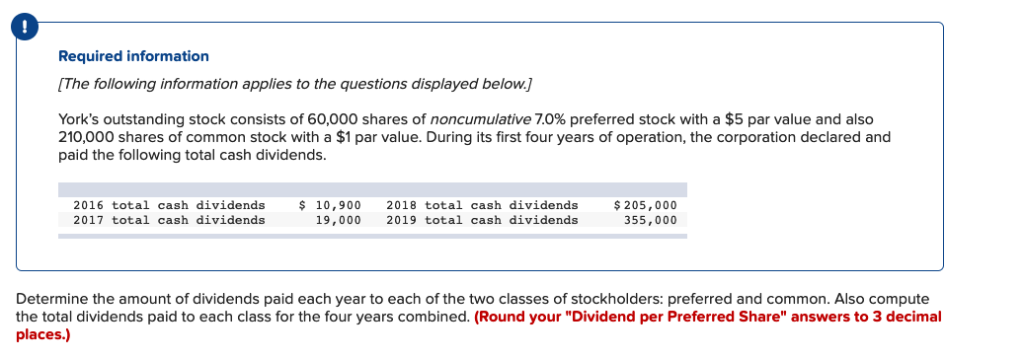

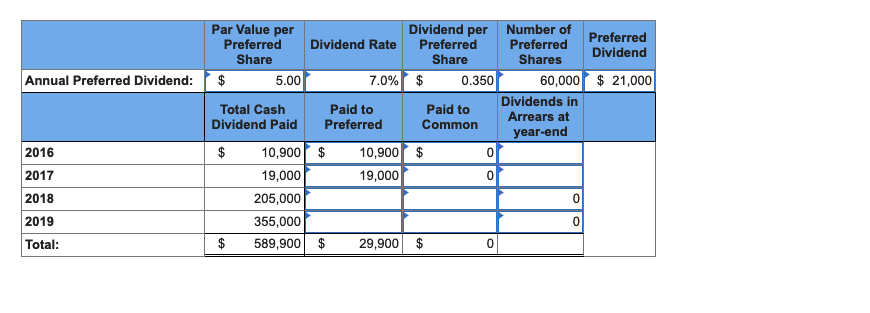

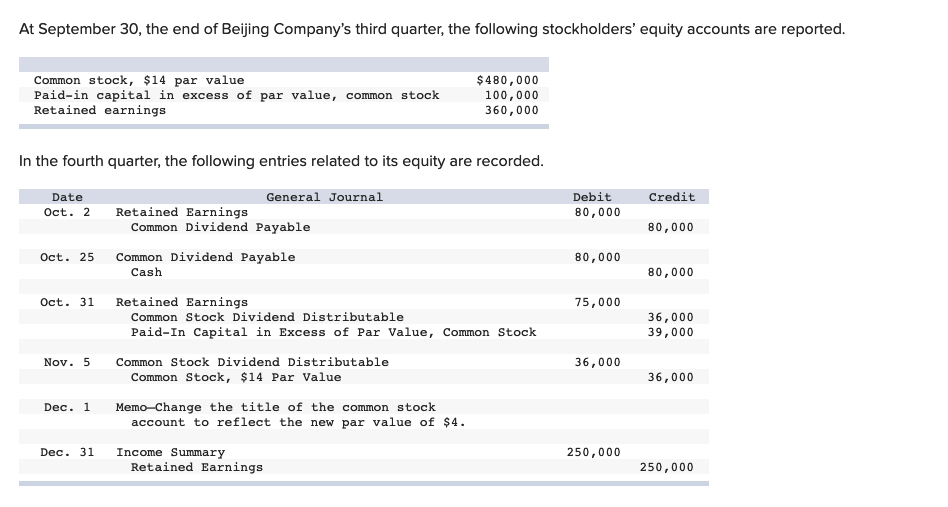

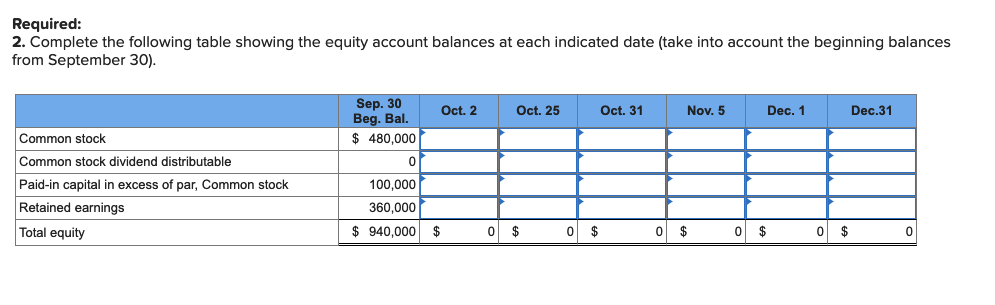

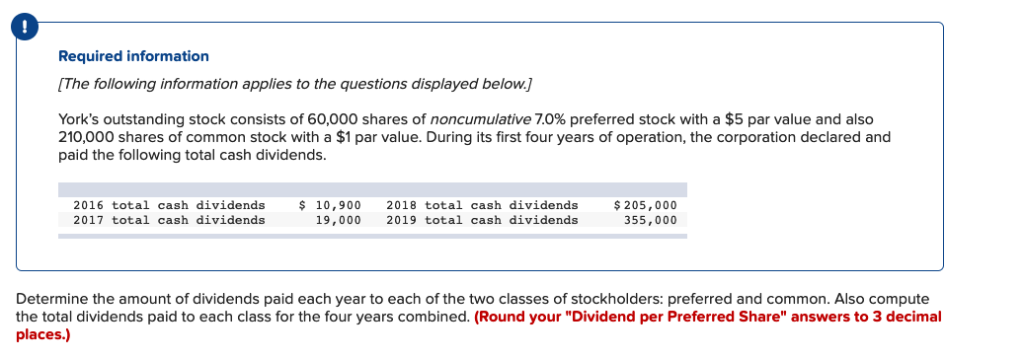

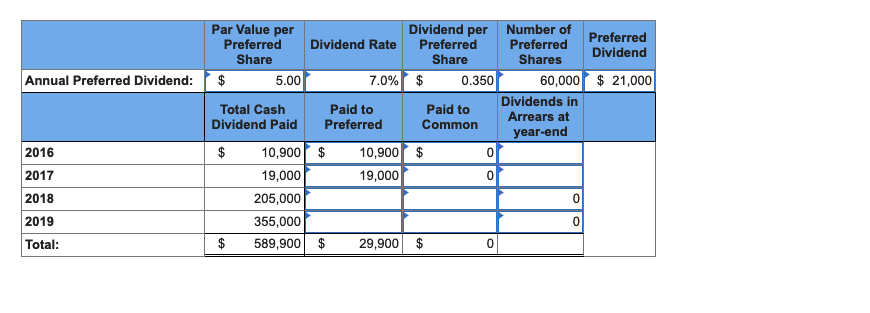

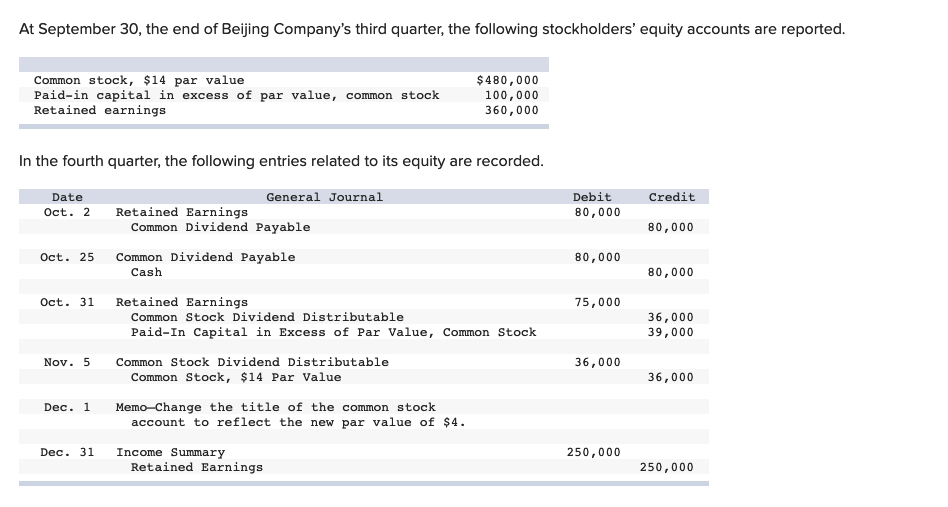

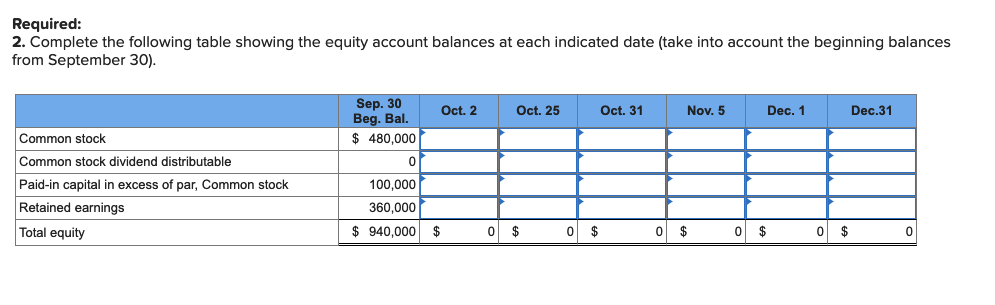

0 Required information The following information applies to the questions displayed below. York's outstanding stock consists of 60,000 shares of noncumulative 70% preferred stock with a $5 par value and also 210,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends. 2016 total cash dividends 2017 total cash dividends 10,900 2018 total cash dividends 205,000 19,000 2019 total cash dividends 355,000 Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. (Round your "Dividend per