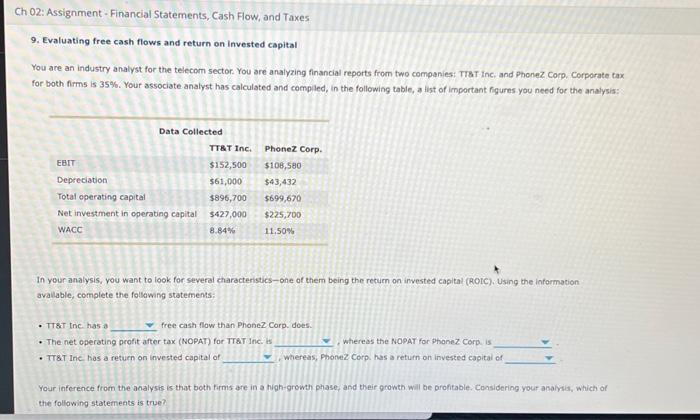

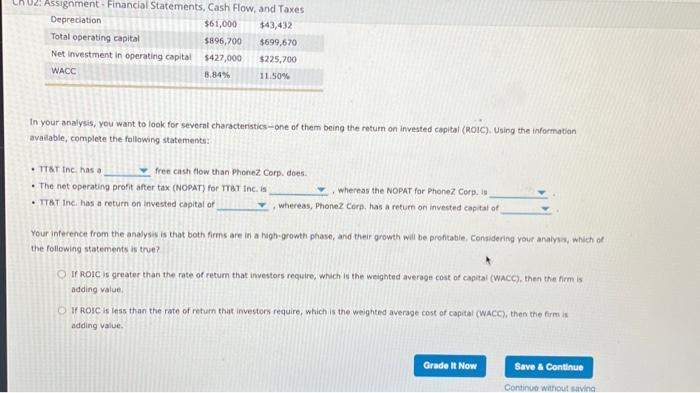

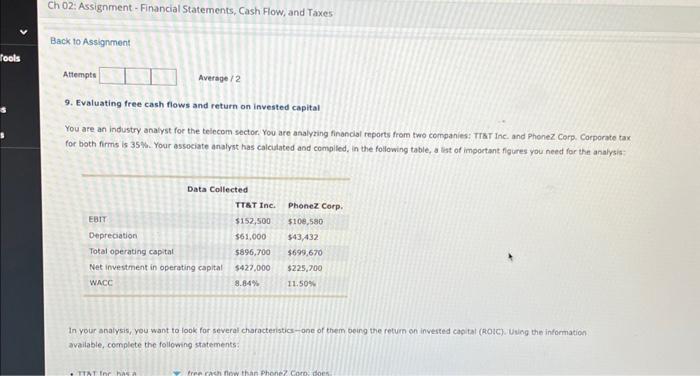

02: Assignment-Financial Statements, Cash Flow, and Taxes 9. Evaluating free cash flows and return on invested capital You are an industry analyst for the telecom sector. You are analyzing financial reports from two companies: TTBT Inc. and PhoneZ Corp. Corporate tax for both firms is 35%. Your associate analyst has calculated and compled, in the following table, a list of important figures you need for the analysis: In your analysis, you want to look for several characteristics-one of them being the recurn on invested capltal (ROIC), Using the information available, complete the follawing statement: - Trert tne has a free cash flaw than PhoneZ Corp. does. - The net operating profit after tax (NOPAT) for TTBT Inc. is , Whereas the NOPAT for phanez Corp is - TT\&T Ine has a return on invested capital of . Whereas, Phonez Corp. has a return on invested capital of Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be grofitable, Coasidering your analysis, which of the following statements is true? In your analysis; you want to look for several characteristics-one of them being the retum on invested capital (ROiC). Using the information avalable, complete the following statements: - Ttatine has a fren cash flow than Phonez Corp. does. - The net operating profit after tax (NOPAT) for TTBT Inc. is , whereas the NOPAT for Phone Z Corp, is - TRBT Inc. has a return on invested capital of , whereas, Phonez corp. has a retum on invested captat of Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be proftable, Considering your analyss, which of the following statements is true? If ROIC is greater than the rate of retum that imvestors reeuire, which is the weighted average cost of capital (WACC), then the firm is adding value. If ROIC is less than the rate of retum that investors require, which is the weighted average cost of capital (WACC), then the firm is adding value. 9. Evaluating free cash flows and return on invested capital You are an industry analyst for the teiecom sectoc, You are analyzing financial reports from two cormpanies: TraT Inc. and PhoneZ Corp. Corporate tax. for both firms is 35W. Your associate analyst has calculated and complled, in the following table, a list of important figures you need for the analysis In your analysis, you want to iook for several charactesistick-one of them being the return on invested cagital (foctc). Uving the informiation available, complete the following statements