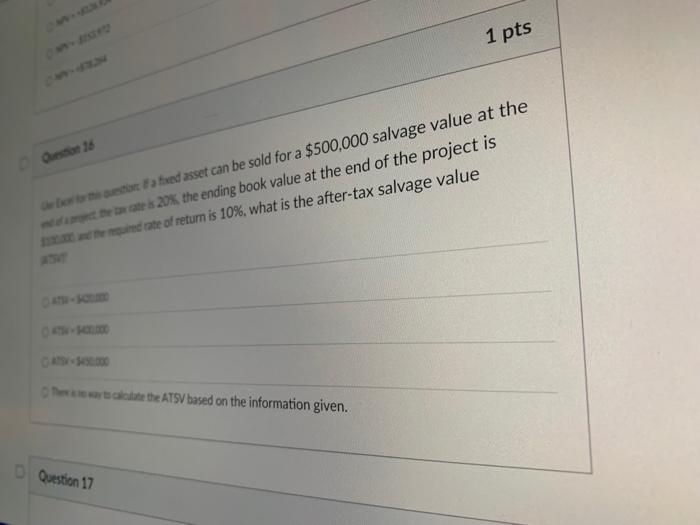

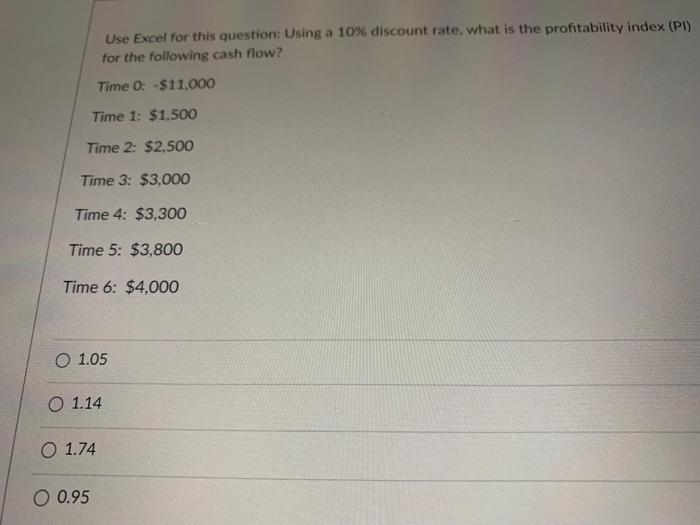

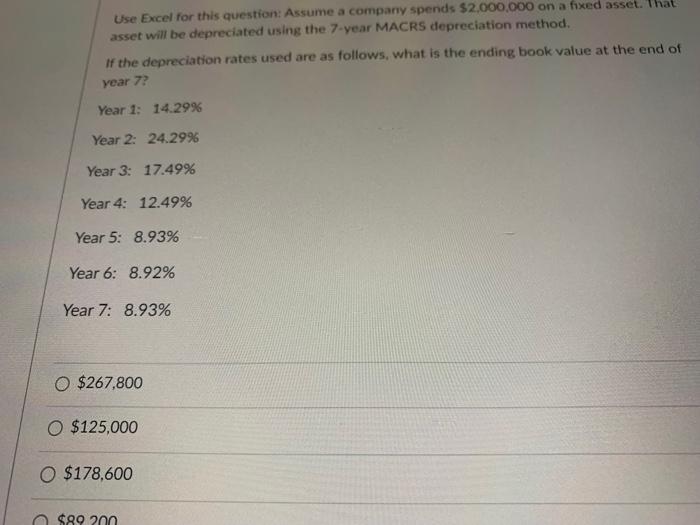

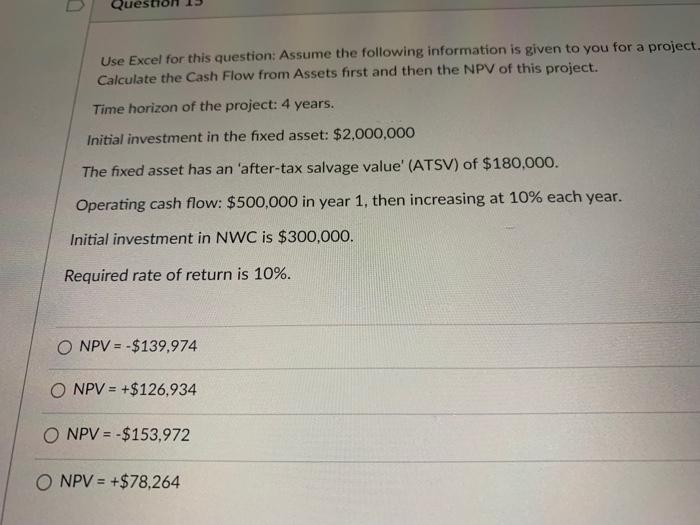

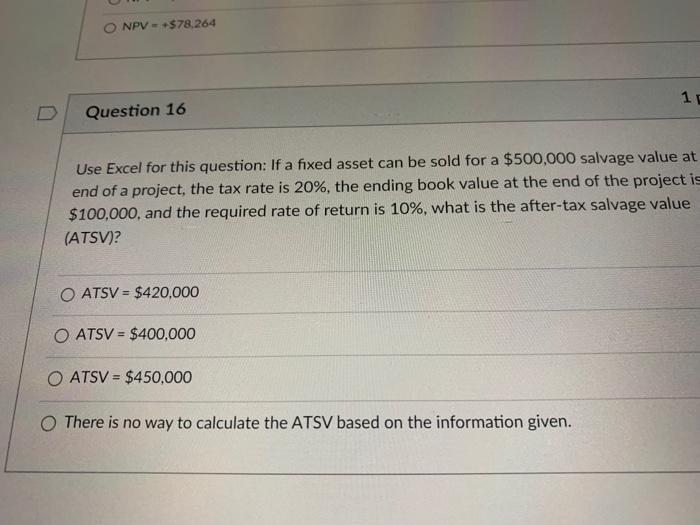

000.000 on feed asset. That their book value at the end of 180.000 10 each yea 1 pts Dwbierto the stort I feed asset can be sold for a $500,000 salvage value at the wente 20% the ending book value at the end of the project is demand rate of return is 10%, what is the after-tax salvage value Det the ATSV based on the information given. Question 17 Use Excel for this question: Using a 10% discount rate, what is the profitability index (PI) for the following cash flow? Time 0: $11,000 Time 1: $1,500 Time 2: $2.500 Time 3: $3.000 Time 4: $3,300 Time 5: $3,800 Time 6: $4,000 0 1.05 O 1.14 0 1.74 O 0.95 Use Excel for this question: Assume a company spends $2,000,000 on a fixed asset. That asset will be depreciated using the 7-year MACRS depreciation method. If the depreciation rates used are as follows, what is the ending book value at the end of year 77 Year 1: 14.2996 Year 2: 24.2996 Year 3: 17.49% Year 4: 12.49% Year 5: 8.93% Year 6: 8.92% Year 7: 8.93% $267,800 $125,000 $178,600 $89 200 Qud Use Excel for this question: Assume the following information is given to you for a project. Calculate the Cash Flow from Assets first and then the NPV of this project. Time horizon of the project: 4 years. Initial investment in the fixed asset: $2,000,000 The fixed asset has an 'after-tax salvage value' (ATSV) of $180,000. Operating cash flow: $500,000 in year 1, then increasing at 10% each year. Initial investment in NWC is $300,000. Required rate of return is 10%. O NPV = -$139,974 O NPV = +$126,934 O NPV = $153,972 O NPV = +$78,264 NPV = $78,264 1 D Question 16 a Use Excel for this question: If a fixed asset can be sold for a $500,000 salvage value at end of a project, the tax rate is 20%, the ending book value at the end of the project is $100,000, and the required rate of return is 10%, what is the after-tax salvage value (ATSV)? O ATSV = $420,000 O ATSV = $400,000 O ATSV = $450,000 There is no way to calculate the ATSV based on the information given. 