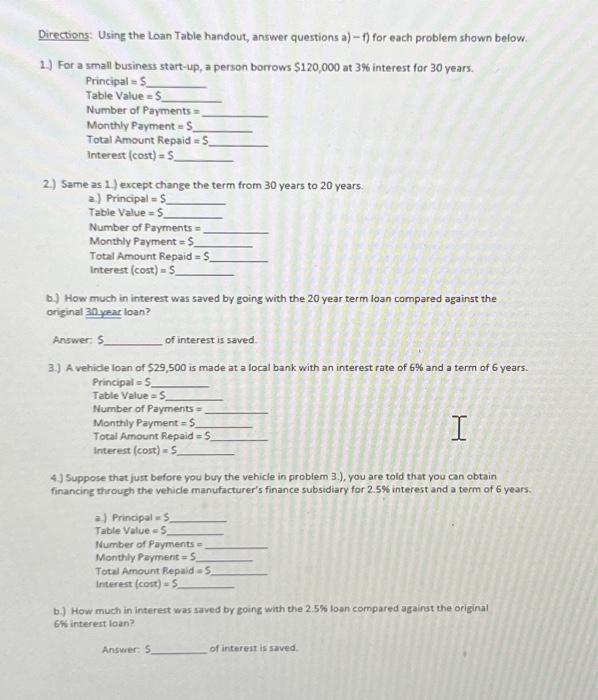

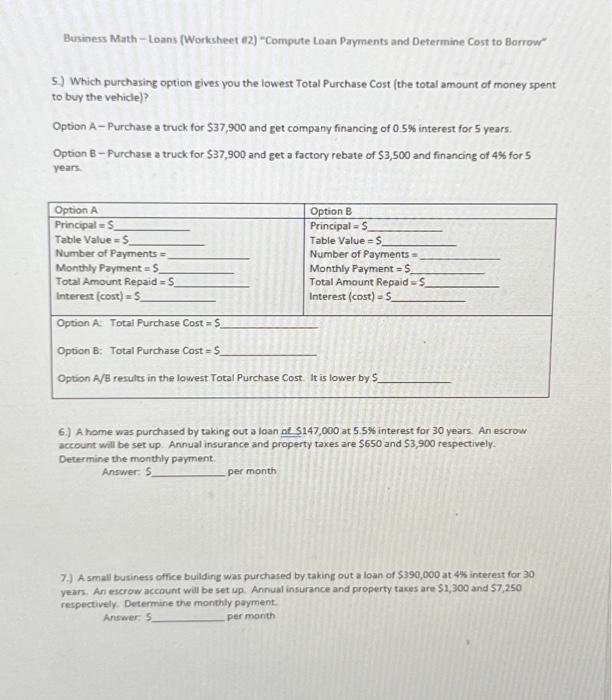

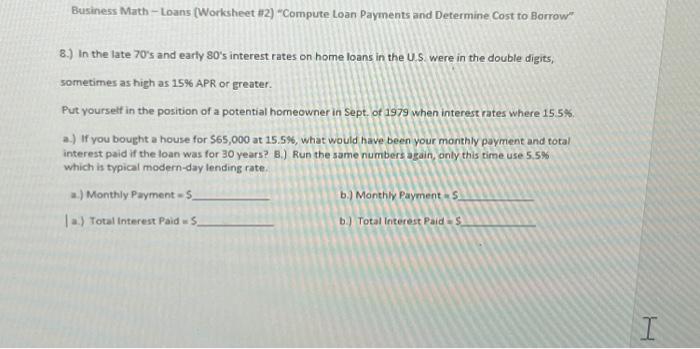

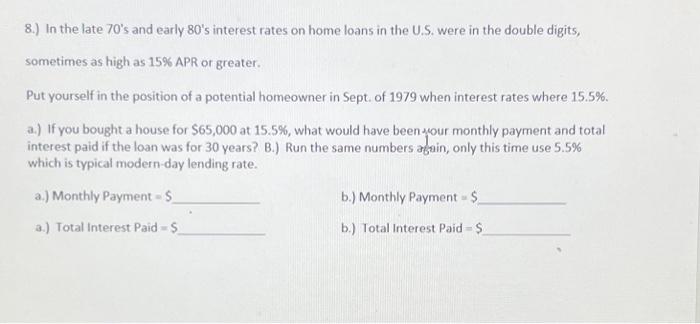

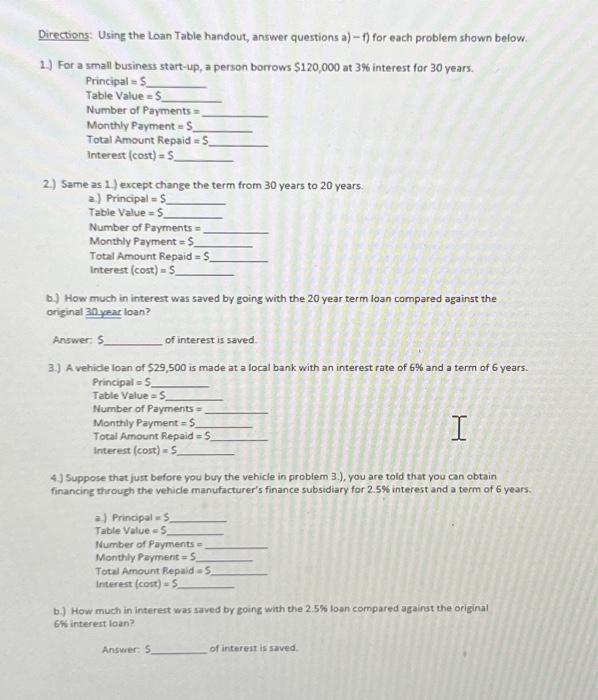

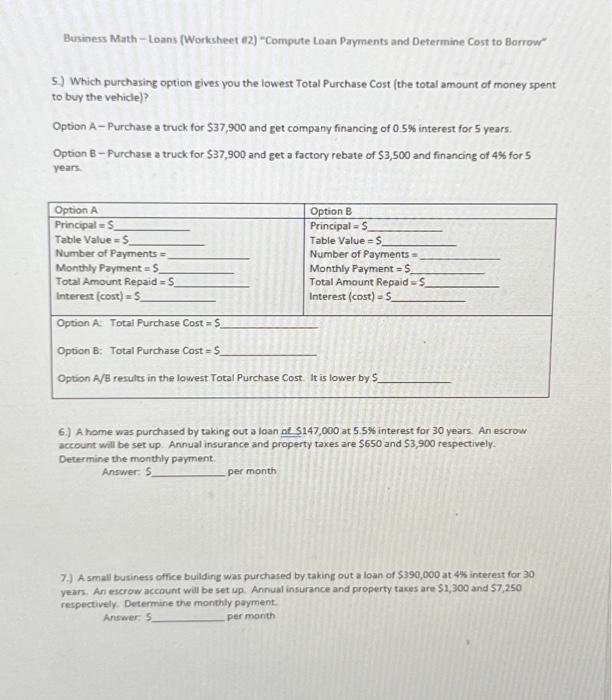

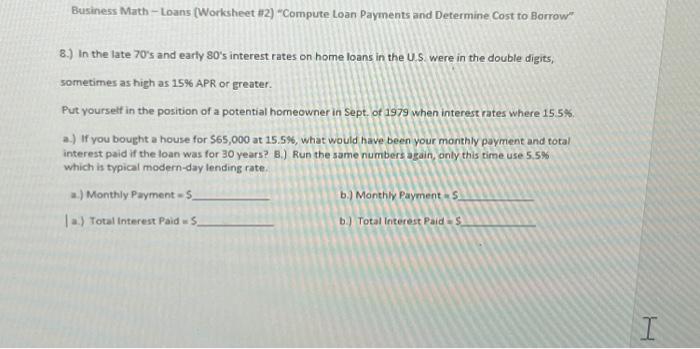

1.) For a small business start-up, a person borrows $120,000 at 3% interest for 30 years. Principal =$ Table Value =$ Number of Payments = Monthly Payment =S Total Amount Repaid = 5 Interest ( cost )=S 2.) Same as 1.) except change the term from 30 years to 20 years. a.) Principal =$ Table Value =5 Number of Payments = Monthly Payment = $ Total Amount Repaid = $ Interest (cost) =$ b.) How much in interest was saved by going with the 20 year term loan compared against the original 3nyear loan? Answer: 5 of interest is saved. 3.) A vehide loan of 529,500 is made at a local bank with an interest rate of 6% and a term of 6 years. Principal =$ Table Velue o 5 Number of Payments = Monthly Payment =5 Total Amount Repaid =5 Interest ( cost )=5 4.) Suppose that just before you buy the vehicle in problem 3.), you are told that you can obtain financing through the vehicle manufacturer's finance subsidiary for 2.5% interest and a term of 6 years. a) Principal =5 Jable Value =5 Number of Payments = Monthly Payment =5 Total Amount Repaid o 5 interest (cont) =S b.) How much in interert was saved by going with the 2.5% loan compared against the original 6% interest loan? Answer: 5 of interest is saved. 5) Which purchasing option gives you the lowest Total Purchase Cost (the total amount of money spent to buy the vehicle)? Option A-Purchase a truck for $37,900 and get company financing of 0.5% interest for 5 years. Option B - Purchase a truck for $37,900 and get a factory rebate of $3,500 and financing of 4% for 5 years. 