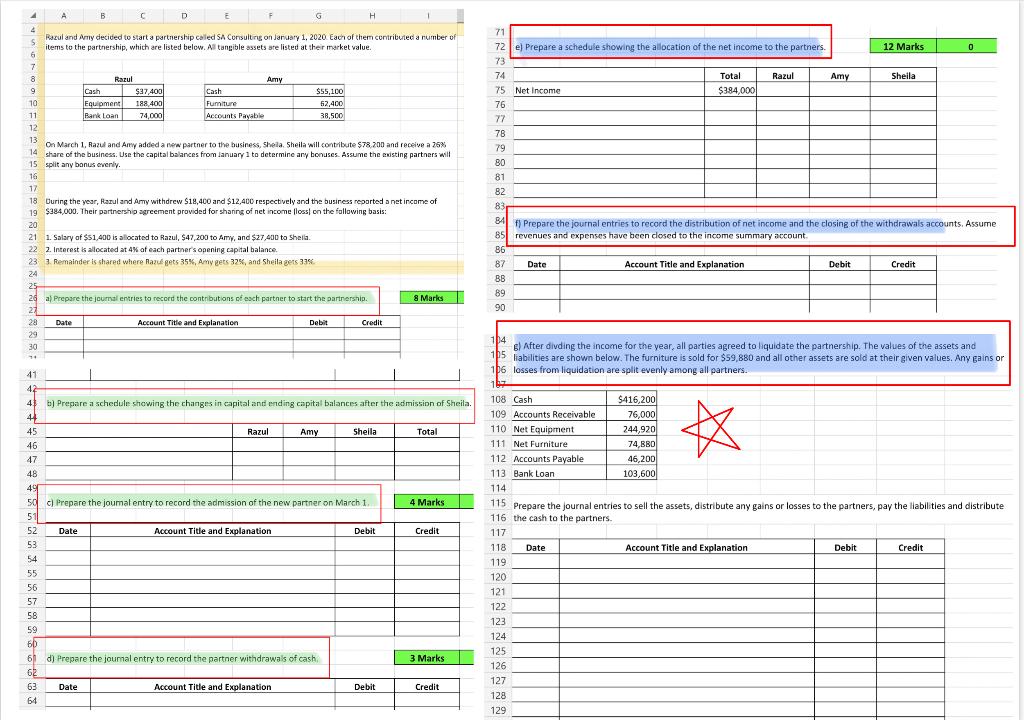

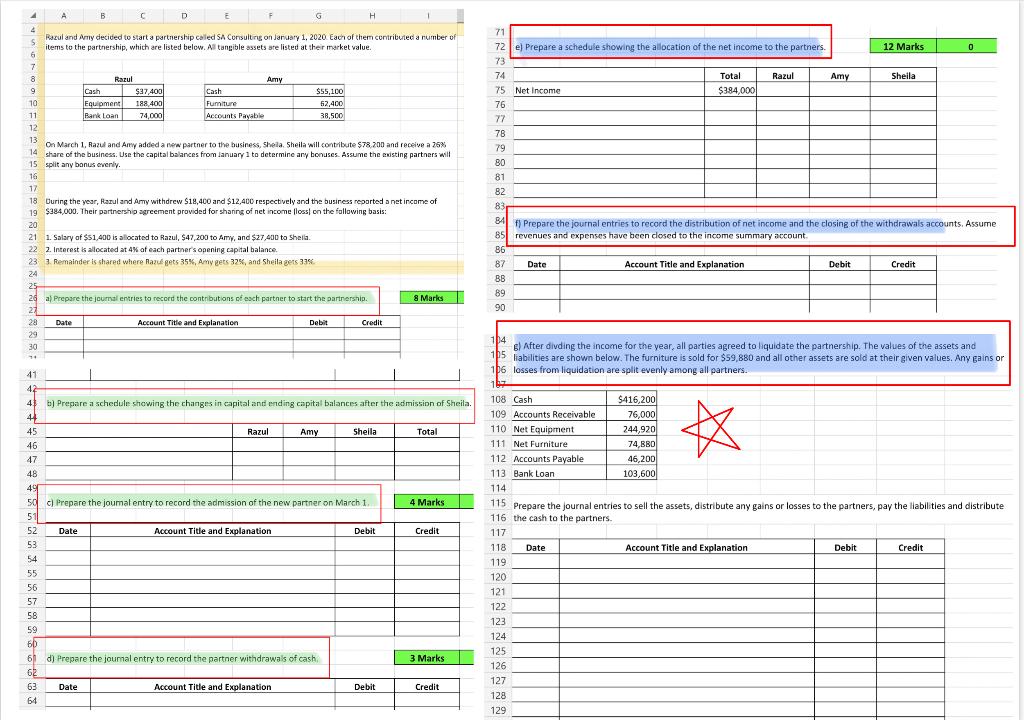

0 tazul B D E G H 4 Razul and Amy decided to start a partnership called SA Consulting on January 1, 2020 Each of them contributed a number of S items to the partnership, which are listed below. As tangible assets are listed at their market value. 6 7 8 Razul Amy 9 Cash $37,400 Cash $55,100 10 Equipment 188.400 Furniture 52,400 11 Bank Loan 74,000 Accounts Payable 38,500 12 13 On March 1, Razul and Amy added a new partner to the business, Sheila, Sheila will contribute $78,200 and receive a 25% 14 share of the business. Use the capital balances from January 1 to determine any bonuses. Assume the existing partners will 15 split any bonus evenly. 16 17 18 During the year, Karul and Ary withdrew $19,400 and $12,400 respectively and the business reported a net income of 19 $984,000. Their partnership agreement provided for sharing of net income loss on the following basis: 20 21 1. Salary of $51,400 is allocated to Razul, $47,200 to Amy, and $27,400 to Sheila 22 2. Interest allocated at 4% of each partner's opening capital balance. 23 3. Remainder is shared where Razu gets 35%, Amy gets 32%, and Sheila gets 33% 24 25 28 a) Prepare the journal entries to record the contributions of each partner to start the partnershio. & Marks 27 28 Date Account Title and Explanation Debat Credit 29 30 71 72ePrepare a schedule showing the allocation of the net income to the partners. 12 Marks 73 74 Total Razu Amy Sheila 75 Net Income $384.000 76 77 78 79 80 81 82 83 84 f) Prepare the journal entries to record the distribution of net income and the closing of the withdrawals accounts. Assume 85 revenues and expenses have been closed to the income summary account 86 87 Dats Account Title and Explanation Debit Credit 89 90 41 44 4! b) Prepare a schedule showing the changes in capital and ending capital balances after the admission of Sheila. 42 45 Razul Amy Sheila Total 46 47 48 491 50 c) Prepare the joumal entry to record the admission of the new partner on March 1 4 Marks 511 52 Date Account Title and Explanation Debit Credit 53 54 55 56 57 58 59 . 6 di Prepare the journal entry to record the partner withdrawals of cash, 3 Marks 62 63 Date Account Title and Explanation Debit Credit 64 104 14 ) After divding the income for the year, all parties agreed to liquidate the partnership. The values of the assets and 1P5 liabilities are shown below. The furniture is sold for $59,880 and all other assets are sold at their given values. Any gains or 16 losses from liquidation are split evenly among all partners 165 108 Cash $416,200 109 Accounts Receivable 76,000 110 Net Equipment 244,920 111 Net Furniture 74,BBO 112 Accounts Payable 46,200 113 Bank Loan 103,600 114 115 Prepare the journal entries to sell the assets, distribute any gains or losses to the partners, pay the abilities and distribute 116 the cash to the partners. 