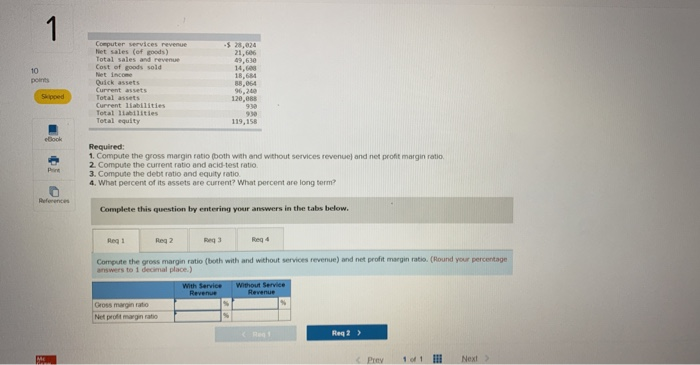

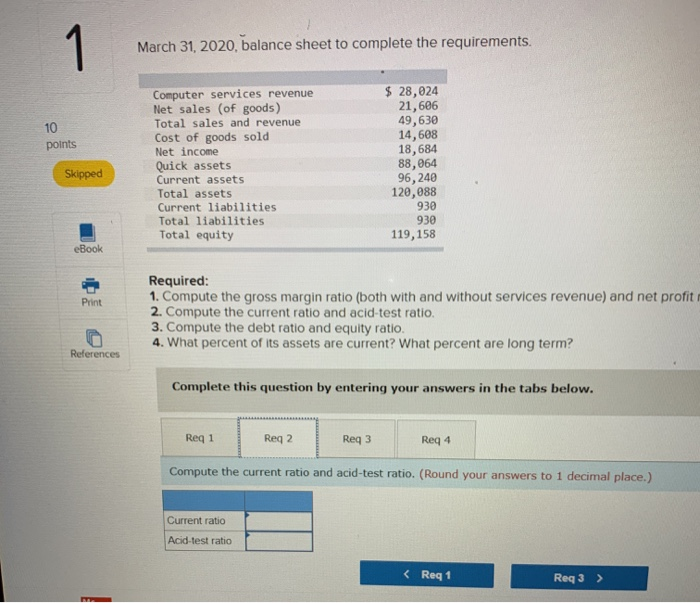

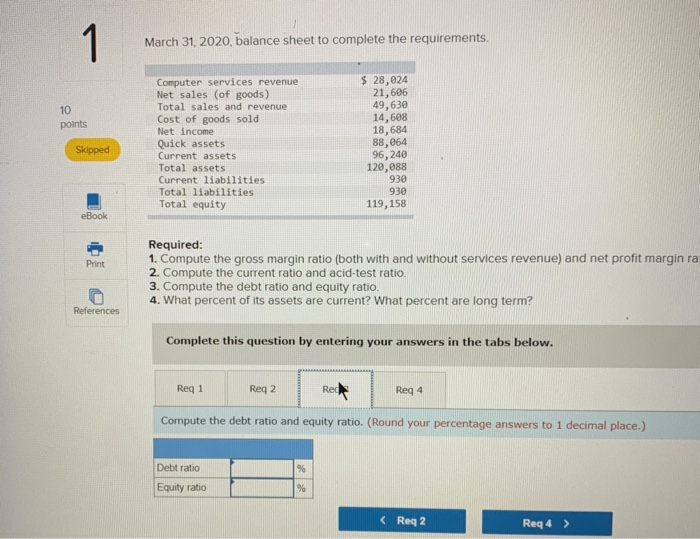

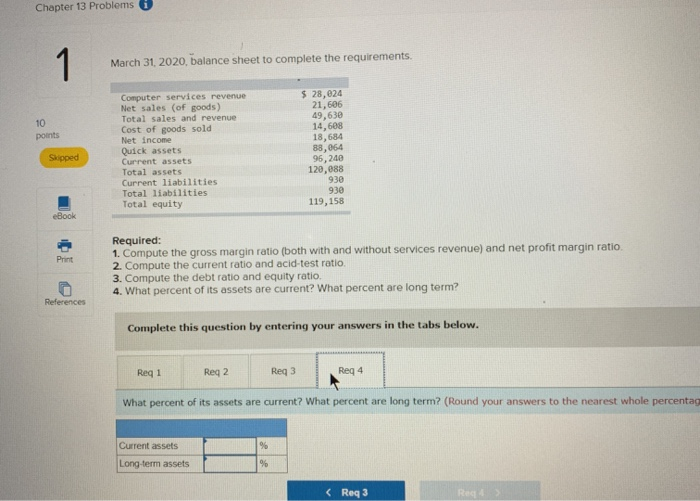

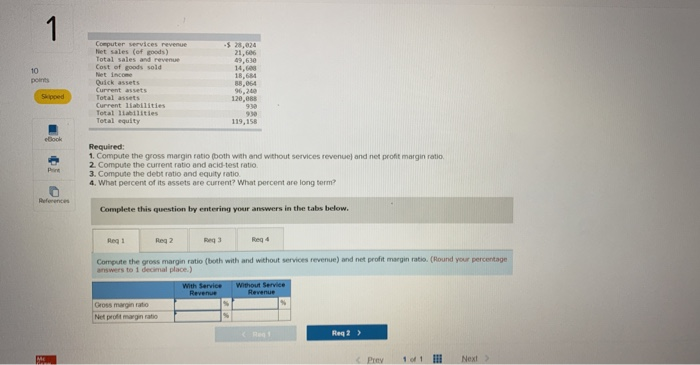

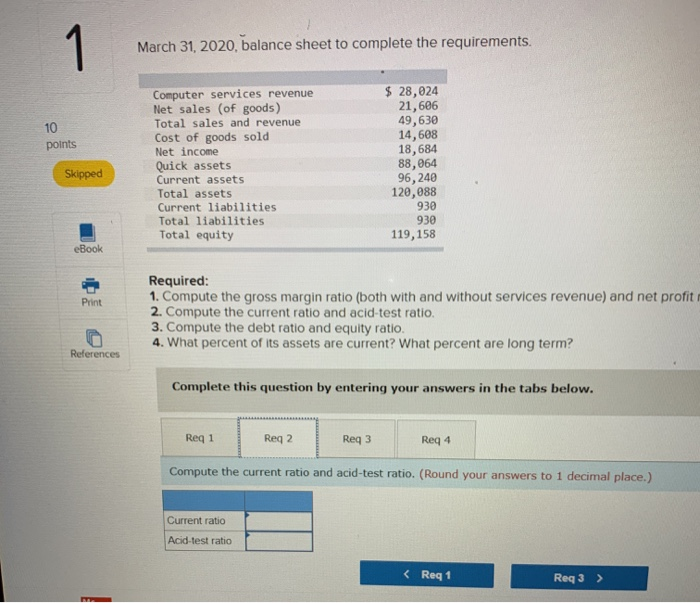

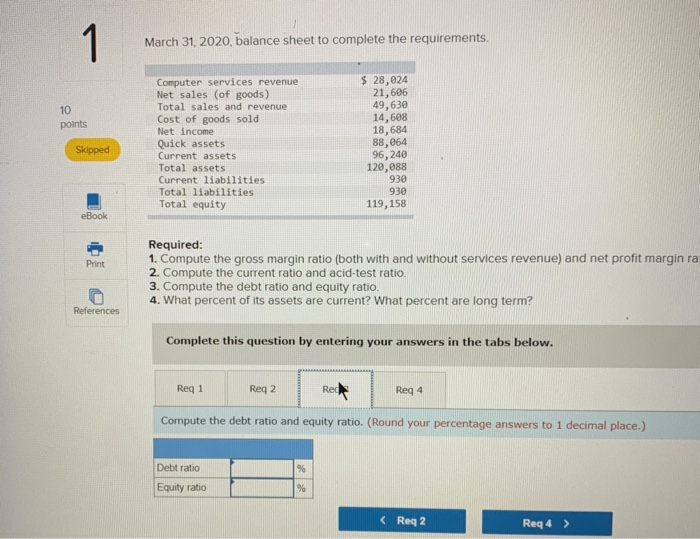

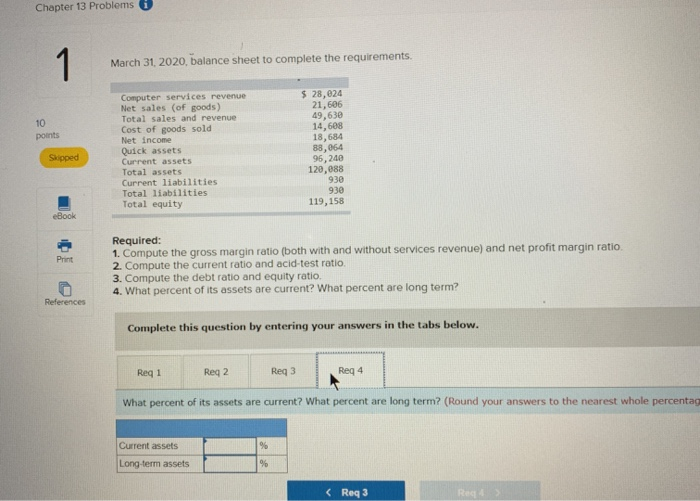

$ ,024 het sales (of goods) 49.630 Cost of goods sold Quick assets 120.08 Total liabilities Total equity 119.158 Required: 1. Compute the gross margin ratio both with and without services revenue and net profit margin ratio 2. Compute the current ratio and acid-test ratio 3. Compute the debt ratio and equity ratio 4. What percent of its assets are current? What percent are long term References Complete this question by entering your answers in the tabs below. Reg 1 Reg 4 Compute the gross margin ratio both with and without services revenue) and net profit margin ratio (Pound your percentage answers to I decimal place.) Revenue Cross marginato Net profit margin ratio Reg 2 > Prey 101 ! Next > March 31, 2020, balance sheet to complete the requirements. 