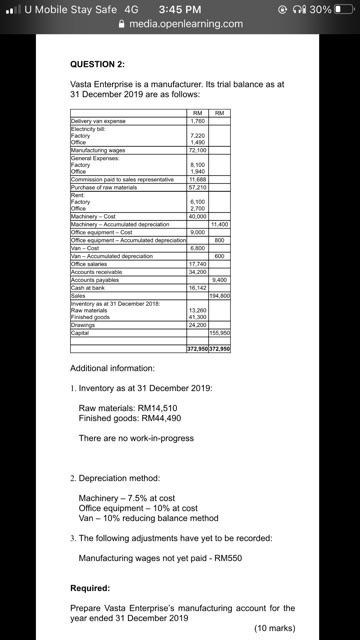

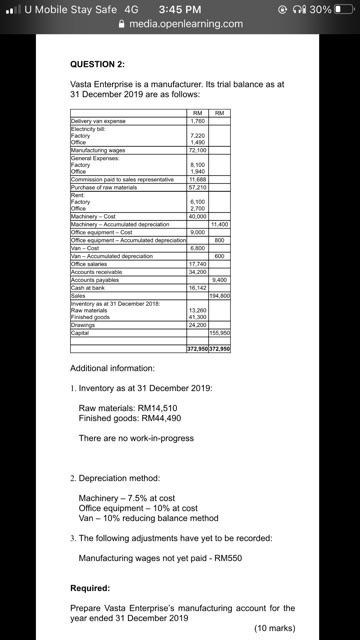

@ 01 30% .. U Mobile Stay Safe 4G 3:45 PM media.openlearning.com QUESTION 2: Vasta Enterprise is a manufacturer. Its trial balance as at 31 December 2019 are as follows: RM ROM 7.220 1400 12100 1.940 16 57210 Devery pe Electricity lice Marung General Expenses Factory Office Con la representative Puriae Rent Factory Machinery Cool Machinery precio Office Cost Office mal. Acumdad de Lan-Acourt be icelaries Accounts rece Account Cash and 6,100 2.700 40.000 11100 DO 100 600 600 1710 3200 1.450 16.142 14.00 verlory A3 December Raw materials had goods Brown Capita 1.3.200 at 500 4200 1963 1972.3503122010 Additional information: 1. Inventory as at 31 December 2019: Raw materials: RM14,510 Finished goods: RM44.490 There are no work in progress 2. Depreciation method: Machinery - 7.5% at cost Office equipment -10% at cost Van - 10% reducing balance method 3. The following adjustments have yet to be recorded Manufacturing wages not yet paid - RM550 Required: Prepare Vasta Enterprise's manufacturing account for the year ended 31 December 2019 (10 marks) @ 01 30% .. U Mobile Stay Safe 4G 3:45 PM media.openlearning.com QUESTION 2: Vasta Enterprise is a manufacturer. Its trial balance as at 31 December 2019 are as follows: RM ROM 7.220 1400 12100 1.940 16 57210 Devery pe Electricity lice Marung General Expenses Factory Office Con la representative Puriae Rent Factory Machinery Cool Machinery precio Office Cost Office mal. Acumdad de Lan-Acourt be icelaries Accounts rece Account Cash and 6,100 2.700 40.000 11100 DO 100 600 600 1710 3200 1.450 16.142 14.00 verlory A3 December Raw materials had goods Brown Capita 1.3.200 at 500 4200 1963 1972.3503122010 Additional information: 1. Inventory as at 31 December 2019: Raw materials: RM14,510 Finished goods: RM44.490 There are no work in progress 2. Depreciation method: Machinery - 7.5% at cost Office equipment -10% at cost Van - 10% reducing balance method 3. The following adjustments have yet to be recorded Manufacturing wages not yet paid - RM550 Required: Prepare Vasta Enterprise's manufacturing account for the year ended 31 December 2019 (10 marks)