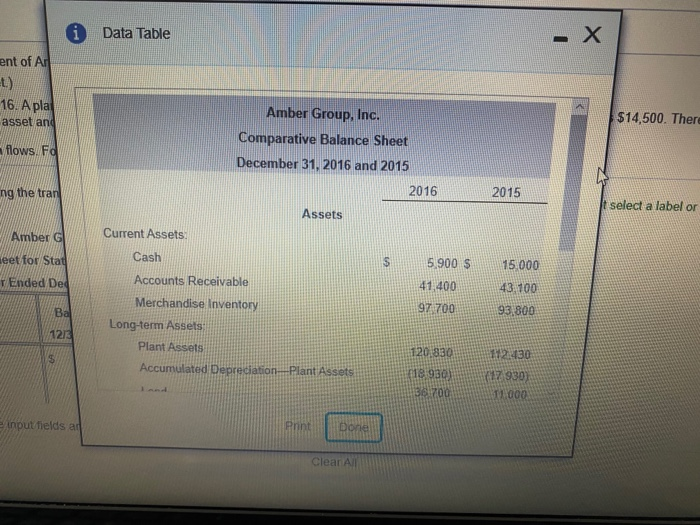

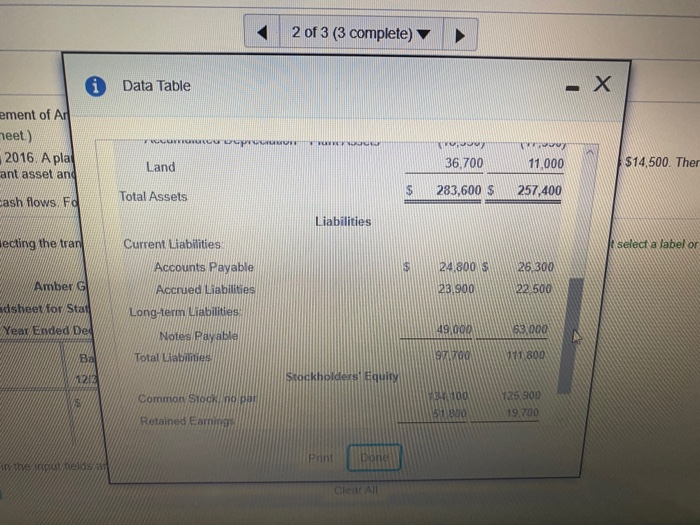

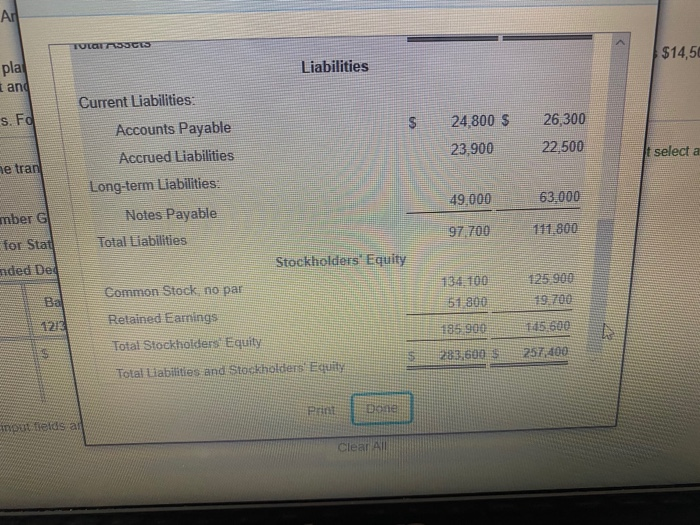

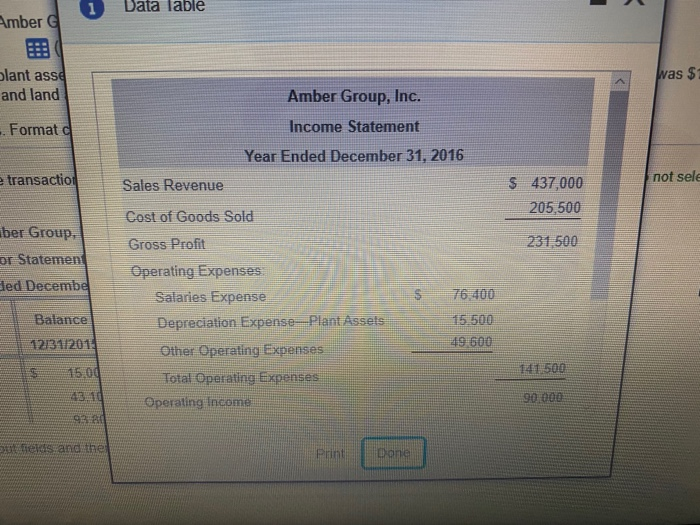

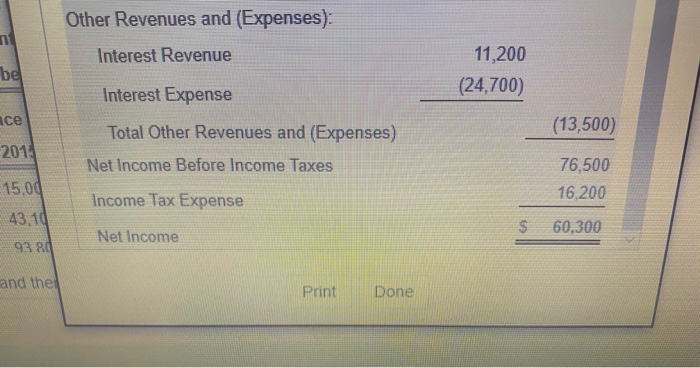

0 Question Help The 2016 comparative balance sheet and income statement of Amber Group, Inc. follow Click the icon to view the comparative balance sheet) Click the icon to view the income statement) Amber disposed of a plant asset at book value during 2016. A plant asset was disposed of for 50. The cost and accumulated depreciation of the disposed asset was $14.500. There were no sales of land, ne retirement of common stock and ne treasury stock transactions. Assume plant asset and land acquisitions were for cash Prepare the spreadsheet for the 2016 statement of cash flows.Format cash flows from operating activities by the Indirect method Use the transaction erences in Panel B when selecting the transaction references in Pasal (8 box is not used in the spreadsheet weave the box amply, do not select a label or enter a zero. Do not check your own both Panel and Panel B have been completed) Amber Group, Inc Spreadsheet for Statement of Cash Flows Year Ended December 31, 2016 Balance Transaction Analysis Penel Balance Sheet 12/31/2015 DEBT CREDIT 12031/2015 15 000 5.900 1700 41.400 lid Choose from a lot of any number in the inputs and then check Data Table - ent of Ar t) 16. A pla asset and $14,500. There Amber Group, Inc. Comparative Balance Sheet December 31, 2016 and 2015 flows. Fo ng the tran 2016 2015 t select a label or Assets Amber G Current Assets seet for Stat Cash 5,900 $ 15,000 1 Ended Ded 41,400 43.100 Bal 971700 93,800 Accounts Receivable Merchandise Inventory Long-term Assets Plant Assets Accumulated Depreciation Plant Assets 1213 CA 120.830 118 930) 31200 112130 