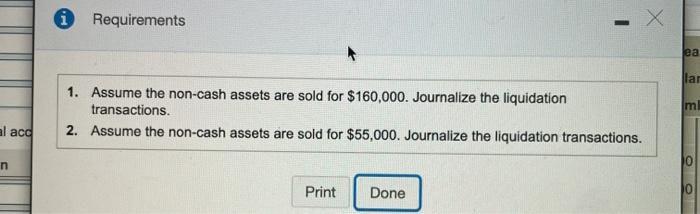

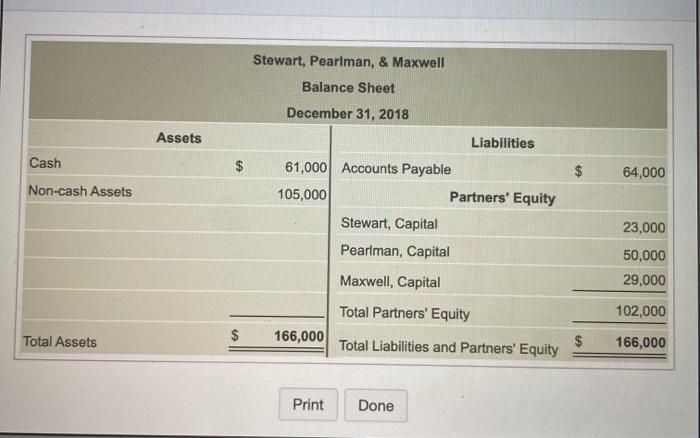

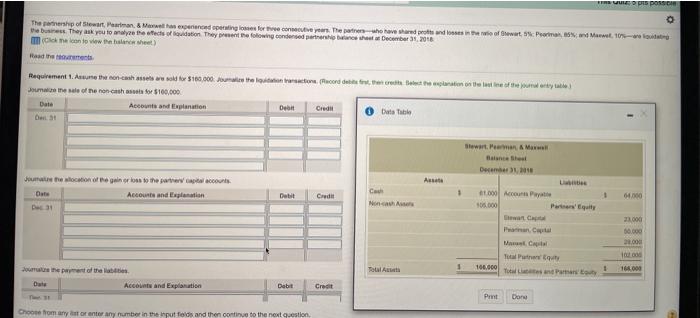

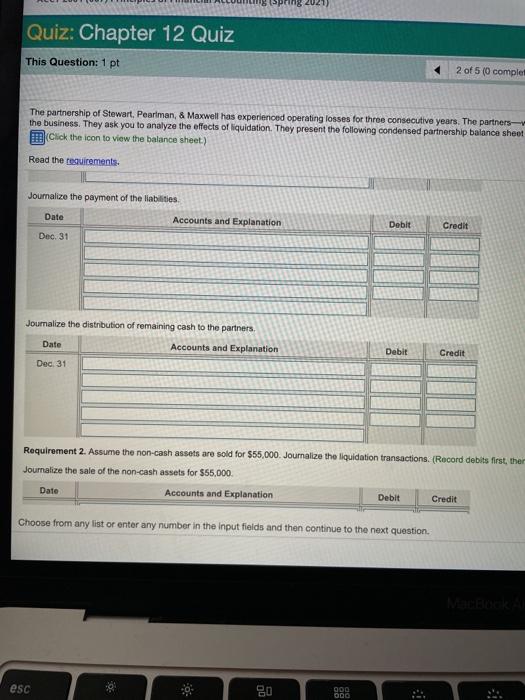

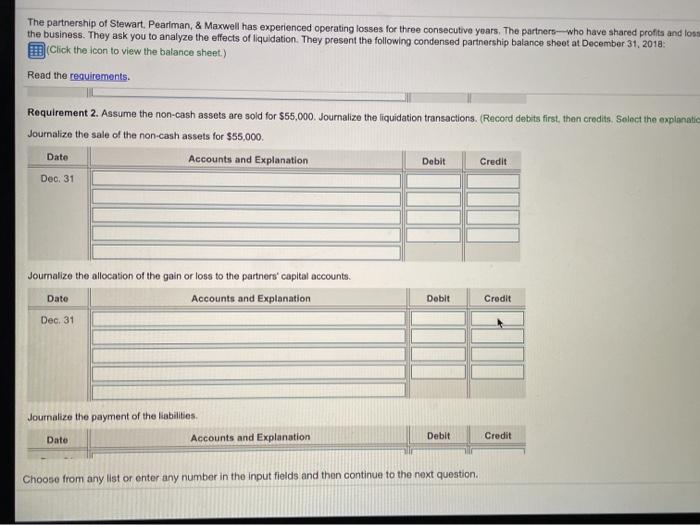

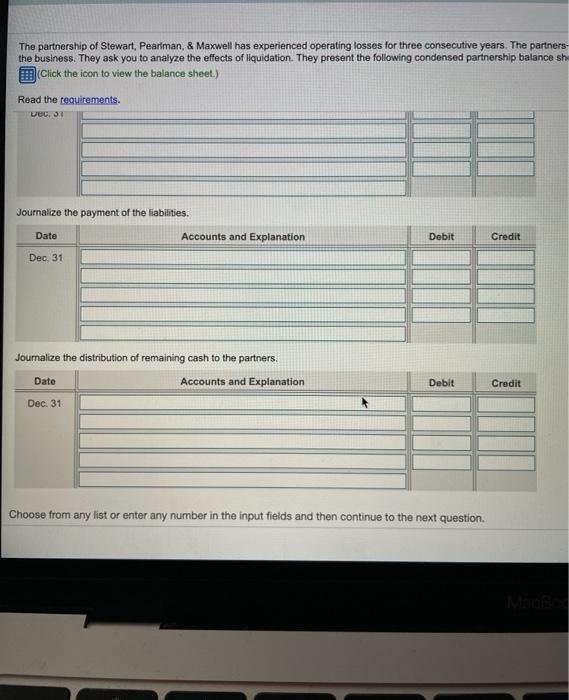

0 Requirements X ea lar m 1. Assume the non-cash assets are sold for $160,000. Journalize the liquidation transactions. 2. Assume the non-cash assets are sold for $55,000. Journalize the liquidation transactions. alaca n Print Done Stewart, Pearlman, & Maxwell Balance Sheet December 31, 2018 Assets Liabilities Cash $ 64,000 Non-cash Assets 61,000 Accounts Payable 105,000 Partners' Equity Stewart, Capital Pearlman, Capital 23,000 50,000 29,000 Maxwell, Capital Total Partners' Equity 102,000 Total Assets $ 166,000 Total Liabilities and Partners' Equity $ 166,000 Print Done s poss The map of Stewart Priman & Meernandesting for consecutives. The who have shared protsendes in the woofwat Prime M10 - business. They ask you to alyze the sets of dation They the following condensed partner December 2016 Come on to view the heat) Hand that Requirement une the non-cash or $160.000 hectacord Gewerbesplanation on the line of the worytale Jamaicine sale of the non-cash for $100.000 Date Accounts and explanation Data Table Stewart, Perman C Accounts and plantion Cred 000 Account 1 64 23000 00.000 2000 Mascara Pre Total and to 1 Total 106.000 16.000 Date Account and Explanation Debit Credit Pant bond Choose from any for enter any number in the input folds and then continue to the next question Quiz: Chapter 12 Quiz This Question: 1 pt 2 of 5 (0 complet The partnership of Stewart, Pearlman, & Maxwell has experienced operating losses for three consecutive years. The partners the business. They ask you to analyze the effects of liquidation. They present the following condensed partnership balance sheet (Click the icon to view the balance sheet.) Read the requirements. Journalize the payment of the liabilities Date Accounts and Explanation Dobit Credit Dec 31 Journalize the distribution of remaining cash to the partners. Date Accounts and Explanation Debit Credit Dec 31 Requirement 2. Assume the non-cash assets are sold for $55,000. Journalize the liquidation transactions. (Record debits first, ther Journalize the sale of the non-cash assets for $55,000 Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question. esc BO 000 ODO The partnership of Stewart, Pearlman, & Maxwell has experienced operating losses for three consecutive years. The partners who have shared profits