Answered step by step

Verified Expert Solution

Question

1 Approved Answer

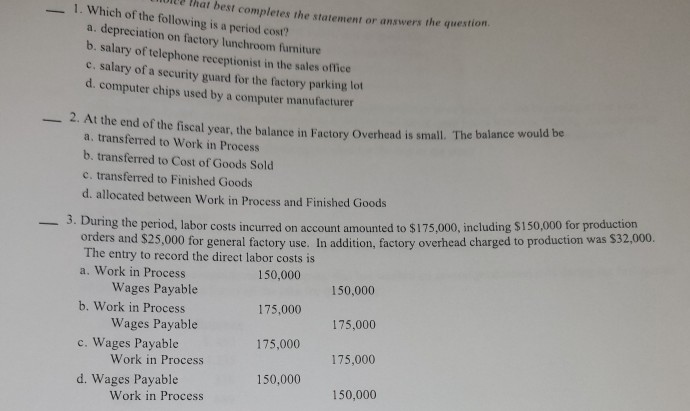

00 that best completes the statement or answers the question. -1. Which of the following is a period cost? a. depreciation on factory lunchroom furniture

00 that best completes the statement or answers the question. -1. Which of the following is a period cost? a. depreciation on factory lunchroom furniture b. salary of telephone receptionist in the sales office c. salary of a security guard for the factory parking lot d. computer chips used by a computer manufacturer 2. At the end of the fiscal year, the balance in Factory Overhead is small. The balance wou ld be a. transferred to Work in Proces b. transferred to Cost of Goods Sold c. transferred to Finished Goods d. allocated between Work in Process and Finished Goods 3. During the period, labor costs incurred on account amounted to $175,000, including $150,000 for production orders and $25,000 for general factory use. In addition, factory overhead charged to production was $32,000 The entry to record the direct labor costs is a. Work in Process 150,000 175,000 175,000 150,000 150,000 175,000 175,000 150,000 Wages Payable Wages Payable Work in Process b. Work in Process c. Wages Payable d. Wages Payable Work in Process

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started