Answered step by step

Verified Expert Solution

Question

1 Approved Answer

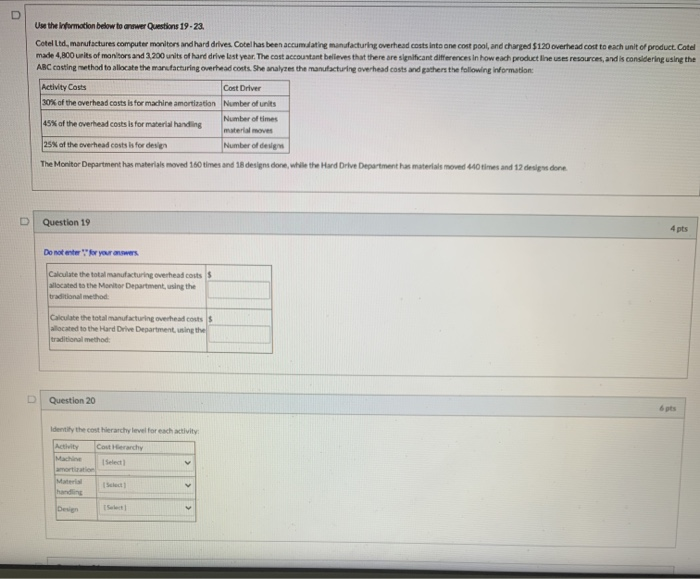

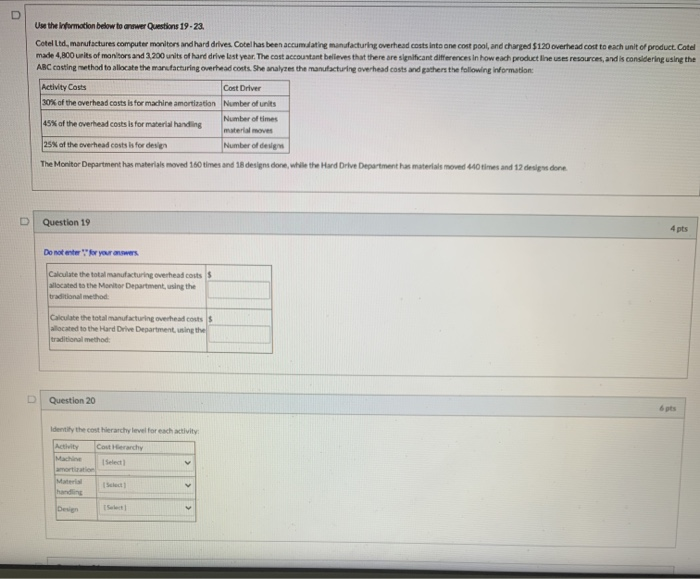

0 Use the information below to answer Questions 19-23. Cotel Ltd, manufactures computer monitors and hard drives Cotel has been accumulating manufacturing overhead costs into