117 118 Date Account Title and Explanation Debit Credit 119 120 121 122 123 124 125 126 127 128 129 0 tazul B D E G H 4 Razul and Amy decided to start a partnership called SA Consulting on January 1, 2020 Each of them contributed a number of S items to the partnership, which are listed below. As tangible assets are listed at their market value. 6 7 8 Razul Amy 9 Cash $37,400 Cash $55,100 10 Equipment 188.400 Furniture 52,400 11 Bank Loan 74,000 Accounts Payable 38,500 12 13 On March 1, Razul and Amy added a new partner to the business, Sheila, Sheila will contribute $78,200 and receive a 25% 14 share of the business. Use the capital balances from January 1 to determine any bonuses. Assume the existing partners will 15 split any bonus evenly. 16 17 18 During the year, Karul and Ary withdrew $19,400 and $12,400 respectively and the business reported a net income of 19 $984,000. Their partnership agreement provided for sharing of net income loss on the following basis: 20 21 1. Salary of $51,400 is allocated to Razul, $47,200 to Amy, and $27,400 to Sheila 22 2. Interest allocated at 4% of each partner's opening capital balance. 23 3. Remainder is shared where Razu gets 35%, Amy gets 32%, and Sheila gets 33% 24 25 28 a) Prepare the journal entries to record the contributions of each partner to start the partnershio. & Marks 27 28 Date Account Title and Explanation Debat Credit 29 30 71 72ePrepare a schedule showing the allocation of the net income to the partners. 12 Marks 73 74 Total Razu Amy Sheila 75 Net Income $384.000 76 77 78 79 80 81 82 83 84 f) Prepare the journal entries to record the distribution of net income and the closing of the withdrawals accounts. Assume 85 revenues and expenses have been closed to the income summary account 86 87 Dats Account Title and Explanation Debit Credit 89 90 41 44 4! b) Prepare a schedule showing the changes in capital and ending capital balances after the admission of Sheila. 42 45 Razul Amy Sheila Total 46 47 48 491 50 c) Prepare the joumal entry to record the admission of the new partner on March 1 4 Marks 511 52 Date Account Title and Explanation Debit Credit 53 54 55 56 57 58 59 . 6 di Prepare the journal entry to record the partner withdrawals of cash, 3 Marks 62 63 Date Account Title and Explanation Debit Credit 64 104 14 ) After divding the income for the year, all parties agreed to liquidate the partnership. The values of the assets and 1P5 liabilities are shown below. The furniture is sold for $59,880 and all other assets are sold at their given values. Any gains or 16 losses from liquidation are split evenly among all partners 165 108 Cash $416,200 109 Accounts Receivable 76,000 110 Net Equipment 244,920 111 Net Furniture 74,BBO 112 Accounts Payable 46,200 113 Bank Loan 103,600 114 115 Prepare the journal entries to sell the assets, distribute any gains or losses to the partners, pay the abilities and distribute 116 the cash to the partners. 117 118 Date Account Title and Explanation Debit Credit 119 120 121 122 123 124 125 126 127 128 129