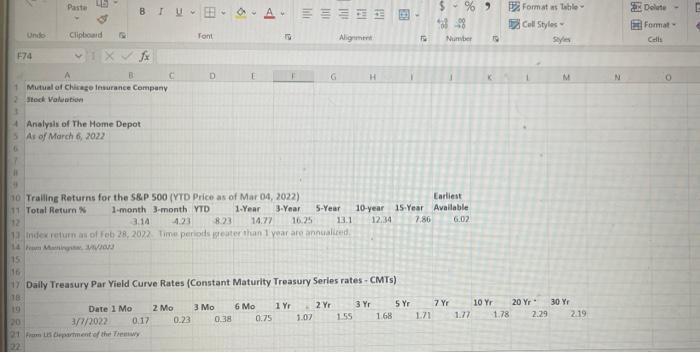

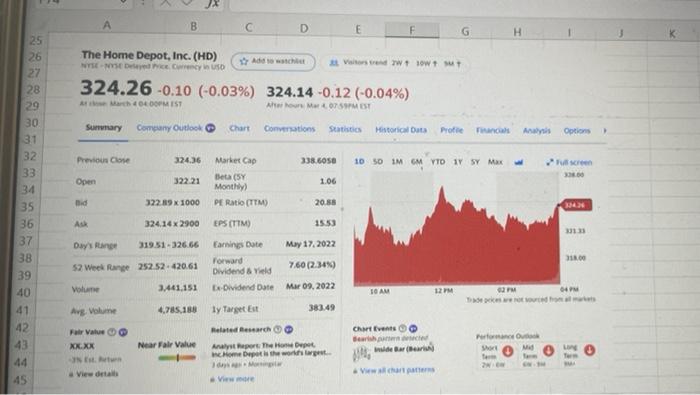

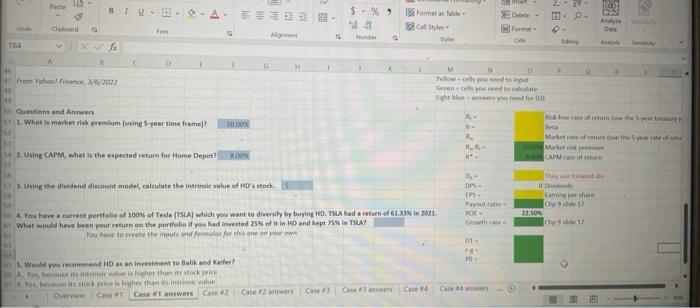

00 B 1 Mutual of Chicago Insurance Company 2 Stock Valuation 3 Robert Balik and Carol Kiefer are senior vice presidents of the Mutual of Chicago Insurance Company. They are codirectors of the company's pension fund management division, with Balik having responsibility for fixed-income securities (primarily bonds) and Kiefer being responsible for equity investments. A major new client, the California League of Cities, has requested that Mutual of Chicago present an investment seminar to the mayors of the represented cities; Balik 4 and Kiefer, who will make the actual presentation, have asked you to help them. S To illustrate the common stock valuation process, Balik and Kiefer have asked you to analyze the Home Depot Company (HD). They picked this company because it is an established, mature 6 company that the audience knows. 7 You recently joined the firm as an equity analyst. Your job is to help Balik and Kiefer evaluate 8 investment opportunities. 9 10 11 Part 5 BTU $ - % ) Delete - A 6 TH P2 Formats Table Cell Styles Une Clipboard Tont Format Cels e Alig Number 574 D H M N 0 B 1 Mutual of Chicago Insurance Company 2 Stock Valuation 4 Analysis of The Home Depot 5 As of March 6, 2022 10 Trailing Returns for the S&P 500 YTD Price as of Mar 04, 2022) Earliest 11 Total Return 1-month 3-month VTD 1-Year 3-Year 5-Year 10-year 15-Year Available 3.14 823 14.77 16.25 13.1 12.34 7.86 6.02 12 Index return of Feb 28, 2022. Time period cater than 1 year are annualled 14 MW 15 17 Daily Treasury Par Yield Curve Rates (Constant Maturity Treasury Series rates - CMTS) TB Date 1 Mo 2 Mo 3 Mo 6 Mo 1 Y 2 Vr 3 Y 5 YI 20 91/2022 0.17 0.23 0.38 0.75 1.02 1.55 168 21 rum parment of the Trew 7 Yr 1.21 10 YT 20 Yr 30 Y 1.77 1.78 2.29 2.19 A B D E G H 25 26 27 28 29 30 31 The Home Depot, Inc. (HD) Adid och Vitor w+ w+ ST EN DUO 324.26 -0.10 (-0.03%) 324.14 -0.12 (-0.04%) March LOOMIST Ahow M7 MEST Summary Company Outlook Chart Conversations Statistics Historical Data Prote Tancas Previous Close 324.36 Market Cap 338.60S 10 $0 Imam YTD 1Y SY Max Open 322.21 Beta (SY 1.06 Month) Bid 32239 x 1000 PE Ratio (TTM) 20.58 Options 32 screen 360 3043 As 324.14% 2900 EPS (TTM) 15.53 133 Day's Range 319.51-326.66 318.00 52 Week Range 252 5242061 33 34 35 36 37 38 39 40 41 42 43 44 45 Earnings Date May 17, 2022 Forward Dividend & Yield 7.60 12.34%) Ex Dividend Date Mar 09, 2022 Volume 3.441.151 10 AM 12 4,785,188 Aug volume 1y Target Est 383.49 Chat Events Ger Near Fair Value Related Research Asteport The Depot Come Depot is the worst Pero Short Fur Value xx.xx NE View deta Mid 0 0 ware View LUS 2. fa A $% 1 SO Formato Styles Al D From Yahoo Finance 76/2002 M N 0 low call your rout Green you need to hefur 49 so Questions and Answers 1. What is market rik premium (sing 5 year time frame! is the way 100% R Market Mark CAR 2. Using CAPM, what is the expected return for Home Depot? KOON Dy the dividend discount mindel, calculate the intrimule value of Hol's stock They ITO OPS . Putti OE- Bron Colide 22.SON Do 17 4. You have a current portfolio of 100% of Tesle (TSA) which you want to diversity by buying HD. TSA had a return of 61.31 in 2021. What would have been your return on the portfolio Wyou had invested 25 of it in HD and kept 75in SA? You have to create the mouton formules for this one on your 111 FO 3. Wycommend HD as an investment to talk and Keer! Ateit intrinsic vicher than it tockice Ye best piisher than intim