6.) A home was purchased by taking out a loan of $147,000 at 5.5% interest for 30 years. An escrow account will be set up. Annual insurance and property taxes are $650 and $3,900 respectively. Determine the monthly pavment. Answer: per month 7.) A small business office bullding was purchased by taking out a loan of $390,000 at 4% intereat for 30 years. An escrow account will be set up. Annual insurance and property taxes are $1,300 and 57,250 respectively. Determine the monthly payment. Answer: permonth 8.) In the late 70 's and earfy 80 's interest rates on home loans in the U.S. were in the double digits, sometimes as high as 15% APR or greater. Put yourself in the position of a potential homeowner in Sept. of 1979 when interest rates where 15.5%, a.) If you bought a house for 565,000 at 15.5%, what would have been your monthly payment and total interest paid if the loan was for 30 years? B.) Run the same numbers again, only this time use 5.5% Which is typical modern-day lending rate. a.) Monthly Payment =$ b.) Monthly Payment = 5 |a.) Total interest Paid =$ b.) Total Interest Paid = 8.) In the late 70 's and early 80 's interest rates on home loans in the U.S. were in the double digits, sometimes as high as 15% APR or greater. Put yourself in the position of a potential homeowner in Sept. of 1979 when interest rates where 15.5%. a.) If you bought a house for $65,000 at 15.5%, what would have been wour monthly payment and total interest paid if the loan was for 30 years? B.) Run the same numbers abain, only this time use 5.5% which is typical modern-day lending rate. a.) Monthly Payment = $ b.) Monthly Payment =$ a.) Total Interest Paid =$ b.) Total Interest Paid =$