10 points Computer services revenue Net sales (of goods) Total sales and revenue Cost of goods sold Net income Quick assets Current assets Total assets Current liabilities Total liabilities Total equity $ 28,024 21,606 49,630 14,608 18,684 88,064 96,240 120,088 930 930 119,158 Skipped eBook Print Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit 2. Compute the current ratio and acid-test ratio. 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? References Complete this question by entering your answers in the tabs below. Reg1 Req 1 Req 2 Req2 Req3 Rega Req 4 Compute the current ratio and acid-test ratio. (Round your answers to 1 decimal place.) Current ratio Acid-test ratio March 31, 2020, balance sheet to complete the requirements. points Computer services revenue Net sales (of goods) Total sales and revenue Cost of goods sold Net income Quick assets Current assets Total assets Current liabilities Total liabilities Total equity $ 28,024 21,606 49,630 14,608 18,684 88,064 96,240 120,088 930 930 119, 158 Skipped eBook Print Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit margin ra 2. Compute the current ratio and acid-test ratio. 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? References Complete this question by entering your answers in the tabs below. Req 1 Req 2 Rech Reg 4 Compute the debt ratio and equity ratio. (Round your percentage answers to 1 decimal place.) Debt ratio Equity ratio Chapter 13 Problems March 31, 2020, balance sheet to complete the requirements. points Computer services revenue Net sales (of goods) Total sales and revenue Cost of goods sold Net Income Quick assets Current assets Total assets Current liabilities Total liabilities Total equity $ 28,024 21,606 49,630 14,608 18,684 88,064 96, 240 120,088 93e 930 119,158 Skipped eBook Print Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. 2. Compute the current ratio and acid-test ratio. 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? References Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Req3 Req 4 What percent of its assets are current? What percent are long term? (Round your answers to the nearest whole percentag Current assets Long-term assets