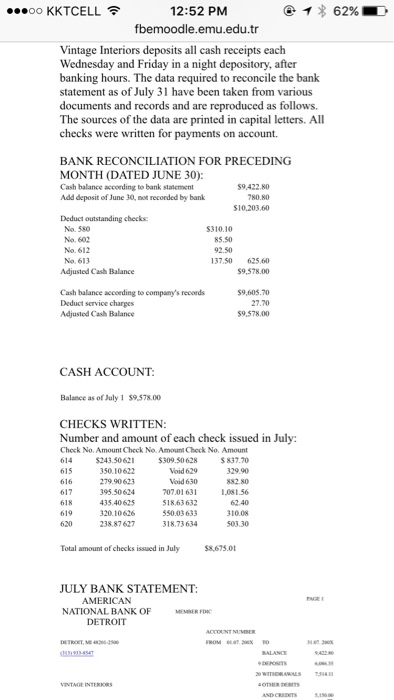

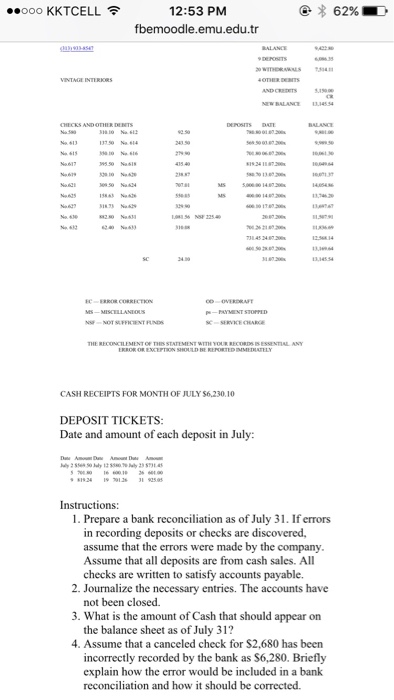

00 KKTCELL? 12:52 PM fbemoodle.emu.edu.tr Vintage Interiors deposits all cash receipts each Wednesday and Friday in a night depository, after banking hours. The data required to reconcile the bank statement as of July 31 have been taken from various documents and records and are reproduced as follows. The sources of the data are printed in capital letters. All checks were written for payments on account. BANK RECONCILIATION FOR PRECEDING MONTH (DATED JUNE 30): Cash balance according to bank statement Add deposit of June 30, mot recorded by bank 9.422.80 780.80 $10.203.60 Deduct outstanding checks No. 580 No. 602 No. 612 No. 613 $310.10 85.50 92.50 137.50 625.60 $9,578.00 Adjusted Cash Balance Cash balance accoeding to company's records Deduct service charges Adjusted Cash Balance $9,605.70 27.70 $9,578.00 CASH ACCOUNT Balance as of July 1 $9,578.00 CHECKS WRITTEN Number and amount of each check issued in July Check No. Amount Check No. Amount Check No. Amount 614 $243.50621 615 617 618 619 620 350.10622 279.90 623 395.50624 435.40625 320.10626 23887627 $309.50628 Void 629 Void 630 707.01 631 1863 632 50.03 633 318.73634 3 837.70 329.90 882.80 1,081.56 62.40 310.08 503.30 Total amount of checks issued in July JULY BANK STATEMENT PAGE AMERICAN NATIONAL BANK OF DETROIT 00 KKTCELL? 12:52 PM fbemoodle.emu.edu.tr Vintage Interiors deposits all cash receipts each Wednesday and Friday in a night depository, after banking hours. The data required to reconcile the bank statement as of July 31 have been taken from various documents and records and are reproduced as follows. The sources of the data are printed in capital letters. All checks were written for payments on account. BANK RECONCILIATION FOR PRECEDING MONTH (DATED JUNE 30): Cash balance according to bank statement Add deposit of June 30, mot recorded by bank 9.422.80 780.80 $10.203.60 Deduct outstanding checks No. 580 No. 602 No. 612 No. 613 $310.10 85.50 92.50 137.50 625.60 $9,578.00 Adjusted Cash Balance Cash balance accoeding to company's records Deduct service charges Adjusted Cash Balance $9,605.70 27.70 $9,578.00 CASH ACCOUNT Balance as of July 1 $9,578.00 CHECKS WRITTEN Number and amount of each check issued in July Check No. Amount Check No. Amount Check No. Amount 614 $243.50621 615 617 618 619 620 350.10622 279.90 623 395.50624 435.40625 320.10626 23887627 $309.50628 Void 629 Void 630 707.01 631 1863 632 50.03 633 318.73634 3 837.70 329.90 882.80 1,081.56 62.40 310.08 503.30 Total amount of checks issued in July JULY BANK STATEMENT PAGE AMERICAN NATIONAL BANK OF DETROIT