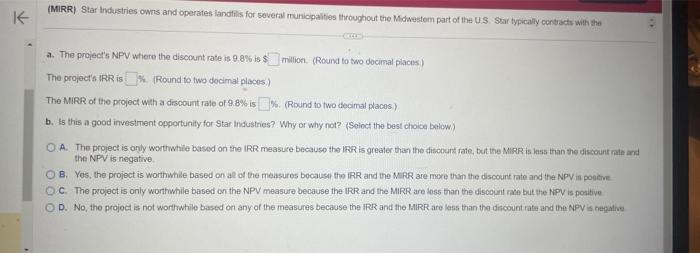

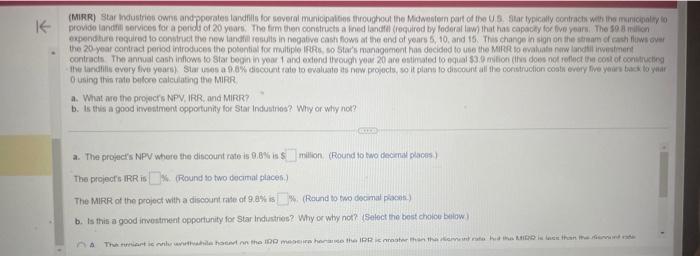

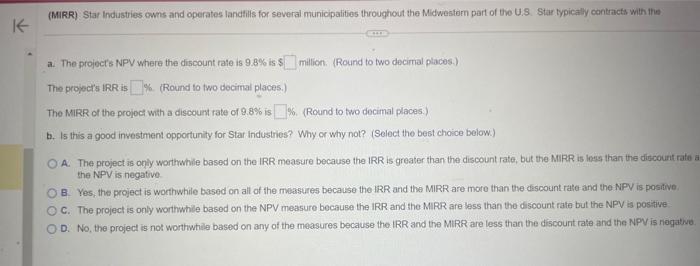

0 ueing this rate before caleulating the MilzR. a. What are the propeits N.PV, IRR, and Mark? b. Is this a good imettment opportinity for Star industive? Why of why not? a. The project's NPV whete the discount male is 3.8% is milion. (Round to two decinal placent) The projoct's IRR is 8. (Round to Two decimal places:) The Miraf of the project wet a decount rate of 9.8% is of (Round ta two decimail placen.) b. Is this a pood investment opportunity for star industries? Why of why not? (Seloct the best choice be'ion) (MiRR) Star Industries owns and operates landitis for several municpaities throughout the Midwestem part of the U.S. S2ar typically contyacts with the a. The project's NPV where the discount rate is 9.8% is: million. (Round to two docimal places) The project's IRR is (Rocind to two docimal places.) The MiRR of the project with a discount rale of 9.8% is \%. (Round to two decimal places) b. Is this a good investment oppertunity for Star industries? Why or why not? (Seioct the best choica betion.) A. The project is only wortiwhice based on the IRR measure because the IRR is greater than the ditcount rate, but the MiRR is iess than the discount nala and the NPV is negative B. Yes, the project is worthwhile based on al of the measures bocausi the IRR and the MirR are more than the discourt rate and the NPV iti poetive C. The project is only worthwhile based on the NPV measure because the IRRR and the MIRR are less than the discount race but the Nipy is poaitive D. No, the project is not worthwhile based on any of the measures because the IRR and the MirR are less than the discount ratie and the NPV is negative 0 using thin rais bulsee caleciating the MiRR a. What me tha progecris NPY, IRR., and Mirer? b. Is this a good itivestment opportanity for Star Industrios? Why or why nok? 3. The project's NPN where the discount rate is 8.B4 is 4 million (Round to two decrial places.) The project s IRR is (Roound to two docimal places.) The MiRR of the project with a ciscount rate of 9.35 is 76. (Found to tivo decimat placin.) b. Is this a good imestmeat opporiunity for Star industries? Why or why not? (Setect the best cheliou butow ) (MiRR) Star Industries cons and operates landtils for several municipalities throughout the Midwestern part of the U.S. Star typically contracts With the a. The project's NPV where the discount rate is 9.8% is $ million. (Round to two decirral places.) The proyect's IRR is (Round to two decimal places.) The MiRR of the project with a discount rate of 9.8% is _\%. (Round to two docimal places.) b. I5 this a good investment opportunity for Star industries? Why or why not? (Select the best choice below.) A. The project is only worthwhile based on the IRR measure because the IRR is greater than the discount rate, but the MiRR is less than the discourit rate the NPV is negative. B. Yes, the project is worthwhile based on all of the misasures because the IRR and the MIRR are mote than the discount rate and the NPV is positive C. The project is only worthwhile based on the NPV measure because the IRR and the MIRR are lass than the discount rate but the NPV is positive D. No, the project is not worthwhile based on any of the measures because the IRR and the MiRR are less than the discount rate and the NPV is negative