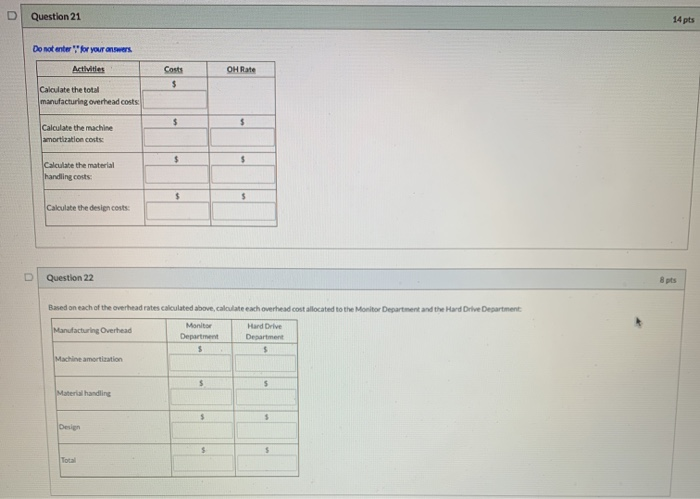

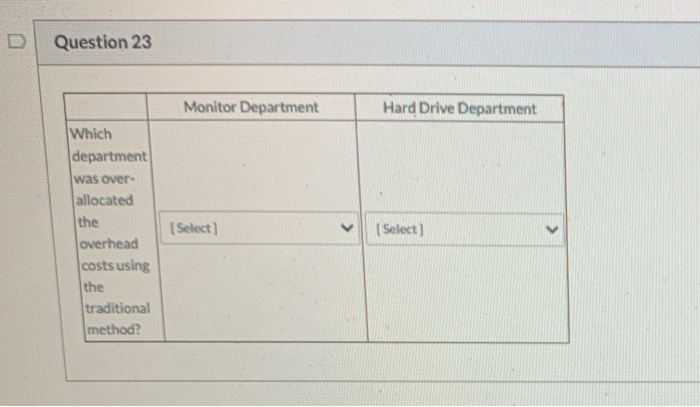

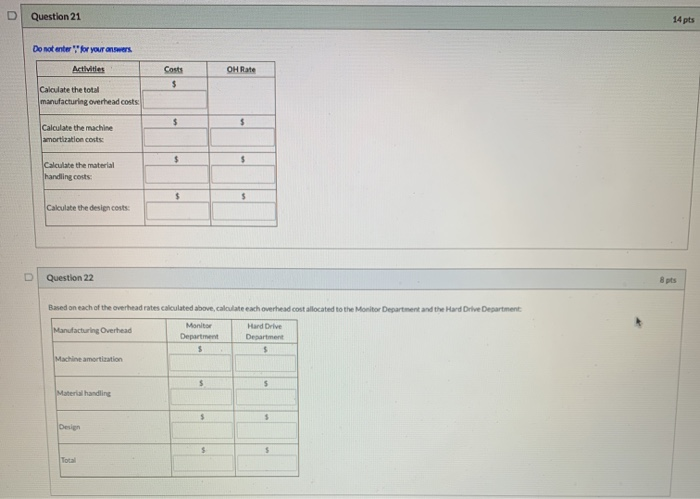

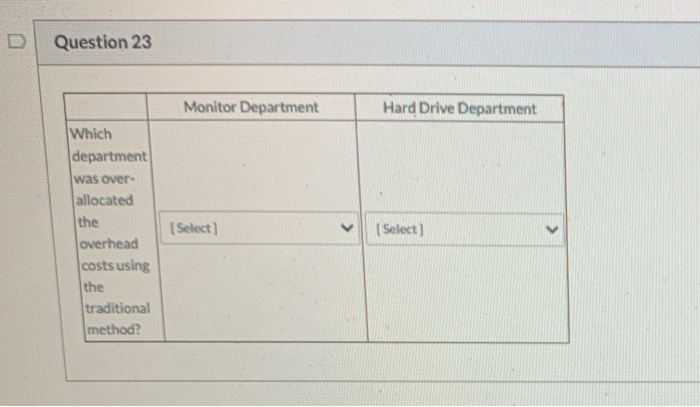

0 Use the information below to answer Questions 19-23. Cotel Ltd, manufactures computer monitors and hard drives Cotel has been accumulating manufacturing overhead costs into one cost pool, and charged $120 overhead cost to each unit of product Catel made 4,800 units of monitors and 3.200 units of hard drive last year. The cost accountant believes that there are significant differences in how each product line uses resources, and is considering using the ABC casting method to allocate the manufacturing overhead costs. She analyze the manufacturing overhead costs and gathers the following information: Activity Costs Cost Driver 30% of the overhead costs is for machine amortization Number of units Number of times 45% of the overhead costs is for material handing materiales 25% of the overhead costs is for design Number of designs The Monitor Department has materials moved 160 times and 18 design done, while the Hard Drive Department has materials moved 440 times and 12 design dere. Question 19 4 pts Do not enter for your answers Calculate the total manufacturing overhead costs $ allocated to the Monitor Department, using the traditional method Calculate the total manufacturing overhead costs $ allocated to the Hard Drive Department using the traditional method: Question 20 6pts Identify the cost hierarchy level for each activity Activity Costerarchy Machine v amortization Material Des Question 21 14 pts Do not enter for your answers Activities Costs OH Rate $ Calculate the total manufacturing overhead costs $ $ Calculate the machine amortization costs $ $ Calculate the material handling costs: $ $ Calculate the design costs: Question 22 8 pts Based on each of the overhead rates Calculated above, calculate each overhead cost allocated to the Monitor Department and the Hard Drive Department Manufacturing Overhead Department Monitor Hard Drive Department $ $ Machine amortization $ $ Material handling $ 5 Design $ $ Total Question 23 Monitor Department Hard Drive Department Which department was over- allocated the overhead costs using the traditional method? Select) Select)

0 Use the information below to answer Questions 19-23. Cotel Ltd, manufactures computer monitors and hard drives Cotel has been accumulating manufacturing overhead costs into one cost pool, and charged $120 overhead cost to each unit of product Catel made 4,800 units of monitors and 3.200 units of hard drive last year. The cost accountant believes that there are significant differences in how each product line uses resources, and is considering using the ABC casting method to allocate the manufacturing overhead costs. She analyze the manufacturing overhead costs and gathers the following information: Activity Costs Cost Driver 30% of the overhead costs is for machine amortization Number of units Number of times 45% of the overhead costs is for material handing materiales 25% of the overhead costs is for design Number of designs The Monitor Department has materials moved 160 times and 18 design done, while the Hard Drive Department has materials moved 440 times and 12 design dere. Question 19 4 pts Do not enter for your answers Calculate the total manufacturing overhead costs $ allocated to the Monitor Department, using the traditional method Calculate the total manufacturing overhead costs $ allocated to the Hard Drive Department using the traditional method: Question 20 6pts Identify the cost hierarchy level for each activity Activity Costerarchy Machine v amortization Material Des Question 21 14 pts Do not enter for your answers Activities Costs OH Rate $ Calculate the total manufacturing overhead costs $ $ Calculate the machine amortization costs $ $ Calculate the material handling costs: $ $ Calculate the design costs: Question 22 8 pts Based on each of the overhead rates Calculated above, calculate each overhead cost allocated to the Monitor Department and the Hard Drive Department Manufacturing Overhead Department Monitor Hard Drive Department $ $ Machine amortization $ $ Material handling $ 5 Design $ $ Total Question 23 Monitor Department Hard Drive Department Which department was over- allocated the overhead costs using the traditional method? Select) Select)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started