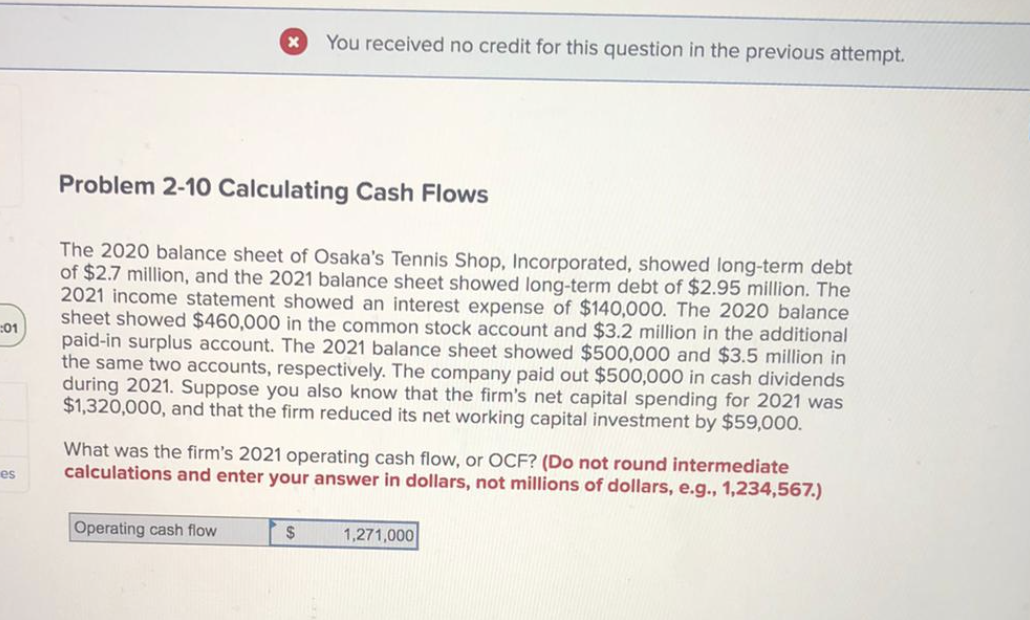

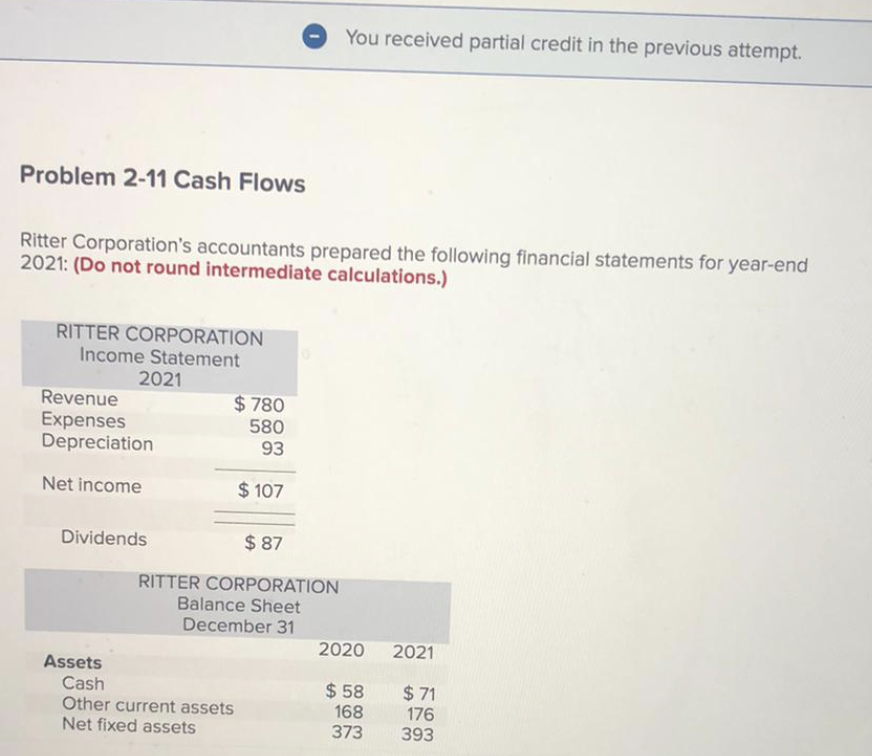

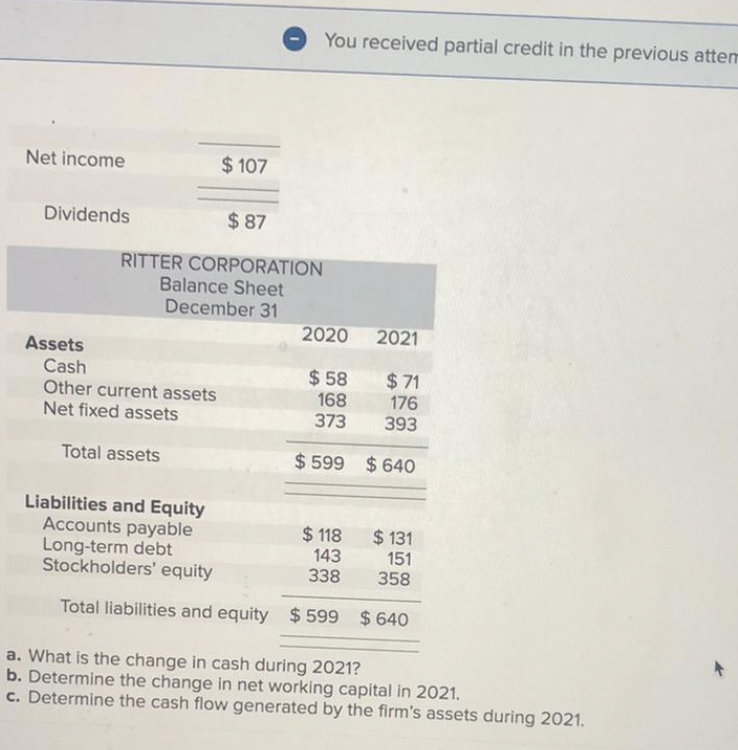

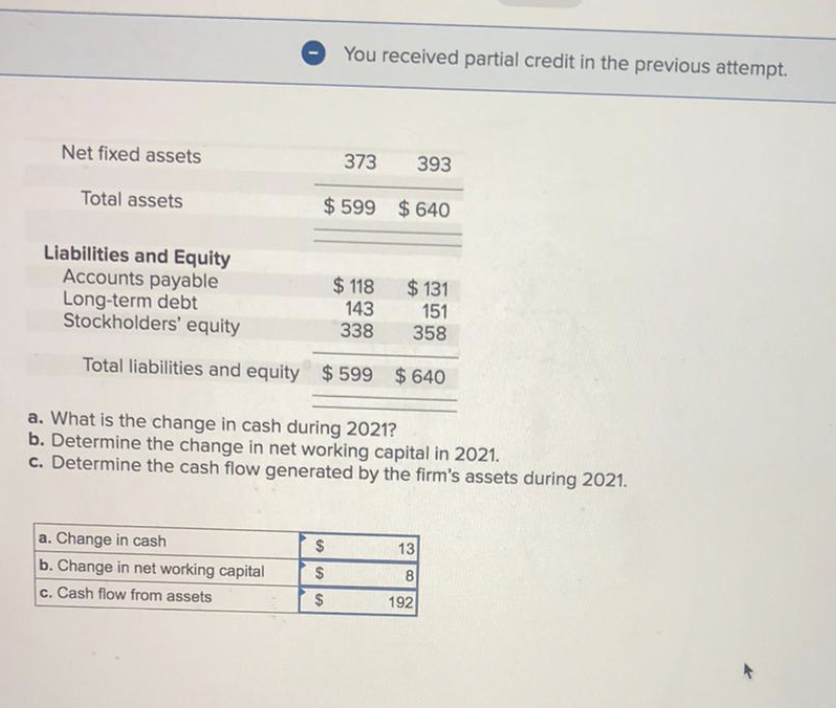

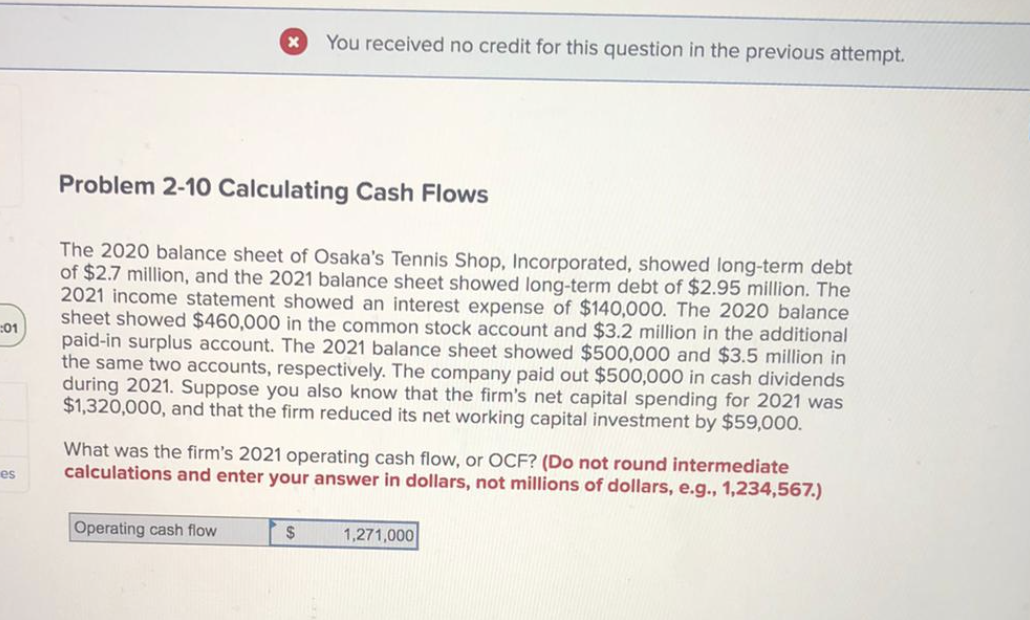

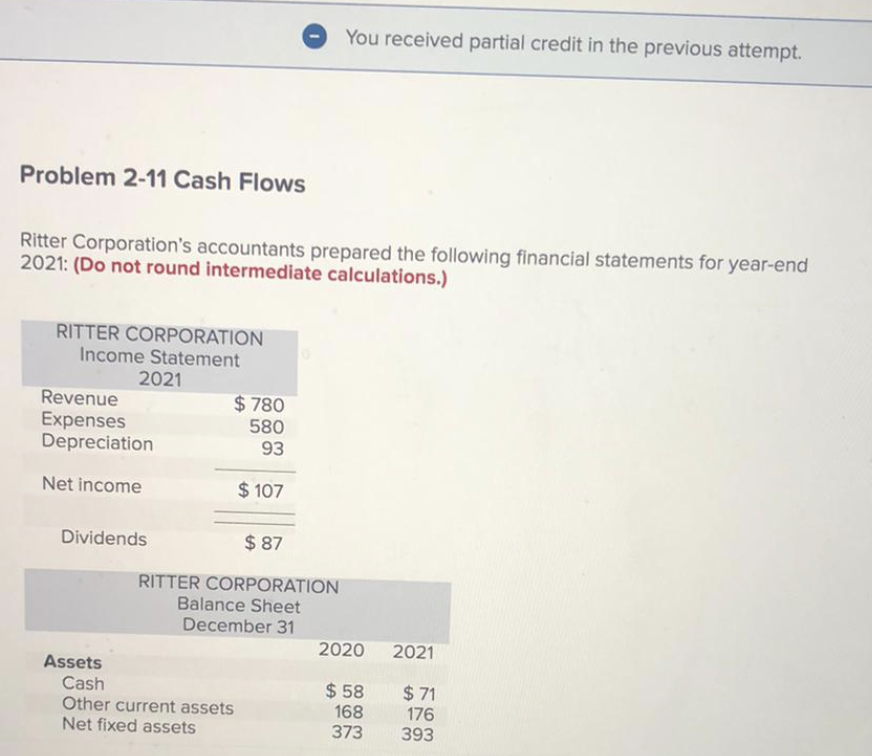

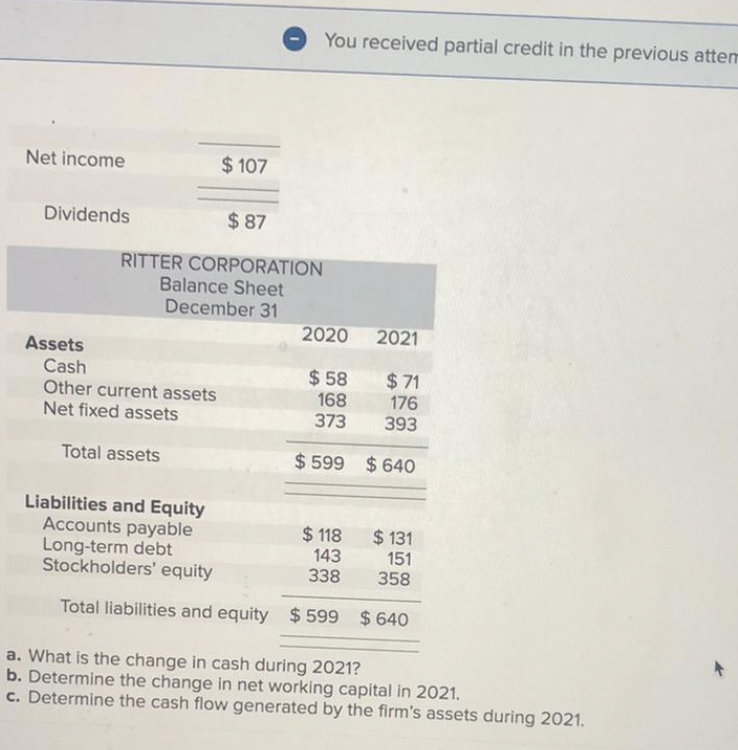

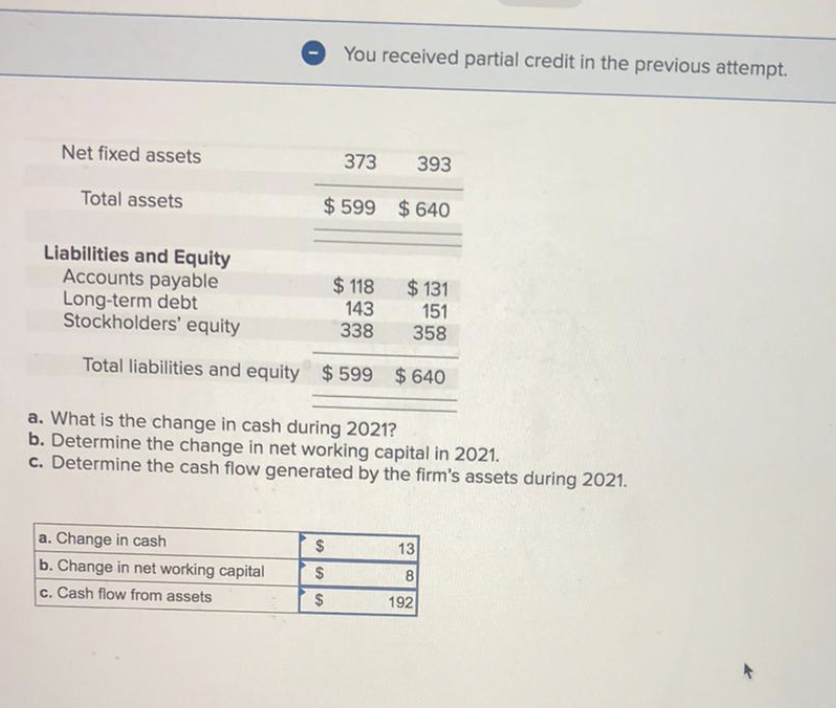

:01 es x Problem 2-10 Calculating Cash Flows The 2020 balance sheet of Osaka's Tennis Shop, Incorporated, showed long-term debt of $2.7 million, and the 2021 balance sheet showed long-term debt of $2.95 million. The 2021 income statement showed an interest expense of $140,000. The 2020 balance sheet showed $460,000 in the common stock account and $3.2 