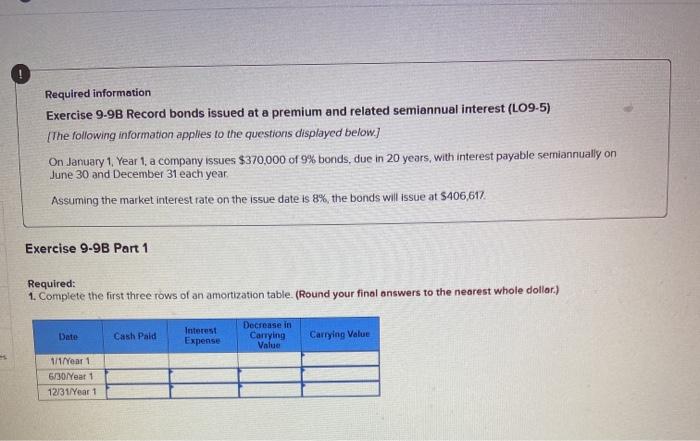

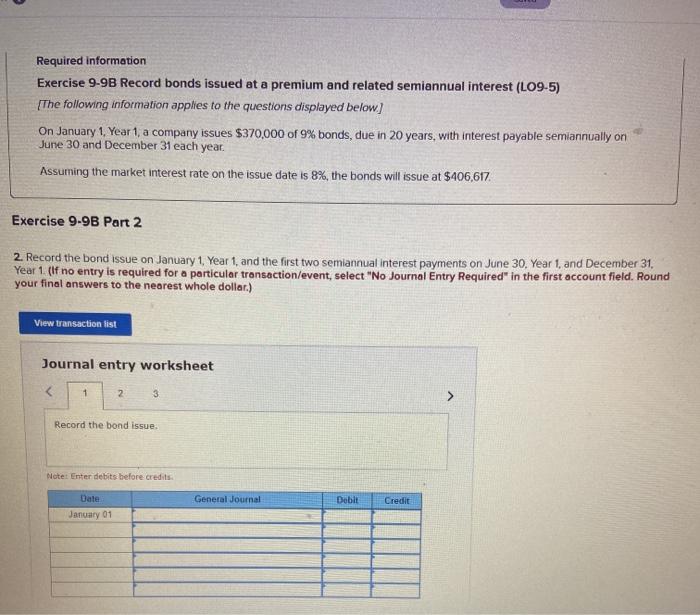

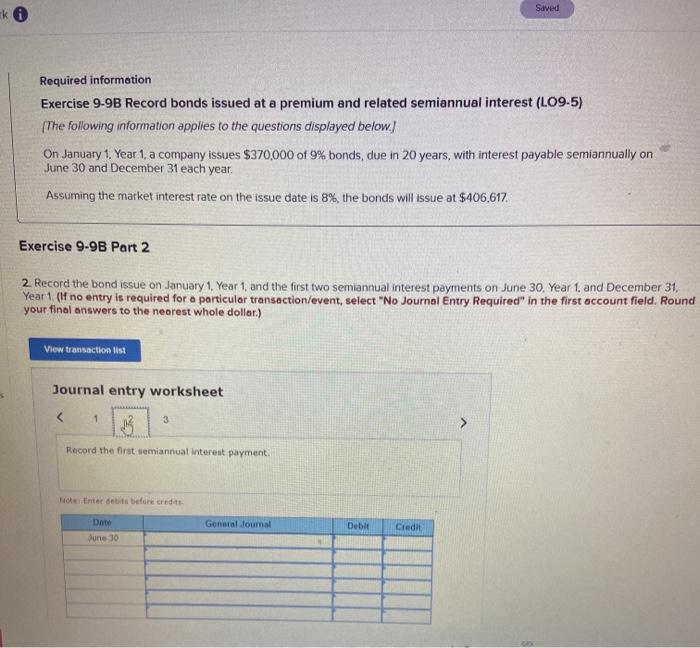

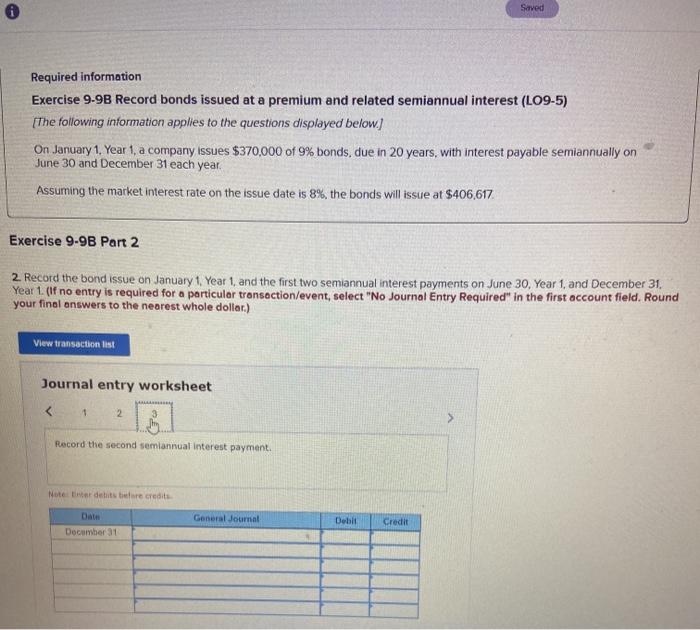

0 Required information Exercise 9-9B Record bonds issued at a premium and related semiannual interest (LO9-5) [The following information applies to the questions displayed below.) On January 1 Year 1, a company issues $370,000 of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year Assuming the market interest rate on the issue date is 8%, the bonds will issue at $406,617 Exercise 9-9B Part 1 Required: 1. Complete the first three rows of an amortization table. (Round your final answers to the nearest whole dollar) Date Cash Pald Interest Expense Decrease in Carrying Value Carrying Value 1/1/Year 1 6/30/Year 1 12/31/Year 1 Required information Exercise 9-9B Record bonds issued at a premium and related semiannual interest (LO9-5) The following information applies to the questions displayed below.) On January 1, Year 1, a company issues $370,000 of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. Assuming the market interest rate on the issue date is 8%, the bonds will issue at $406,617 Exercise 9-9B Part 2 2. Record the bond issue on January 1, Year 1, and the first two semiannual interest payments on June 30, Year 1, and December 31, Year 1 (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your final answers to the nearest whole dollar.) View transaction fist Journal entry worksheet Record the bond issue. Note: Enter debits before credits Date General Journal Deble Credit January 01 Saved Ek Required information Exercise 9-9B Record bonds issued at a premium and related semiannual interest (LO9-5) The following information applies to the questions displayed below. On January 1. Year 1, a company issues $370,000 of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. Assuming the market interest rate on the issue date is 8%, the bonds will issue at $406,617 Exercise 9-9B Part 2 2. Record the bond issue on January 1, Year 1, and the first two semiannual interest payments on June 30, Year 1, and December 31, Year 1 (if no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your final answers to the nearest whole dollar.) View transaction list Journal entry worksheet 1 3 Record the first semiannual interest payment. Hinter debit before credit General Journal Date June 30 Debit Credit Saved Required information Exercise 9-9B Record bonds issued at a premium and related semiannual interest (LO9-5) [The following information applies to the questions displayed below.) On January 1. Year 1, a company issues $370,000 of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. Assuming the market interest rate on the issue date is 8%, the bonds will issue at $406,617 Exercise 9-9B Part 2 2. Record the bond issue on January 1 Year 1, and the first two semiannual interest payments on June 30, Year 1, and December 31. Year 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your final answers to the nearest whole dollar) View transaction list Journal entry worksheet