Preferred Share" answers to 3 decimal places.) Par Value per Dividend per Number of Preferred Preferred Dividend Preferred Dividend Rate Preferred Share Share Shares Annual Preferred Dividend: 5.00 7.0% $ 0.350 60,000$21,000 Total Cash Dividend Paid Paid to Preferred Paid to Common Dividends in Arrears at year-end 10,900$ 2016 2017 2018 2019 Total: 10,900 $ 0 19,000 205,000 355,000 $ 589,900$ 19,000 0 0 0 29,900$ 0 At September 30, the end of Beijing Company's third quarter, the following stockholders' equity accounts are reported Common stock, $14 par value Paid-in capital in excess of par value, common stock Retained earnings $480,000 100,000 360,000 In the fourth quarter, the following entries related to its equity are recorded General Journal Debit 80,000 Credit Date Oct. 2 Retained Earnings Common Dividend Payable 80,000 Oct. 25 Common Dividend Payable 80,000 Cash 80,000 Oct. 31 Retained Earnings 75,000 Common Stock Dividend Distributable Paid-In Capital in Excess of Par Value, Common Stock 36,000 39,000 Nov. 5 Common Stock Dividend Distributable 36,000 Common Stock, $14 Par Value 36,000 Dec. 1 Memo-Change the title of the common stock account to reflect the new par value of $4. Dec. 31 Income Summary 250,000 Retained Earnings 250,000 Required 2. Complete the following table showing the equity account balances at each indicated date (take into account the beginning balances from September 30) Sep. 30 Beg. Bal. $480,000 Oct. 2 Oct. 25 Oct. 31 Nov. 5 Dec. 1 Dec.31 Common stock Common stock dividend distributable Paid-in capital in excess of par, Common stock Retained earnings Total equity 0 100,000 360,000 $ 940,000$