Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(0 Should the value of call and put options increase with uncertainty? Why? [2] (ii) Suppose that a dealer sells a put option, instead of

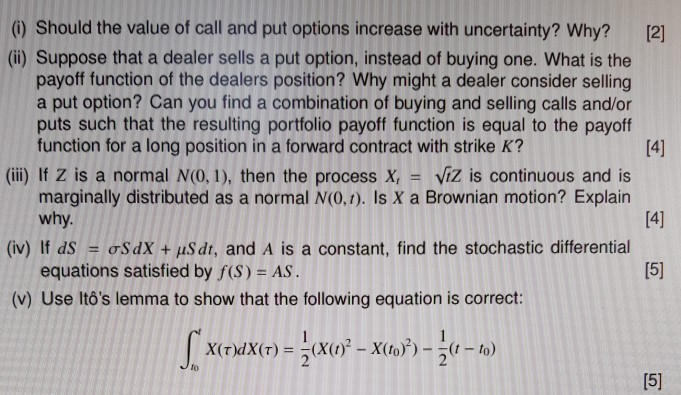

(0 Should the value of call and put options increase with uncertainty? Why? [2] (ii) Suppose that a dealer sells a put option, instead of buying one. What is the payoff function of the dealers position? Why might a dealer consider selling a put option? Can you find a combination of buying and selling calls and/or puts such that the resulting portfolio payoff function is equal to the payoff function for a long position in a forward contract with strike K? (ili) If Z is a normal N(0, 1), then the process X,Viz is continuous and is marginally distributed as a normal N(0.t). Is X a Brownian motion? Explain why (iv) If dS = SJX +pSdt, and A s a constant, find the stochastic differential equations satisfied by f(S) AS (v) Use lt's lemma to show that the following equation is correct: (0 Should the value of call and put options increase with uncertainty? Why? [2] (ii) Suppose that a dealer sells a put option, instead of buying one. What is the payoff function of the dealers position? Why might a dealer consider selling a put option? Can you find a combination of buying and selling calls and/or puts such that the resulting portfolio payoff function is equal to the payoff function for a long position in a forward contract with strike K? (ili) If Z is a normal N(0, 1), then the process X,Viz is continuous and is marginally distributed as a normal N(0.t). Is X a Brownian motion? Explain why (iv) If dS = SJX +pSdt, and A s a constant, find the stochastic differential equations satisfied by f(S) AS (v) Use lt's lemma to show that the following equation is correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started