417 930) 11 000 e input fields ad Print Dorie Clear All 2 of 3 (3 complete) Data Table - X ement of An meet.) 2016. A pla ant asset and Up RYNGOL wowy 36.700 Vio 11,000 Land $14,500. Ther $ Total Assets 283,600 $ 257,400 cash flows Fo Liabilities ecting the tran A select a label or $ 24,800 $ 26 300 Amber G 23 900 22 500 Current Liabilities Accounts Payable Accrued Liabilities Long-term Liabilities Notes Payable Total Liabilities dsteet for Stad Year Ended De 49.000 619.000 Ba 1971 1.800 122 Stockholders Equity Common Stock par Retained Earning 100 51.800 125 900 19.700 Print Done wwwe/ AN TOLOSDCLS $14,50 pla Liabilities I and s. Fd 24,800 $ 26,300 22,500 23.900 select a ne tran Current Liabilities: Accounts Payable Accrued Liabilities Long-term Liabilities: Notes Payable Total Liabilities 49,000 63,000 mber G 97.700 111,800 for Stai Stockholders Equity anded Dee Common Stock no par 136100 51 800 195 900 125 900 9.700 Ba 12212 105.600 Retained Earnings Total Stockholders Equity Total Liabilities and Stockholders Equity 283,600 257,400 PA Done partenas al Clear All 1 Data lable Amber was $ blant asse and land Amber Group, Inc. Income Statement Formato Year Ended December 31, 2016 e transaction Sales Revenue not sele $ 437,000 205,500 Cost of Goods Sold aber Group or Statement Gross Profit 231 500 ded Decembe $ 76.400 Balance Operating Expenses Salaries Expense Depreciation Expense-Plant Assets Other Operating Expenses Total Operating Expenses Operating Income 15.500 49 600 12131/2013 1500 141.500 id 190.000 93 es and the Print one Other Revenues and (Expenses): Interest Revenue be 11,200 (24,700) ace Interest Expense Total Other Revenues and (Expenses) (13,500) 201 Net Income Before Income Taxes 76,500 16,200 15,00 Income Tax Expense 43,10 $ 60,300 Net Income 9380 and the Print Done