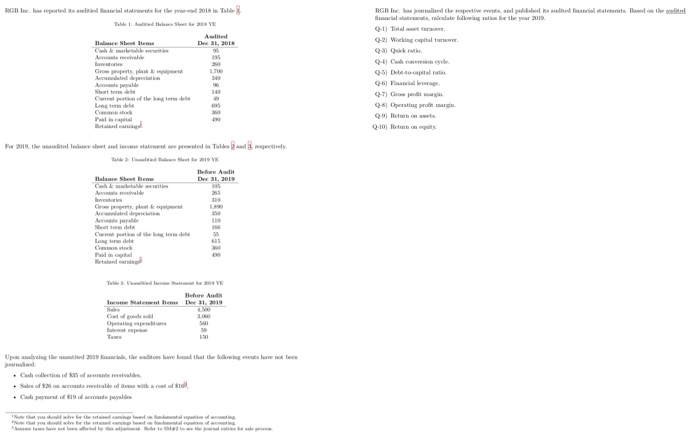

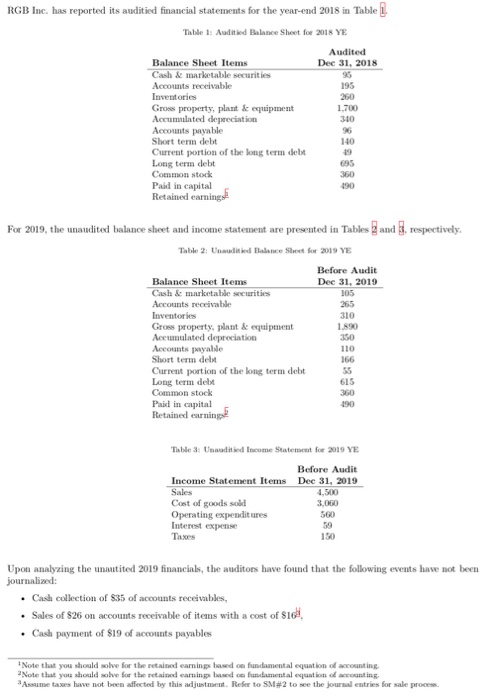

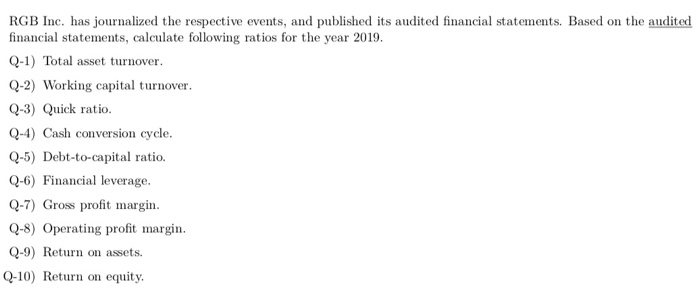

0-1) Tawe 0-2) Working capital 2-3) Quick 2-5) Deocapital 2.7) Great www Q-) Operating primar Balance Sheet Before Uping the wed 2009 the wolved that the foot water Cus t od $190 payable RGB Inc. has reported its auditied financial statements for the year-end 2018 in Table Table 1: Audited Balance Sheet for 2018 YE Audited Dec 31, 2018 195 260 1.700 310 Balance Sheet Items Cash & marketable securities Accounts receivable Inventories Gross property, plant & equipment Accumulated depreciation Accounts payable Short term debt Current portion of the long term debit Long term debt Common stock Paid in capital Retained earning 140 360 190 For 2019, the unaudited balance sheet and income statement are presented in Tables 2 and 3. respectively. Table 2: Unaudited Balance Sheet for 2019 YE Before Audit Dec 31, 2019 105 265 310 180 150 Balance Sheet Items Cash & marketable securities Accounts receivable Inventories Gross property, plant & equipment Accumulated depreciation Accounts payable Short term det Current portion of the long term debt Long term delt Common stock Paid in capital Retained earning 110 615 360 190 Table 3: Unedited Income Statement for 2019 YE Before Audit Income Statement Items Dec 31, 2019 Sales 4.500 Cost of goods sold 1.000 Operating expenditures 560 Interest expense Taxes 150 39 Upon analyzing the unautited 2019 financials, the auditors have found that the following events have not been journalised: Cash collection of $35 of accounts receivables, Sales of $26 on accounts receivable of items with a cost of $10 Cash payment of $19 of accounts payables Note that you should solve for the retained earning b ed on fundamental equation of accounting 2 Note that you should be for the retained earning and fundamental equation of accounting Assume taxes have not been affected by this adjustment. Refer to SM#2 to see the journal entries for sale process RGB Inc. has journalized the respective events, and published its audited financial statements. Based on the audited financial statements, calculate following ratios for the year 2019. Q-1) Total asset turnover. Q-2) Working capital turnover. Q-3) Quick ratio. Q-4) Cash conversion cycle Q-5) Debt-to-capital ratio. Q-6) Financial leverage. Q-7) Gross profit margin. Q-8) Operating profit margin. Q-9) Return on assets. Q-10) Return on equity