and loss the business. They ask you to analyze the effects of liquidation. They present the following condensed partnership balance sheet at December 31, 2018: Click the icon to view the balance sheet.) Read the requirements. Requirement 2. Assume the non-cash assets are sold for $55,000. Journalize the liquidation transactions. (Record debits first, then credits. Select the explanatic Journalize the sale of the non-cash assets for $55,000 Date Accounts and Explanation Debit Credit Dec 31 Journalize the allocation of the gain or loss to the partners' capital accounts Date Accounts and Explanation Dobit Credit Dec. 31 Journalize the payment of the liabilities. Debit Accounts and Explanation Date Credit Choose from any list or enter any number in the input fields and then continue to the next question. The partnership of Stewart, Pearlman, & Maxwell has experienced operating losses for three consecutive years. The partners- the business. They ask you to analyze the effects of liquidation. They present the following condensed partnership balance sh Click the icon to view the balance sheet.) Read the requirements. vec. 31 Journalize the payment of the liabilities. Date Accounts and Explanation Debit Credit Dec. 31 Journalize the distribution of remaining cash to the partners. Date Accounts and Explanation Debit Credit Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question. 0 Requirements X ea lar m 1. Assume the non-cash assets are sold for $160,000. Journalize the liquidation transactions. 2. Assume the non-cash assets are sold for $55,000. Journalize the liquidation transactions. alaca n Print Done Stewart, Pearlman, & Maxwell Balance Sheet December 31, 2018 Assets Liabilities Cash $ 64,000 Non-cash Assets 61,000 Accounts Payable 105,000 Partners' Equity Stewart, Capital Pearlman, Capital 23,000 50,000 29,000 Maxwell, Capital Total Partners' Equity 102,000 Total Assets $ 166,000 Total Liabilities and Partners' Equity $ 166,000 Print Done s poss The map of Stewart Priman & Meernandesting for consecutives. The who have shared protsendes in the woofwat Prime M10 - business. They ask you to alyze the sets of dation They the following condensed partner December 2016 Come on to view the heat) Hand that Requirement une the non-cash or $160.000 hectacord Gewerbesplanation on the line of the worytale Jamaicine sale of the non-cash for $100.000 Date Accounts and explanation Data Table Stewart, Perman C Accounts and plantion Cred 000 Account 1 64 23000 00.000 2000 Mascara Pre Total and to 1 Total 106.000 