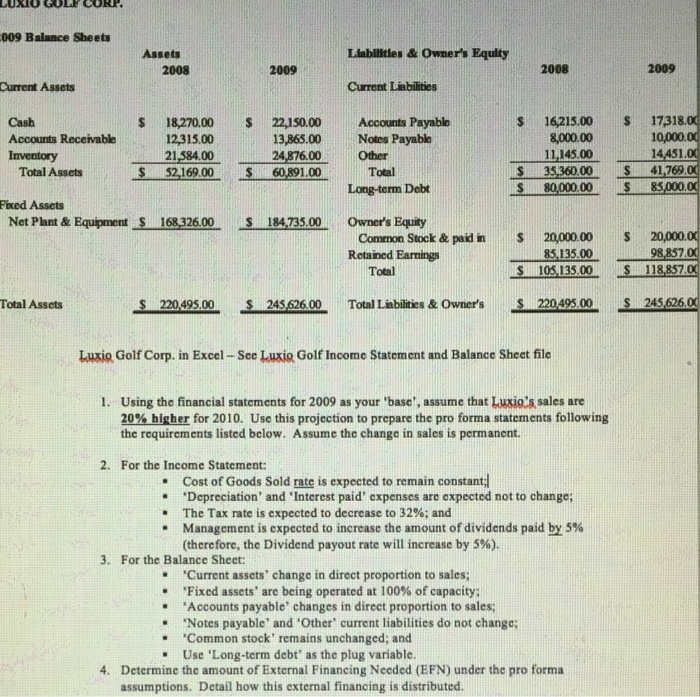

009 Balance Sheets Assets Liabllitles & Owners Equlty 2008 2009 2008 2009 Current Assets Current Liabilities S 16215.00 S 17318. 10,000 S18,270.0022,150.00Accounts Payable Accounts Receivable Inventory 12315.00 21,584.0024,876.00 Other 8,000.00 11,145.00 13,865.00Notes Payable Total AssetsS 52 169,0060891.00Total 3536000 S 41,269 S 80,000.00 S 85,000 Long-term Debt Fixed Assets Net Plant & Equipment S 168326.00 S 184735.00 Owner's Equity Common Stock & paid inS 2000000 S 20,000.0 S 105,135.00 118857.0 -0495-5245 2600 Total Liabilities & Owner's 52 260 Retained Earnings 85,135.00 Total Total Assets Luxig Golf Corp. in Excel -See Luxic Golf Income Statement and Balance Sheet file 1. Using the financial statements for 2009 as your base', assume that Luxig's sales are 20% higher for 2010. Use this projection to prepare the pro forma statements following the requirements listed below. Assume the change in sales is permanent. 2. For the Income Statement: . Cost of Goods Sold rate is expected to remain constant "Depreciation, and Interest paid"expenses are expected not to change; The Tax rate is expected to decrease to 32%; and Management is expected to increase the amount of dividends paid by 5% (therefore, the Dividend payout rate will increase by 5%). 3. For the Balance Sheet: "Current assets' change in direct proportion to sales Fixed assets, are being operated at 100% of capacity; Accounts payable, changes in direct proportion to sales; "Notes payable, andOther, current liabilities do not change; . 'Common stock' remains unchanged; and Use 'Long-term debt' as the plug variable. Determine the amount of External Financing Needed (EFN) under the pro forma assumptions. Detail how this external financing is distributed. 4. 009 Balance Sheets Assets Liabllitles & Owners Equlty 2008 2009 2008 2009 Current Assets Current Liabilities S 16215.00 S 17318. 10,000 S18,270.0022,150.00Accounts Payable Accounts Receivable Inventory 12315.00 21,584.0024,876.00 Other 8,000.00 11,145.00 13,865.00Notes Payable Total AssetsS 52 169,0060891.00Total 3536000 S 41,269 S 80,000.00 S 85,000 Long-term Debt Fixed Assets Net Plant & Equipment S 168326.00 S 184735.00 Owner's Equity Common Stock & paid inS 2000000 S 20,000.0 S 105,135.00 118857.0 -0495-5245 2600 Total Liabilities & Owner's 52 260 Retained Earnings 85,135.00 Total Total Assets Luxig Golf Corp. in Excel -See Luxic Golf Income Statement and Balance Sheet file 1. Using the financial statements for 2009 as your base', assume that Luxig's sales are 20% higher for 2010. Use this projection to prepare the pro forma statements following the requirements listed below. Assume the change in sales is permanent. 2. For the Income Statement: . Cost of Goods Sold rate is expected to remain constant "Depreciation, and Interest paid"expenses are expected not to change; The Tax rate is expected to decrease to 32%; and Management is expected to increase the amount of dividends paid by 5% (therefore, the Dividend payout rate will increase by 5%). 3. For the Balance Sheet: "Current assets' change in direct proportion to sales Fixed assets, are being operated at 100% of capacity; Accounts payable, changes in direct proportion to sales; "Notes payable, andOther, current liabilities do not change; . 'Common stock' remains unchanged; and Use 'Long-term debt' as the plug variable. Determine the amount of External Financing Needed (EFN) under the pro forma assumptions. Detail how this external financing is distributed. 4