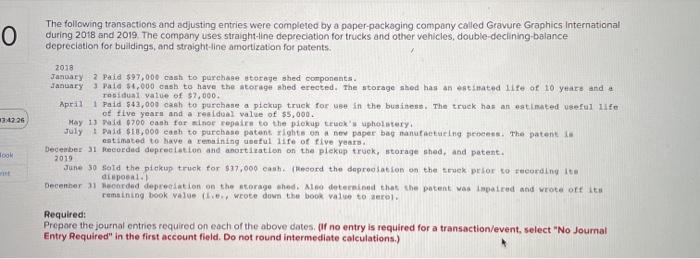

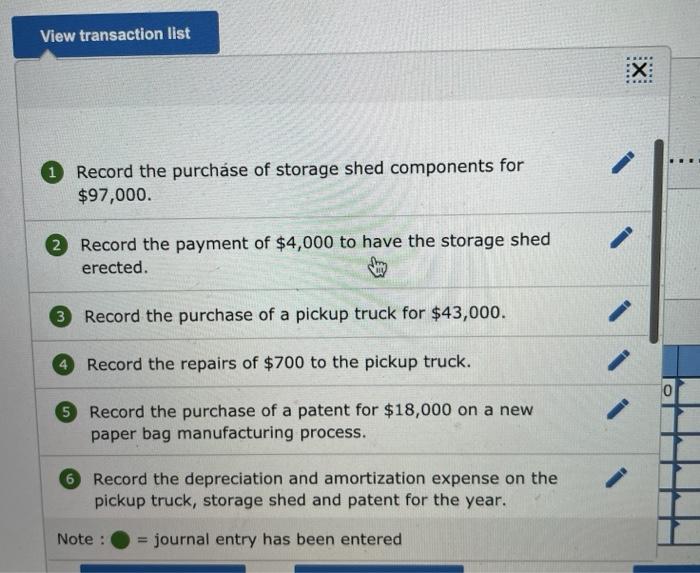

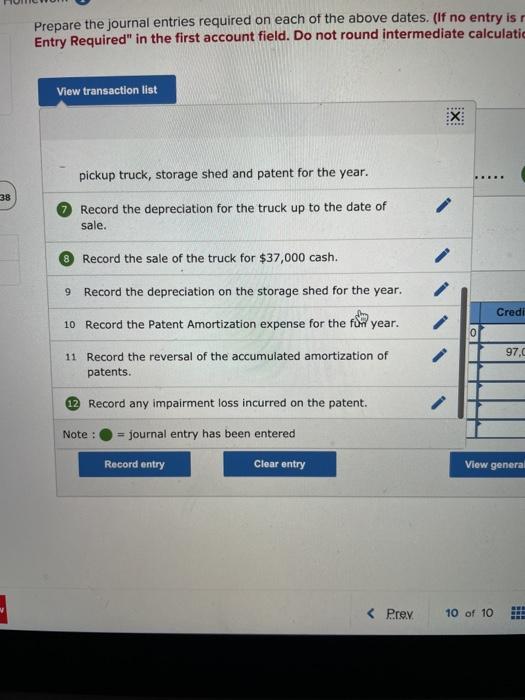

0 The following transactions and adjusting entries were completed by a paper-packaging company called Gravure Graphics International during 2018 and 2019. The company uses straight-line depreciation for trucks and other vehicles, double-declining balance depreciation for buildings, and straight-line amortization for patents. Rook 2018 January 2 Paid $97,000 cash to purchase storage shed components. January 3 Paid $4,000 cash to have the storage shed erected. The storage shed has an estimated life of 10 years and residual value of $2,000. April 1 Paid $43,000 cash to purchase a pickup truck for use in the business. The truck has an estimated useful life of five years and a real dual value of $5,000. Hay 13 Mad 0700 cash for minor repairs to the pickup truck' upholstery July 1 Paid $10,000 cash to purchase patent rights on a new paper bag nanufacturing process. The patentu estimated to have a remaining useful life of five years December 31 Recorded depreciation and anortication on the pickup truck, storage shed, and patent. 2019 June 30 sold the pickup truck for $37.000 cash record the depreciation on the true prior to recording to diapoeal) December 31 Horded depreciation on the storage shed. Also determined that the patent vas Impared and wrote of its remaining book value wote down the book value to ao Required: Prepare the journal entries required on each of the above dates. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) View transaction list EX: Record the purchase of storage shed components for $97,000. 2 Record the payment of $4,000 to have the storage shed erected. 3 Record the purchase of a pickup truck for $43,000. Record the repairs of $700 to the pickup truck. o 5 Record the purchase of a patent for $18,000 on a new paper bag manufacturing process. 6 Record the depreciation and amortization expense on the pickup truck, storage shed and patent for the year. Note : journal entry has been entered Prepare the journal entries required on each of the above dates. (If no entry is Entry Required" in the first account field. Do not round intermediate calculatic View transaction list :X pickup truck, storage shed and patent for the year. 38 Record the depreciation for the truck up to the date of sale. 8 Record the sale of the truck for $37,000 cash. 9 Record the depreciation on the storage shed for the year. Credi 10 Record the Patent Amortization expense for the fun year. 0 97.C 11 Record the reversal of the accumulated amortization of patents. 12 Record any impairment loss incurred on the patent. Note : journal entry has been entered Record entry Clear entry View general