16.000 Date Account and Explanation Debit Credit Pant bond Choose from any for enter any number in the input folds and then continue to the next question Quiz: Chapter 12 Quiz This Question: 1 pt 2 of 5 (0 complet The partnership of Stewart, Pearlman, & Maxwell has experienced operating losses for three consecutive years. The partners the business. They ask you to analyze the effects of liquidation. They present the following condensed partnership balance sheet (Click the icon to view the balance sheet.) Read the requirements. Journalize the payment of the liabilities Date Accounts and Explanation Dobit Credit Dec 31 Journalize the distribution of remaining cash to the partners. Date Accounts and Explanation Debit Credit Dec 31 Requirement 2. Assume the non-cash assets are sold for $55,000. Journalize the liquidation transactions. (Record debits first, ther Journalize the sale of the non-cash assets for $55,000 Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question. esc BO 000 ODO The partnership of Stewart, Pearlman, & Maxwell has experienced operating losses for three consecutive years. The partners who have shared profits and loss the business. They ask you to analyze the effects of liquidation. They present the following condensed partnership balance sheet at December 31, 2018: Click the icon to view the balance sheet.) Read the requirements. Requirement 2. Assume the non-cash assets are sold for $55,000. Journalize the liquidation transactions. (Record debits first, then credits. Select the explanatic Journalize the sale of the non-cash assets for $55,000 Date Accounts and Explanation Debit Credit Dec 31 Journalize the allocation of the gain or loss to the partners' capital accounts Date Accounts and Explanation Dobit Credit Dec. 31 Journalize the payment of the liabilities. Debit Accounts and Explanation Date Credit Choose from any list or enter any number in the input fields and then continue to the next question. The partnership of Stewart, Pearlman, & Maxwell has experienced operating losses for three consecutive years. The partners- the business. They ask you to analyze the effects of liquidation. They present the following condensed partnership balance sh Click the icon to view the balance sheet.) Read the requirements. vec. 31 Journalize the payment of the liabilities. Date Accounts and Explanation Debit Credit Dec. 31 Journalize the distribution of remaining cash to the partners. Date Accounts and Explanation Debit Credit Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next