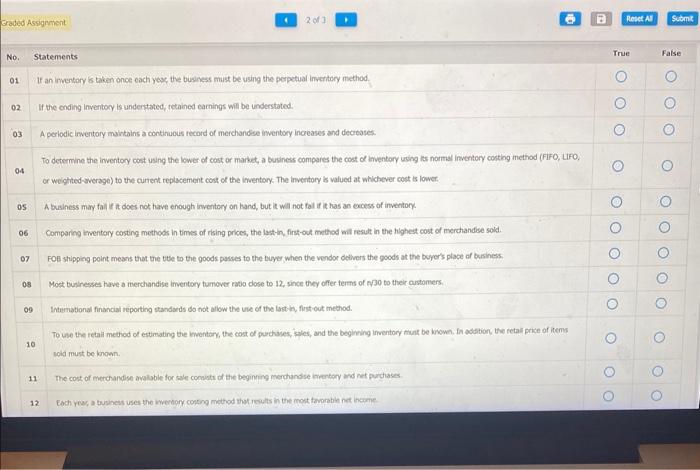

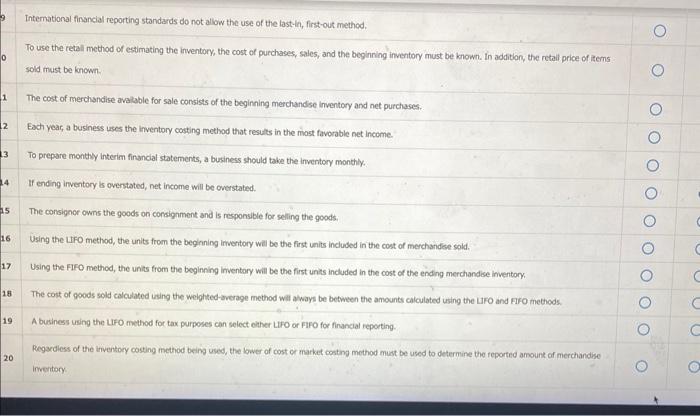

01. If an inventory is tiken once esch yex, the business must be using the perpetual inventary method. 02. If the onding inventory is understated, tetained earnings wit be understated. 03. A perlodic invertory mantoins a continuous record of merchandise inventory increases and decreases To determine the inventory cost using the lower of cost or manct, a business compares the cost of inventary using is normal inventory corthg inethod (Fifo, ufo, 04 of weighted-werage) to the cunent replacement cost of the inventory. The inventory is valued at whichever cost is lower. 05 A business may tall if it does not have enough inventery on tand, but it will not fal if it has an eccess of invertiory. 06 Comporing imentory costing methoos in times of rising prices, the lastin, first-out method will result in the highest cost of merchandise sold. 07. FOB stippiog point means that the the to the goods parses to the buyer when the vendor detivers the goods at the buyer's place of buriness. 09 Intemational financial reporting itandards do not allow the ure of the last the, first-out method. 10 uola must be known. 11. The cont of merchandise watuble for cale consits of the begining merthandse inertany and net purchases Intemational finsuncial reporting standards do not allow the use of the last-in, first-out method. To use the retall method of estimating the inventory, the cost of purchases, sales, and the beginning inventory must be known. In addititon, the retail price of items sold must be known. The cost of merchandise avalable for sale consists of the beginning merchandse inventary and net purchuses. Eact year, a business uses the inventory costing method that resuts in the most favonable net income. To prepare monthy interim financial statements, a business should take the inventory monthly. If ending inventory is oventated, net income will be overstated. The consignor owns the goods on consignment and is responsible for selling the goods. Using the UIfo method, the units from the begining irvertory will be the first units induded in the cost of merchandee sold. Using the FIFO method, the units from the beginning inventary will be the first units induded in the cost of the ending merchandise invertory. 18. The coit of goods sold calculated iasing the welphted-rvenge method will aways be between the amounts calculated using the Lfo and fro methods. 19 A business using the Ufo method for tax purposes can select elther Lifo of Fifo for finuncial reporting. Regsediess of the tiventory costing method being used, the bwer of cost of market costing method must be used to determine the feported anount of merchandise. 20 invertory