Overview Case at Case 1 answers Case #2 Cases Cave Castan Case Can 00 B 1 Mutual of Chicago Insurance Company 2 Stock Valuation 3 Robert Balik and Carol Kiefer are senior vice presidents of the Mutual of Chicago Insurance Company. They are codirectors of the company's pension fund management division, with Balik having responsibility for fixed-income securities (primarily bonds) and Kiefer being responsible for equity investments. A major new client, the California League of Cities, has requested that Mutual of Chicago present an investment seminar to the mayors of the represented cities; Balik 4 and Kiefer, who will make the actual presentation, have asked you to help them. S To illustrate the common stock valuation process, Balik and Kiefer have asked you to analyze the Home Depot Company (HD). They picked this company because it is an established, mature 6 company that the audience knows. 7 You recently joined the firm as an equity analyst. Your job is to help Balik and Kiefer evaluate 8 investment opportunities. 9 10 11 Part 5 BTU $ - % ) Delete - A 6 TH P2 Formats Table Cell Styles Une Clipboard Tont Format Cels e Alig Number 574 D H M N 0 B 1 Mutual of Chicago Insurance Company 2 Stock Valuation 4 Analysis of The Home Depot 5 As of March 6, 2022 10 Trailing Returns for the S&P 500 YTD Price as of Mar 04, 2022) Earliest 11 Total Return 1-month 3-month VTD 1-Year 3-Year 5-Year 10-year 15-Year Available 3.14 823 14.77 16.25 13.1 12.34 7.86 6.02 12 Index return of Feb 28, 2022. Time period cater than 1 year are annualled 14 MW 15 17 Daily Treasury Par Yield Curve Rates (Constant Maturity Treasury Series rates - CMTS) TB Date 1 Mo 2 Mo 3 Mo 6 Mo 1 Y 2 Vr 3 Y 5 YI 20 91/2022 0.17 0.23 0.38 0.75 1.02 1.55 168 21 rum parment of the Trew 7 Yr 1.21 10 YT 20 Yr 30 Y 1.77 1.78 2.29 2.19 A B D E G H 25 26 27 28 29 30 31 The Home Depot, Inc. (HD) Adid och Vitor w+ w+ ST EN DUO 324.26 -0.10 (-0.03%) 324.14 -0.12 (-0.04%) March LOOMIST Ahow M7 MEST Summary Company Outlook Chart Conversations Statistics Historical Data Prote Tancas Previous Close 324.36 Market Cap 338.60S 10 $0 Imam YTD 1Y SY Max Open 322.21 Beta (SY 1.06 Month) Bid 32239 x 1000 PE Ratio (TTM) 20.58 Options 32 screen 360 3043 As 324.14% 2900 EPS (TTM) 15.53 133 Day's Range 319.51-326.66 318.00 52 Week Range 252 5242061 33 34 35 36 37 38 39 40 41 42 43 44 45 Earnings Date May 17, 2022 Forward Dividend & Yield 7.60 12.34%) Ex Dividend Date Mar 09, 2022 Volume 3.441.151 10 AM 12 4,785,188 Aug volume 1y Target Est 383.49 Chat Events Ger Near Fair Value Related Research Asteport The Depot Come Depot is the worst Pero Short Fur Value xx.xx NE View deta Mid 0 0 ware View LUS 2. fa A $% 1 SO Formato Styles Al D From Yahoo Finance 76/2002 M N 0 low call your rout Green you need to hefur 49 so Questions and Answers 1. What is market rik premium (sing 5 year time frame! is the way 100% R Market Mark CAR 2. Using CAPM, what is the expected return for Home Depot? KOON Dy the dividend discount mindel, calculate the intrimule value of Hol's stock They ITO OPS . Putti OE- Bron Colide 22.SON Do 17 4. You have a current portfolio of 100% of Tesle (TSA) which you want to diversity by buying HD. TSA had a return of 61.31 in 2021. What would have been your return on the portfolio Wyou had invested 25 of it in HD and kept 75in SA? You have to create the mouton formules for this one on your 111 FO 3. Wycommend HD as an investment to talk and Keer! Ateit intrinsic vicher than it tockice Ye best piisher than intim Overview Case at Case 1 answers Case #2 Cases Cave Castan Case Can