million in the additional paid-in surplus account. The 2021 balance sheet showed $500,000 and $3.5 million in the same two accounts, respectively. The company paid out $500,000 in cash dividends during 2021. Suppose you also know that the firm's net capital spending for 2021 was $1,320,000, and that the firm reduced its net working capital investment by $59,000. Operating cash flow You received no credit for this question in the previous attempt. What was the firm's 2021 operating cash flow, or OCF? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) $ 1,271,000 Problem 2-11 Cash Flows Ritter Corporation's accountants prepared the following financial statements for year-end 2021: (Do not round intermediate calculations.) RITTER CORPORATION Income Statement 2021 Revenue Expenses Depreciation Net income Dividends $780 580 93 $107 $87 RITTER CORPORATION Balance Sheet December 31 Assets Cash Other current assets Net fixed assets You received partial credit in the previous attempt. 2020 2021 $58 $71 168 176 373 393 Net income Dividends $87 RITTER CORPORATION Balance Sheet December 31 Assets Cash Other current assets Net fixed assets $107 Total assets You received partial credit in the previous attem 2020 2021 $58 $71 168 176 373 393 $599 $640 Liabilities and Equity $118 $131 Accounts payable Long-term debt Stockholders' equity 143 151 338 358 Total liabilities and equity $599 $ 640 a. What is the change in cash during 2021? b. Determine the change in net working capital in 2021. c. Determine the cash flow generated by the firm's assets during 2021. Net fixed assets Total assets Liabilities and Equity Accounts payable Long-term debt Stockholders' equity $118 143 338 Total liabilities and equity $599 a. Change in cash b. Change in net working capital c. Cash flow from assets You received partial credit in the previous attempt. 373 393 $599 $640 a. What is the change in cash during 2021? b. Determine the change in net working capital in 2021. c. Determine the cash flow generated by the firm's assets during 2021. $ 555 $131 151 358 $640 13 8 192