Answered step by step

Verified Expert Solution

Question

1 Approved Answer

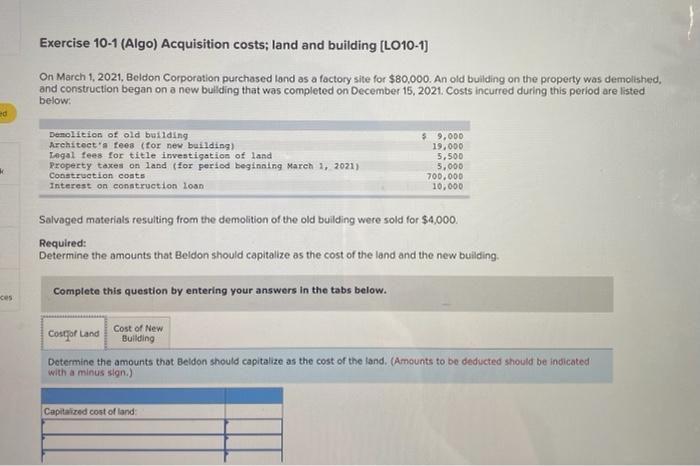

ed Exercise 10-1 (Algo) Acquisition costs; land and building [LO10-1] On March 1, 2021, Beldon Corporation purchased land as a factory site for $80,000.

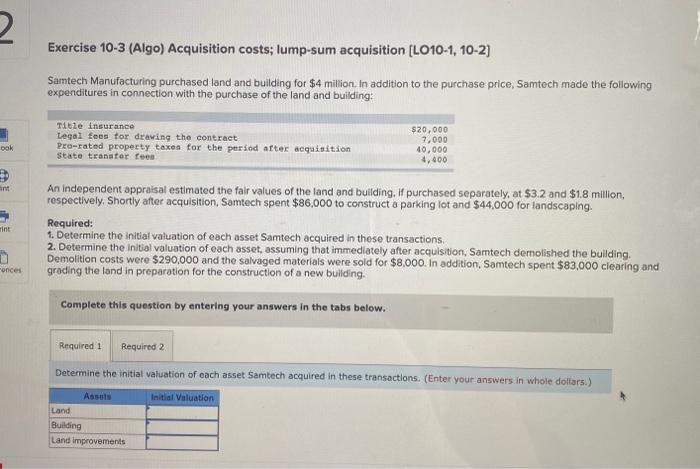

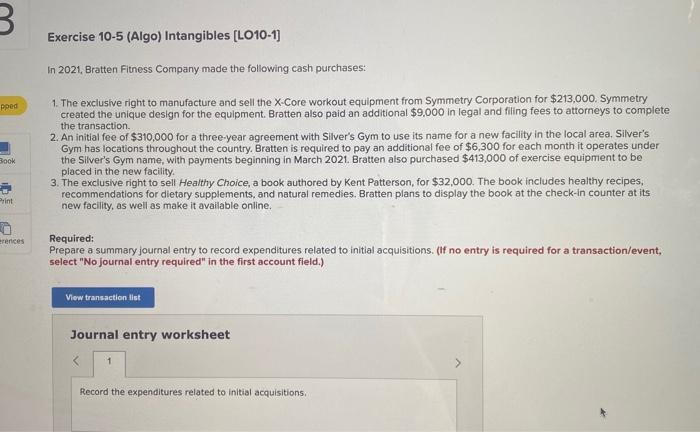

ed Exercise 10-1 (Algo) Acquisition costs; land and building [LO10-1] On March 1, 2021, Beldon Corporation purchased land as a factory site for $80,000. An old building on the property was demolished, and construction began on a new building that was completed on December 15, 2021. Costs incurred during this period are listed below: Demolition of old building Architect's fees (for new building) Legal fees for title investigation of land C Property taxes on land (for period beginning March 1, 2021) Construction costs Interest on construction loan $ 9,000 19,000 5,500 5,000 700,000 10,000 Salvaged materials resulting from the demolition of the old building were sold for $4,000. Required: Determine the amounts that Beldon should capitalize as the cost of the land and the new building. Complete this question by entering your answers in the tabs below. ces Cost of Land Cost of New Building Determine the amounts that Beldon should capitalize as the cost of the land. (Amounts to be deducted should be indicated with a minus sign.) Capitalized cost of land: 2 Exercise 10-3 (Algo) Acquisition costs; lump-sum acquisition (LO10-1, 10-2] Samtech Manufacturing purchased land and building for $4 million. In addition to the purchase price, Samtech made the following expenditures in connection with the purchase of the land and building: ook int int Conces Title insurance Legal fees for drawing the contract Pro-rated property taxes for the period after acquisition State transfer fees $20,000 7,000 40,000 4,400 An independent appraisal estimated the fair values of the land and building, if purchased separately, at $3.2 and $1.8 million, respectively. Shortly after acquisition, Samtech spent $86,000 to construct a parking lot and $44,000 for landscaping. Required: 1. Determine the initial valuation of each asset Samtech acquired in these transactions. 2. Determine the initial valuation of each asset, assuming that immediately after acquisition, Samtech demolished the building. Demolition costs were $290,000 and the salvaged materials were sold for $8,000. In addition, Samtech spent $83,000 clearing and grading the land in preparation for the construction of a new building. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the initial valuation of each asset Samtech acquired in these transactions. (Enter your answers in whole dollars.) Land Building Assets Land improvements Initial Valuation B Exercise 10-5 (Algo) Intangibles [LO10-1] pped Book Print erences In 2021, Bratten Fitness Company made the following cash purchases: 1. The exclusive right to manufacture and sell the X-Core workout equipment from Symmetry Corporation for $213,000. Symmetry created the unique design for the equipment. Bratten also paid an additional $9,000 in legal and filing fees to attorneys to complete the transaction. 2. An initial fee of $310,000 for a three-year agreement with Silver's Gym to use its name for a new facility in the local area. Silver's Gym has locations throughout the country. Bratten is required to pay an additional fee of $6,300 for each month it operates under the Silver's Gym name, with payments beginning in March 2021. Bratten also purchased $413,000 of exercise equipment to be placed in the new facility. 3. The exclusive right to sell Healthy Choice, a book authored by Kent Patterson, for $32,000. The book includes healthy recipes, recommendations for dietary supplements, and natural remedies. Bratten plans to display the book at the check-in counter at its new facility, as well as make it available online. Required: Prepare a summary journal entry to record expenditures related to initial acquisitions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the expenditures related to initial acquisitions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

101 Lets convert the amounts into dollars based on the information provided Land Costs in Costs directly related to the land include Purchase Price of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started