000.000 on feed asset. That their book value at the end of 180.000 10 each yea 1 pts Dwbierto the stort I feed asset can be sold for a $500,000 salvage value at the wente 20% the ending book value at the end of the project is demand rate of return is 10%, what is the after-tax salvage value Det the ATSV based on the information given. Question 17 Use Excel for this question: Using a 10% discount rate, what is the profitability index (PI) for the following cash flow? Time 0: $11,000 Time 1: $1,500 Time 2: $2.500 Time 3: $3.000 Time 4: $3,300 Time 5: $3,800 Time 6: $4,000 0 1.05 O 1.14 0 1.74 O 0.95 Use Excel for this question: Assume a company spends $2,000,000 on a fixed asset. That asset will be depreciated using the 7-year MACRS depreciation method. If the depreciation rates used are as follows, what is the ending book value at the end of year 77 Year 1: 14.2996 Year 2: 24.2996 Year 3: 17.49% Year 4: 12.49% Year 5: 8.93% Year 6: 8.92% Year 7: 8.93% $267,800 $125,000 $178,600 $89 200 Qud Use Excel for this question: Assume the following information is given to you for a project. Calculate the Cash Flow from Assets first and then the NPV of this project. Time horizon of the project: 4 years. Initial investment in the fixed asset: $2,000,000 The fixed asset has an 'after-tax salvage value' (ATSV) of $180,000. Operating cash flow: $500,000 in year 1, then increasing at 10% each year. Initial investment in NWC is $300,000. Required rate of return is 10%. O NPV = -$139,974 O NPV = +$126,934 O NPV = $153,972 O NPV = +$78,264 NPV = $78,264 1 D Question 16 a Use Excel for this question: If a fixed asset can be sold for a $500,000 salvage value at end of a project, the tax rate is 20%, the ending book value at the end of the project is $100,000, and the required rate of return is 10%, what is the after-tax salvage value (ATSV)? O ATSV = $420,000 O ATSV = $400,000 O ATSV = $450,000 There is no way to calculate the ATSV based on the information given