Answered step by step

Verified Expert Solution

Question

1 Approved Answer

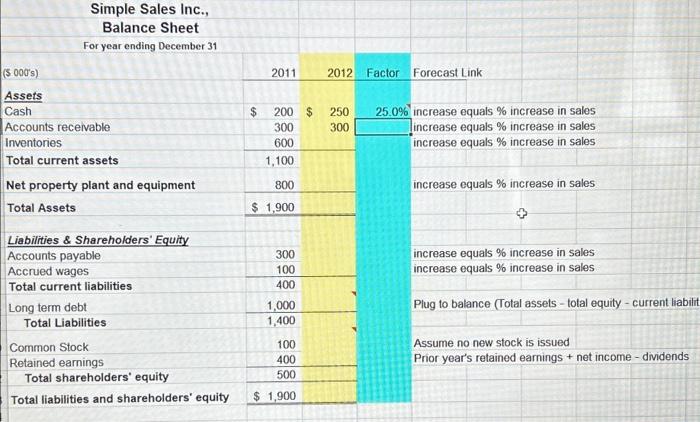

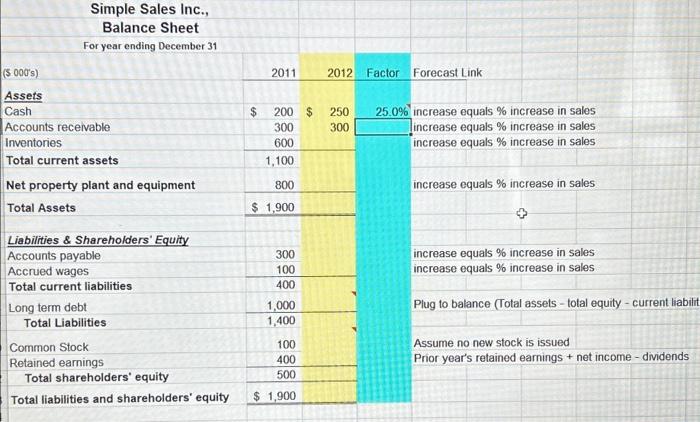

($ 000's) Assets Cash Simple Sales Inc., Balance Sheet year ending December 31 For Accounts receivable Inventories Total current assets Net property plant and equipment

($ 000's) Assets Cash Simple Sales Inc., Balance Sheet year ending December 31 For Accounts receivable Inventories Total current assets Net property plant and equipment Total Assets Liabilities & Shareholders' Equity Accounts payable Accrued wages Total current liabilities Long term debt Total Liabilities Common Stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 2011 200 $ 300 600 1,100 800 $ 1,900 300 100 400 1,000 1,400 100 400 500 $ 1,900 2012 Factor Forecast Link 250 300 25.0% increase equals % increase in sales lincrease equals % increase in sales increase equals % increase in sales increase equals % increase in sales increase equals % increase in sales increase equals % increase in sales Plug to balance (Total assets - total equity - current liabilit Assume no new stock is issued Prior year's retained earnings + net income - dividends

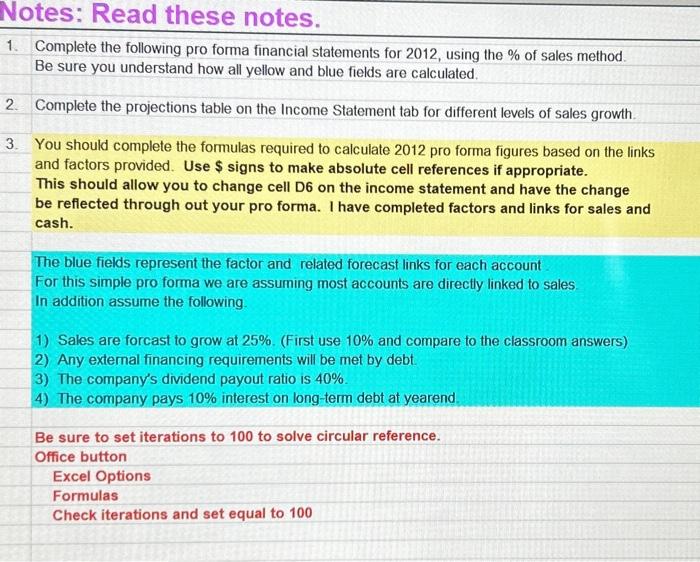

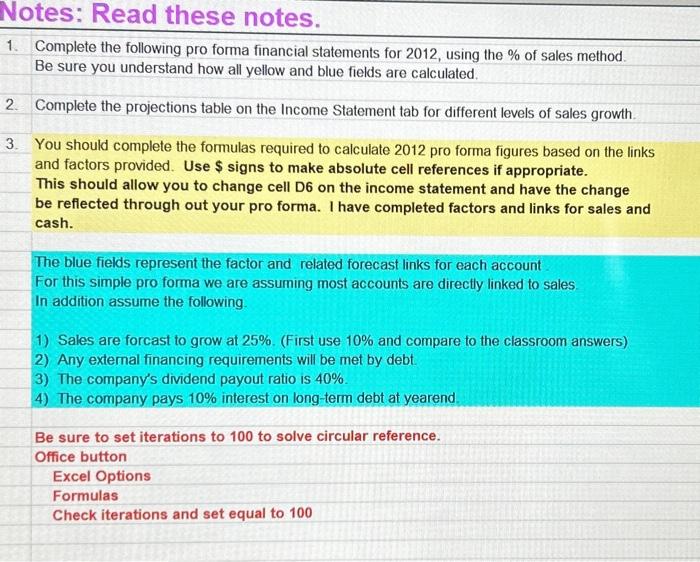

Complete the following pro forma financial statements for 2012 , using the % of sales method. Be sure you understand how all yellow and blue fields are calculated. Complete the projections table on the Income Statement tab for different levels of sales growth. You should complete the formulas required to calculate 2012 pro forma figures based on the links and factors provided. Use $ signs to make absolute cell references if appropriate. This should allow you to change cell D6 on the income statement and have the change be reflected through out your pro forma. I have completed factors and links for sales and cash. The blue fields represent the factor and related forecast links for each account For this simple pro forma we are assuming most accounts are directly linked to sales. In addition assume the following. 1) Sales are forcast to grow at 25\%. (First use 10% and compare to the classroom answers) 2) Any external financing requirements will be met by debt. 3) The company's dividend payout ratio is 40%. 4) The company pays 10% interest on long-term debt at yearend. Be sure to set iterations to 100 to solve circular reference. Office button Excel Options Formulas Check iterations and set equal to 100 Complete the following pro forma financial statements for 2012 , using the % of sales method. Be sure you understand how all yellow and blue fields are calculated. Complete the projections table on the Income Statement tab for different levels of sales growth. You should complete the formulas required to calculate 2012 pro forma figures based on the links and factors provided. Use $ signs to make absolute cell references if appropriate. This should allow you to change cell D6 on the income statement and have the change be reflected through out your pro forma. I have completed factors and links for sales and cash. The blue fields represent the factor and related forecast links for each account For this simple pro forma we are assuming most accounts are directly linked to sales. In addition assume the following. 1) Sales are forcast to grow at 25\%. (First use 10% and compare to the classroom answers) 2) Any external financing requirements will be met by debt. 3) The company's dividend payout ratio is 40%. 4) The company pays 10% interest on long-term debt at yearend. Be sure to set iterations to 100 to solve circular reference. Office button Excel Options Formulas Check iterations and set equal to 100

Complete the following pro forma financial statements for 2012 , using the % of sales method. Be sure you understand how all yellow and blue fields are calculated. Complete the projections table on the Income Statement tab for different levels of sales growth. You should complete the formulas required to calculate 2012 pro forma figures based on the links and factors provided. Use $ signs to make absolute cell references if appropriate. This should allow you to change cell D6 on the income statement and have the change be reflected through out your pro forma. I have completed factors and links for sales and cash. The blue fields represent the factor and related forecast links for each account For this simple pro forma we are assuming most accounts are directly linked to sales. In addition assume the following. 1) Sales are forcast to grow at 25\%. (First use 10% and compare to the classroom answers) 2) Any external financing requirements will be met by debt. 3) The company's dividend payout ratio is 40%. 4) The company pays 10% interest on long-term debt at yearend. Be sure to set iterations to 100 to solve circular reference. Office button Excel Options Formulas Check iterations and set equal to 100 Complete the following pro forma financial statements for 2012 , using the % of sales method. Be sure you understand how all yellow and blue fields are calculated. Complete the projections table on the Income Statement tab for different levels of sales growth. You should complete the formulas required to calculate 2012 pro forma figures based on the links and factors provided. Use $ signs to make absolute cell references if appropriate. This should allow you to change cell D6 on the income statement and have the change be reflected through out your pro forma. I have completed factors and links for sales and cash. The blue fields represent the factor and related forecast links for each account For this simple pro forma we are assuming most accounts are directly linked to sales. In addition assume the following. 1) Sales are forcast to grow at 25\%. (First use 10% and compare to the classroom answers) 2) Any external financing requirements will be met by debt. 3) The company's dividend payout ratio is 40%. 4) The company pays 10% interest on long-term debt at yearend. Be sure to set iterations to 100 to solve circular reference. Office button Excel Options Formulas Check iterations and set equal to 100

($ 000's) Assets Cash Simple Sales Inc., Balance Sheet year ending December 31 For Accounts receivable Inventories Total current assets Net property plant and equipment Total Assets Liabilities & Shareholders' Equity Accounts payable Accrued wages Total current liabilities Long term debt Total Liabilities Common Stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 2011 200 $ 300 600 1,100 800 $ 1,900 300 100 400 1,000 1,400 100 400 500 $ 1,900 2012 Factor Forecast Link 250 300 25.0% increase equals % increase in sales lincrease equals % increase in sales increase equals % increase in sales increase equals % increase in sales increase equals % increase in sales increase equals % increase in sales Plug to balance (Total assets - total equity - current liabilit Assume no new stock is issued Prior year's retained earnings + net income - dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started